PHOTO

Lebanon's chronic economic and financial crisis has its roots in a long history of failed attempts to execute credible economic policy.

A poor record of fiscal performance, the government's failure to address rigidities in the economy, including a rapidly appreciating real exchange rate and rampant public corruption that lead to a steady erosion of confidence in Lebanon and ultimately to the current crisis, the Institute of International Finance said in one of its recent reports.

As economic scenarios are getting worse in Lebanon, ratings agencies downgraded the sovereign’s ratings pointing to the urgent need of debt restructuring. Fitch estimates Lebanon's gross external financing requirement in 2020 at around $10 billion moderating close to $9 billion in 2021.

IIF data suggests that Lebanon has one of the highest debt-to-gross domestic product ratios (166 per cent) in the world. Public debt increased 7.6 per cent to $91.64 billion year-on-year as of the end of December 2019.

Lebanon's central bank, Banque du Liban (BdL) has around $29 billion in gross foreign currency reserves at its disposal as of end-January 2020. According to Fitch the overall net FC position of BdL is negative, with reserves continuing their decline in February.

Lebanon has $1.2bn of eurobonds that hit maturity on March 9. It has another $700 million due in April and $600m in June.

A likely default on its obligations could force ratings agencies worldwide to downgrade Lebanon’s sovereign ratings further or change the outlook on the country and its currency.

Such a scenario would be a huge setback to banks in the country that have been financing fiscal and current account deficits.

Inconsistent fiscal policy

Inflexibility in many sectors of the economy could not compensate for the real appreciation of the Lebanese pound, which partly reflected the strengthening of the U.S. dollar visà- vis currencies of Lebanon’s other major trading partners, including the euro and the yuan.

"Loose fiscal policy stood at odds with the demands of the fixed exchange rate, exacerbated by central bank financing of deficits and financial engineering," noted, Garbis Iradian, IIF Chief Economist, MENA.

On the external front, the conflict in Syria since 2011 and antagonism between Saudi Arabia and Iran—two powers vying for hegemony, with both of whom Lebanon was focused on maintaining close relationships—increased perceptions of regional instability.

As a result, a sharp slowdown ensued in receipts from tourism, remittances, and other capital inflows. Persistently large twin deficits were central to the crisis. The wide external current account deficit was partly the product of an overvalued currency, which encouraged higher imports and private consumption. Persistently large fiscal deficits faced pressure on both sides, the IIF report said.

Widening deficits

Iradian noted that persistently large twin deficits were central to the crisis.

The wide external current account deficit was partly the product of an overvalued currency, which encouraged higher imports and private consumption.

According to the IIF, institutional weakness in tax administration affected the revenue performance and tax compliance was undermined by rampant corruption and widespread bribery.

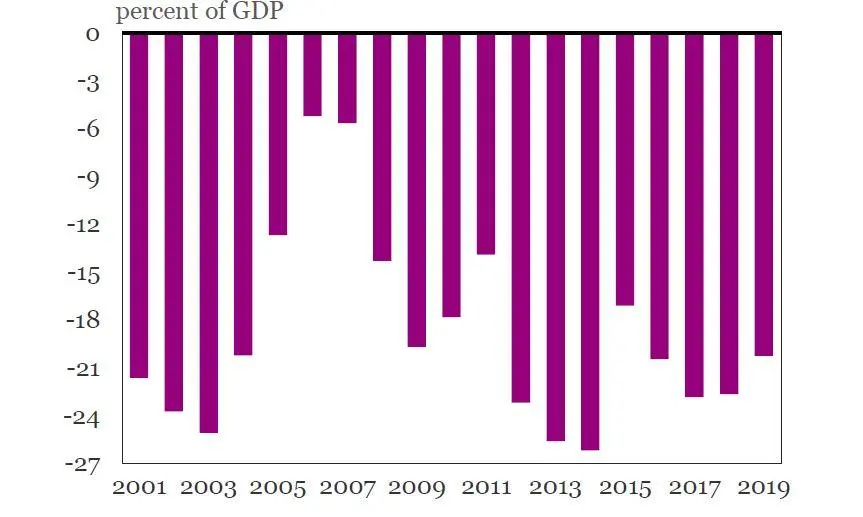

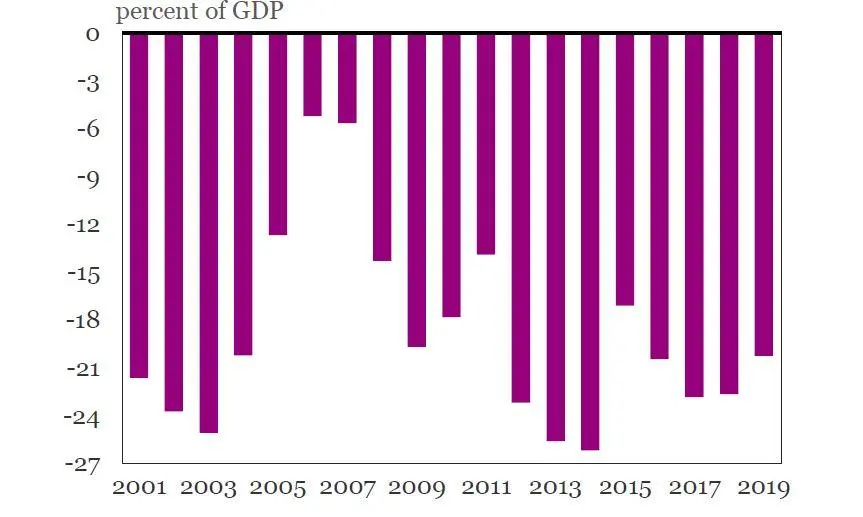

Current account deficits have stayed in double digits in all but two years since 2000. Source: BdL and IIF

