PHOTO

The changing nature of the workplace and new global accounting rules are likely to create a much greater demand for co-working space and temporary office accommodation in the region, according to experts who spoke at the Cityscape Global conference in Dubai on Monday.

In an opening address, Ian Albert, Middle East and North Africa (MENA) regional director for property consultancy firm Colliers International, said that 40 percent of all the new office space that was taken in the Pacific Rim region - stretching from New Zealand through East and South East Asia up to India - was secured by flexible office providers in 2017. He added that these providers now account for 3 percent of total office stock worldwide - a figure that is eventually expected to double to around 6 percent.

Discussing the level of flexible office space in Dubai, Albert added: "Right now, it's under 1 percent of the market. So we've still got plenty of room to grow. But in terms of our growth, 94 percent it's grown in the last four years.”

Craig Plumb, the head of research at JLL MENA, told the same conference that demand for flexible office space has been growing at a rate of about 20 percent per year over the past five years. He said the amount of flexible office space in Dubai - which JLL defines as space that can be leased for a period of less than 12 months - currently stands at just 65,000 square metres out of a total stock of around 8.5 million square metres.

Albert said that flexible office provision has changed, starting with the likes of Servcorp and Regus - both of whom have been operating in the Dubai market for more than 20 years, he said - offering dedicated serviced office space used by corporates for branch or project offices, or for additional short-term space.

In the early part of this decade, he said, co-working space providers such as WeWork developed a new model based on access to global shared working spaces via a membership fee. Albert said the two models were now converging, his presentation stated that the number of co-working spaces had more than doubled in three years to 18,900, while the number of members had trebled - to 169,000 in 2018, from 54,500 in 2015.

Albert said the relative lack of flexible office space in Dubai was partly linked to trade licences. "Labour issues, licencing issues, restrict the ease with which co-working space can be used," he said.

