PHOTO

The United Arab Emirates’ Al Etihad Credit Bureau is working on launching a number of indicators that would give lending institutions a better understanding of the financial situation of the small and medium-sized companies, potentially enhancing the sector’s access to finance, the bureau’s chief executive officer told Zawya.

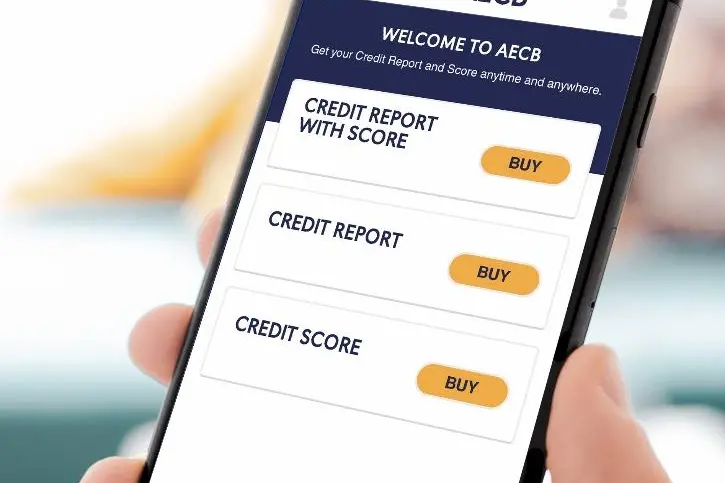

“We are currently studying the SME sector to see what factors would affect them. We discovered we can do more for the SMEs but we need more information. We need more information from the different registration bodies, and from entities other than banks. We currently have a plan to create special indicators for the SMEs,” Marwan Ahmad Lutfi, the chief executive officer for Al Etihad Credit Bureau, told Zawya on the sidelines of a media roundtable hosted by the bureau to announce the launch of the AECB mobile application, which provides consumer credit reports and is currently available on both Apple’s App Store and the Google Play Apps Store.

On the SMEs, Lutfi said that his entity currently issues credit scores for the SMEs the way it would do it for larger companies but plans “to create special indicators and not scores that would give the SME a ranking”.

“Something like a SME stability indicator, and other similar indicators,” he said, adding that the bureau plans to do this next year.

Al Etihad Credit Bureau is a government body in charge of issuing credit reports and scores for companies and individuals in exchange of fees that range between 84 dirhams ($23) to 180 dirhams ($49). The top official said those who apply online will get discounts of around 20 percent. The bureau started issuing credit scoring reports for commercial businesses last year.

The number of formal and informal MSMEs- a classification that includes the micro-businesses and SMEs - is estimated at 19-23 million entities, constituting 80 to 90 percent of businesses in the Middle East and North Africa region that includes all of the Gulf Cooperation Council states, according to a report issued by the International Finance Cooperation in 2017. There have been several public initiatives to support the SMEs sector over the past few years in the Arab states, especially in the region’s three biggest economies of Saudi Arabia, the UAE and Egypt, but the lending rate to the sector remains low.

Marwan Ahmad Lutfi, the chief executive officer for Al Etihad Credit Bureau

Saudi Arabia issued a new bankruptcy law this year, while the UAE introduced its bankruptcy law in 2016 with a view to removing some of the risks associated with running a SME. Late last year, the UAE’s state-run Emirates Development Bank announced plans to allocate around 450 million dirhams ($122.5 million) to the funding of SMEs in 2018.

In 2016, Egypt announced plans to inject 200 billion Egyptian pounds ($11 billion) from its local banks into the SMEs sector over a period of four years and this year announced a five-year tax exemption for SMEs that join the mainstream economy, according to local media reports.

“Today banks need to act differently for the SMEs. They need to study the person running the business and not only the company. Today, banks use credit reports but we need a different level of details for the SMEs such as the number of employees, income or sales turnover. There are several factors that are needed to define the size of the SME. We are currently working on this with the involved entities. We plan to have multiple SME indicators for the banks and subscribers to have access to,” Lutfi said.

He said during the roundtable event that the bureau currently has 95 subscribers that includes banks, telecom companies, financial institutions, government entities and some private companies, who have access to a database that includes around 4.5 million individuals and about 200,000 companies. He said that the UAE law requires that companies and individuals know and agree to the sharing of their reports and scores with financial institutions.

Further reading:

- Saudi Arabia looks to SMEs to help restructure mining sector

- Egypt to host international SME forum in June 2019: Minister

- SMEs in UAE record strong growth despite challenges

- Arab policymakers more supportive of SMEs to aid jobs growth, says founder of new SME ratings agency

- Holding the key: SMEs play major role in economic growth but struggle to gain bank funding

(Reporting by Yasmine Saleh; Editing by Michael Fahy)

Our Standards: The Thomson Reuters Trust Principles

Disclaimer: This article is provided for informational purposes only. The content does not provide tax, legal or investment advice or opinion regarding the suitability, value or profitability of any particular security, portfolio or investment strategy. Read our full disclaimer policy here.

© ZAWYA 2018