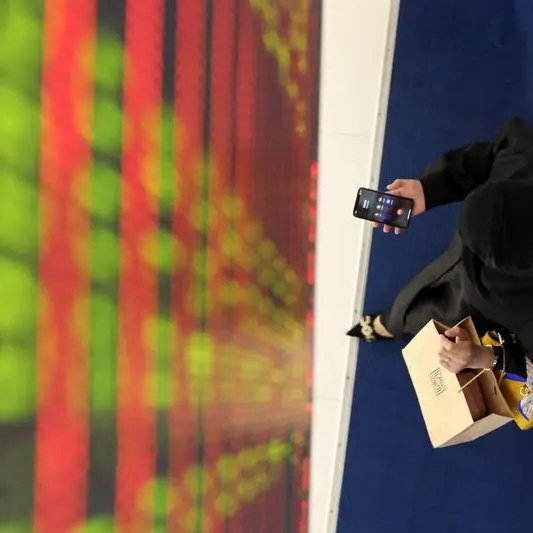

PHOTO

The UAE construction and engineering firm ALEC Holdings made its trading debut on the Dubai Financial Market (DFM) on Wednesday with shares opening at 1.47 UAE dirhams ($0.40), 5% above the IPO price, before slipping to AED 1.41 at close.

Early trade saw a price peak of AED 1.50, representing a 7.14% increase on the AED 1.40 offer price before selling pressure from investors booking gains caused the stock to close at 0.71% above its debut price, according to Vijay Valecha, Chief Investment Officer, Century Financial.

Valecha said a similar trend was evident in several other Dubai listings, where the business model catered to the private sector; ALEC operates as a contractor in the real estate sector, working on a mix of private and government-linked projects.

“The IPOs of Spinneys and Talabat, catering to the private sector, saw a significant fall on their initial trading day but recovered thereafter,” he explained. “This represents investors increasingly preferring sovereign assets and companies for longer-term investment.”

ALEC Holdings raised AED 1.4 billion through the sale of one billion existing ordinary shares by its selling shareholder, the Investment Corporation of Dubai (ICD), the principal investment arm of the Government of Dubai. The offering represented 20% of its issued share capital. The IPO saw a market capitalisation of AED 7 billion at listing.

Subdued start

Valecha called the day one performance of ALEC Holdings “a subdued and restrained beginning”, relative to some of the more spectacular IPOs seen earlier. “Compared to the double-digit first-day performance of Dubai Taxi (18.9%) and Parkin (31.4%), ALEC’s price action was more subdued.

Nishit Lakhotia, Group Head – Research at SICO Bank: “The IPO had seen strong interest during book building and also there is stabilisation manager in place, which can help the stock remain above listing price in the near term.”

DFM called it the largest ever construction IPO on the exchange. The offering attracted demand from a diverse base of regional and international investors, generating total subscriptions of approximately AED 30 billion and an oversubscription level of more than 21 times across all tranches.

Short-term outlook

According to DFM data, as of June 2025, total market capitalisation on the exchange reached AED 995 billion, supported by higher trading activity and growing institutional participation.

Total traded value increased 77% year-on-year to AED 85 billion, with institutional investors accounting for 71% of activity.

However, despite DFM seeing a boost in traded value, Lakhotia called 2025 a slow one for IPOs. “We had Dubai residential REIT earlier, which is still trading higher than its IPO price, albeit lower than August highs,” he said.

(Writing by Bindu Rai, editing by Seban Scaria)