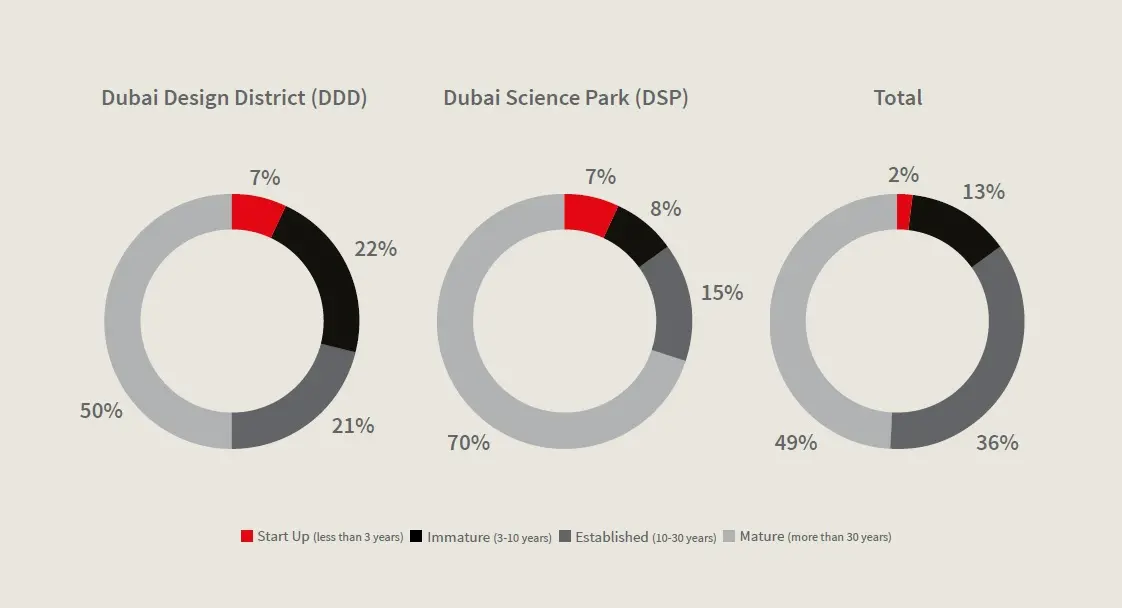

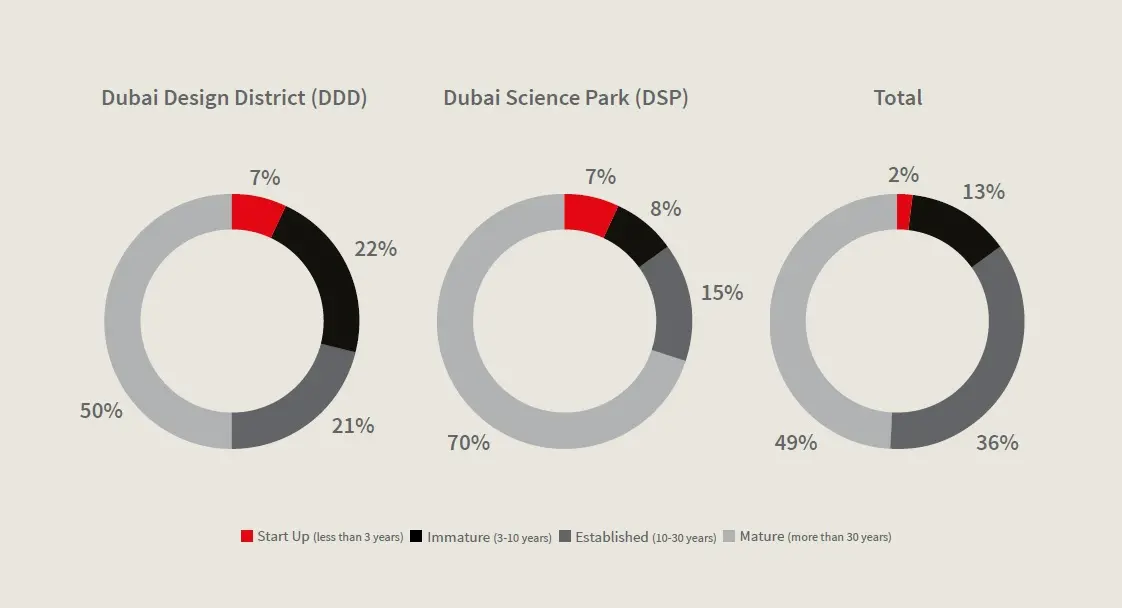

Age of Dubai companies based on space occupied (Source: JLL)

Bigger books

He also said the implementation of IFRS 16 - a new global accounting standard - from January next year requires companies to add all lease obligations longer than 12 months, and with a value of over $5,000, to their balance sheets as liabilities.

"Globally, what that means is an addition of debt onto companies’ books of around $3 trillion," he said.

This will lead to fewer companies wanting to commit to 20-year leases, he said, which will also impact on building valuations, and on sale-and-leaseback transactions which have become a popular source of deals for the region's growing band of real estate investment trusts, Albert said.

In its report analysing the impact of the digital economy on Dubai's office market, JLL found that 85 percent of space it analysed (both onshore and free zone) in the Dubai office market was taken by companies that are more than 10 years old. Around 49 percent of space was taken by companies that are more than 30 years old, and only 2 percent was taken by start-ups (classified as less than three years old).

"That is because Dubai, to date, its economic growth has been driven by two sets of companies - by large, family conglomerates and by major, international companies," Plumb said.

"There hasn't been that much emphasis on small and medium-sized enterprises or start-ups. Even in some of the more innovative districts, like the Dubai Design District or the Science Park, we still see only 7 percent (of space being taken by start-ups).

"We think that will change. One of the reasons that will grow is the increased amount of flexible office space," he added.

Origin of Dubai companies based on space occupied (Source: JLL)

Eastern promise

Around 46 percent of the office space analysed in JLL's report was taken by local companies, and a further 39 percent was taken by Western firms. Eastern corporates now take up 10 percent of space and companies owned by 'other' Arab nations make up 5 percent.

Plumb said that he also expects this to change, with more space being taken in the region by the new corporate giants of China and India.

"They're already very active in leasing markets.... in Amsterdam or in the US. We think they will become more active here in the future."

(Reporting by Michael Fahy; Editing by Shane McGinley)

Our Standards: The Thomson Reuters Trust Principles

Disclaimer: This article is provided for informational purposes only. The content does not provide tax, legal or investment advice or opinion regarding the suitability, value or profitability of any particular security, portfolio or investment strategy. Read our full disclaimer policy here

© ZAWYA 2018