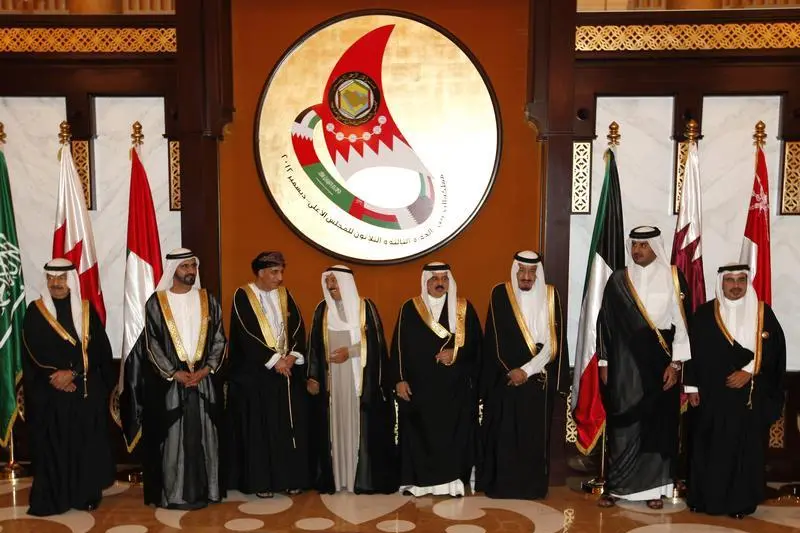

PHOTO

Monday, Oct 17, 2016

Dubai: The Gulf Cooperation Council (GCC) region’s funding requirement has been mounting since 2015, when the drop in oil-related revenue turned fiscal surpluses into deficits. Although the level of deficits differs among the sovereigns in scale and duration, these could result in substantial debt issuance according to S&P Global Ratings.

The rating agency estimates that the financing needs of Gulf governments between 2015 and 2019 could reach $560 billion. According to S&P estimates, in nominal terms, GCC sovereigns’ combined fiscal deficit will reach $150 billion (12.8 per cent of combined GDP) in 2016 alone.

“As a proportion of GDP, we expect that in 2016-2019 these deficits will average around 10 per cent per year in Bahrain, Oman, Kuwait, and Saudi Arabia, and 4 per cent on average in Abu Dhabi and Qatar,” said Benjamin J Young, an analyst with S&P.

GCC sovereigns’ financing needs are likely remain substantial over the next several years, given the region’s almost uniform dependence on hydrocarbons.

“We forecast that the cumulative funding requirement could be as high as $560 billion between 2015 and 2019. The resulting imbalances and their likely impact have been central to our view of a significant deterioration in the region’s creditworthiness over the past 18 months. Although most governments’ balance sheets remain a rating strength, the related assets are finite,” said Young.

Analysts have cautioned that international liquidity sources could start to dry up at a time when foreign inflows are most needed and the liquidity of domestic banking systems is diminishing. This creates uncertainty about how, and at what price, GCC sovereigns will cover their fiscal deficits.

“We expect GCC sovereigns’ fiscal funding needs will stay elevated for a prolonged period and that central government accounts will remain in deficit in 2019, albeit to a lesser extent than in 2016. In our view, the efficacy of government policy as well as the development of oil prices will determine how long this situation will persist,” said Young.

While government measures to counter lower revenues are expected to boost government income this likely to take a fairly long time frame. This is because growth-boosting capital expenditures in the region are set to remain high and current expenditures are frequently subject to political considerations. In addition recovery of oil prices is expected to be gradual which the rating agency assumes at $55 per barrel (/bbl) in 2019 from $42.5/bbl for the rest of 2016.

Saudi Arabia’s deficit makes up the majority (60 per cent) of the GCC sovereigns’ financing requirement in nominal terms, but as a proportion of GDP it is similar to that of Bahrain, Oman, and Kuwait.

Governments’ options in meeting financing requirements are limited to debt or draw down on existing assets. A government may issue debt instruments to balance its books or draw on assets, if available, which includes the use of income generated by those assets. Larger financing needs therefore imply an increase in the annual issuance of debt, a weakening asset position, or both.

“We expect Qatar and Bahrain will finance the vast majority of their deficits through debt, whereas Oman, Saudi Arabia, and Abu Dhabi typically have a fairly even split of asset and debt financing; we expect Kuwait will use its assets to pay for most of its deficits,” said Young.

By Babu Das Augustine Banking Editor

Gulf News 2016. All rights reserved.