PHOTO

* Junk grade status could still boost investment

* Roadshow expected to start in Europe, U.S. next week

* S&P sees growth above 5 pct by 2018 as oil sales pick up

By Stephen Kalin

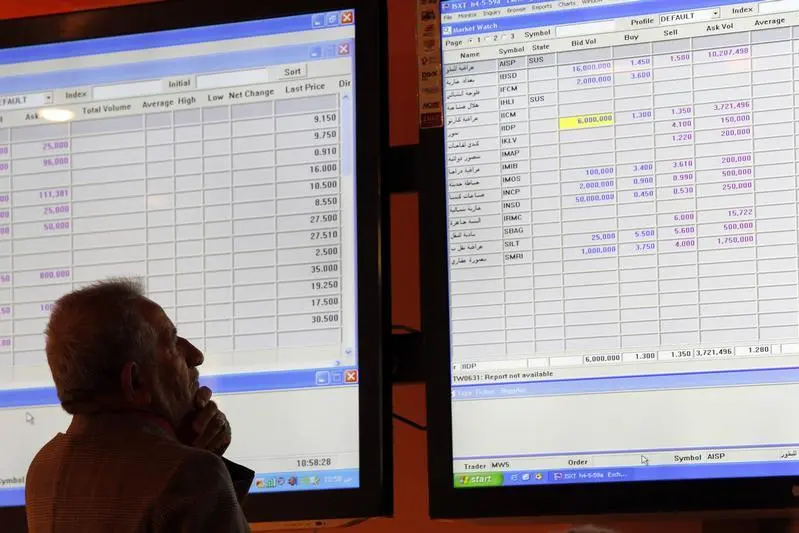

BAGHDAD, Sept 4 (Reuters) - Credit agency Standard & Poor's assigned Iraq a sovereign rating six notches below investment grade on Thursday as the country prepares to return to international capital markets for the first time in nearly a decade.

Citing security and institutional risks among the highest of any sovereign it assesses, S&P rated Iraq at B-, on a par with Egypt and above Greece.

Iraq will in coming days start marketing its first Eurobond in nine years. Obtaining credit ratings could help persuade global fund managers and banks to buy the bonds. Fitch gave Iraq a similar rating last month.

Representatives from the country are expected to meet U.S. and European investors following the Labor Day holiday on Sept. 7.

Baghdad is seeking to raise up to $6 billion, though sources indicate this first deal will be much smaller. Sources have said Citigroup, Deutsche Bank and JP Morgan will be the lead managers for the deal, which is likely to be unsecured.

Iraq has been ravaged by war for more than a decade and its government is struggling to contain sectarian divisions that are hampering efforts to combat militant group Islamic State (IS), which has carved out a territory in the north and west and in neighbouring Syria.

But as the holder of the world's fifth biggest oil reserves, Iraq could nevertheless be an attractive investment for some investors. Oil accounts for around 40 percent of gross domestic product and over 90 percent of fiscal and current external receipts.

S&P said in a statement the outlook on its rating was stable, predicting oil production of 5 million barrels per day (bpd) by 2018 compared with around 3.1 million last year.

It expects the government to maintain control of southern oil fields, which account for more than 85 percent of production and are far from areas controlled by IS.

The agency estimates 0.3 percent economic growth in 2015, rising to an average of 5.7 percent from 2016-2018, and a double-digit fiscal deficit in 2015 and 2016 due to lower oil revenues and higher military and humanitarian expenditure.

(editing by John Stonestreet) ((stephen.kalin@thomsonreuters.com; +961 81639179; Reuters Messaging: stephen.kalin.thomsonreuters.com@reuters.net))

Keywords: IRAQ RATING/

* Roadshow expected to start in Europe, U.S. next week

* S&P sees growth above 5 pct by 2018 as oil sales pick up

By Stephen Kalin

BAGHDAD, Sept 4 (Reuters) - Credit agency Standard & Poor's assigned Iraq a sovereign rating six notches below investment grade on Thursday as the country prepares to return to international capital markets for the first time in nearly a decade.

Citing security and institutional risks among the highest of any sovereign it assesses, S&P rated Iraq at B-, on a par with Egypt and above Greece.

Iraq will in coming days start marketing its first Eurobond in nine years. Obtaining credit ratings could help persuade global fund managers and banks to buy the bonds. Fitch gave Iraq a similar rating last month.

Representatives from the country are expected to meet U.S. and European investors following the Labor Day holiday on Sept. 7.

Baghdad is seeking to raise up to $6 billion, though sources indicate this first deal will be much smaller. Sources have said Citigroup, Deutsche Bank and JP Morgan will be the lead managers for the deal, which is likely to be unsecured.

Iraq has been ravaged by war for more than a decade and its government is struggling to contain sectarian divisions that are hampering efforts to combat militant group Islamic State (IS), which has carved out a territory in the north and west and in neighbouring Syria.

But as the holder of the world's fifth biggest oil reserves, Iraq could nevertheless be an attractive investment for some investors. Oil accounts for around 40 percent of gross domestic product and over 90 percent of fiscal and current external receipts.

S&P said in a statement the outlook on its rating was stable, predicting oil production of 5 million barrels per day (bpd) by 2018 compared with around 3.1 million last year.

It expects the government to maintain control of southern oil fields, which account for more than 85 percent of production and are far from areas controlled by IS.

The agency estimates 0.3 percent economic growth in 2015, rising to an average of 5.7 percent from 2016-2018, and a double-digit fiscal deficit in 2015 and 2016 due to lower oil revenues and higher military and humanitarian expenditure.

(editing by John Stonestreet) ((stephen.kalin@thomsonreuters.com; +961 81639179; Reuters Messaging: stephen.kalin.thomsonreuters.com@reuters.net))

Keywords: IRAQ RATING/