On the expenditure side, plans to reform the chronically loss-making electricity sector were fiercely resisted by vested interests, while the sharp increase in the public wage bill in 2018 worsened the country's ability to pay its debts. Consequently, debt spiraled from 2011 onward.

Lebanon failed in putting public debt on a more sustainable path at the same time, perceptions of widespread corruption, reflected in the country's rankings in the lowest quartile worldwide on many indicators undermined public support for reforms and the business environment.

Statistics from the Association of Banks suggests that Lebanon's public debt has risen to a record level of about $90 billion. Corruption Perceptions Index 2019 by Transparency International has placed the country at 137th position on the list of least corrupt countries out of 180 countries.

The debt-ridden country's pro Syria, pro Hezbollah government is expected to address the issue of corruption, which prevents the implementation of bold decisions to redirect economic policies.

Negative growth

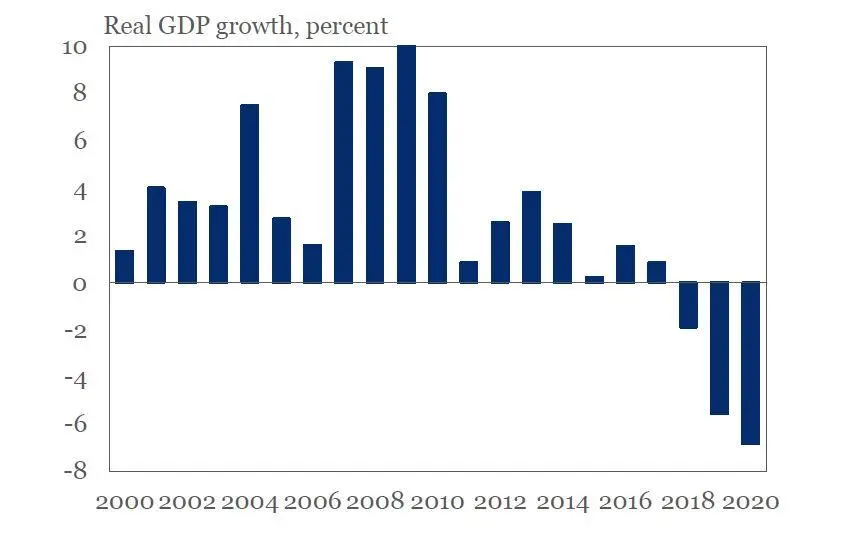

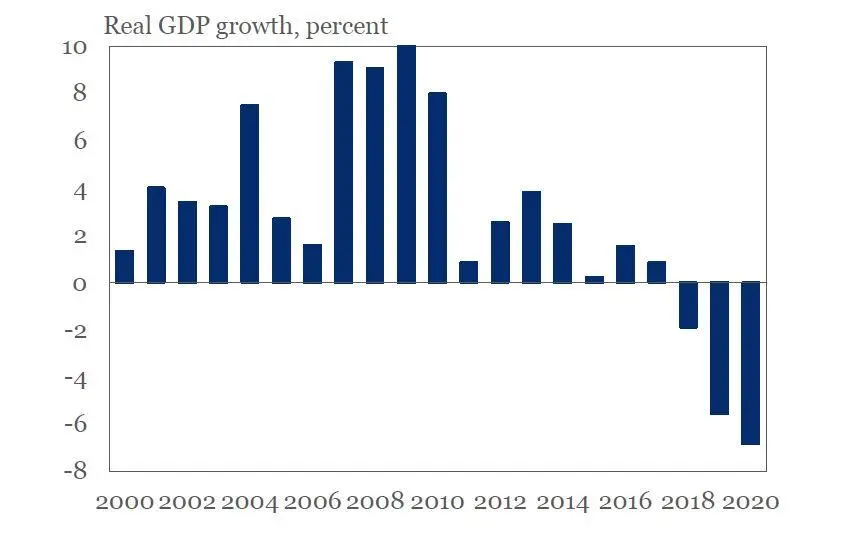

The Lebanese economy has entered its third consecutive year of negative growth.

In the period 2011-2019, real GDP growth averaged 0.5 percent, the current account deficit exceeded 21 percent of GDP, and the fiscal deficit 9 percent of GDP.

IIF estimates that in 2020, real GDP is set to contract for the third consecutive year. Public debt increased to unsustainable levels, rising from 131 percent of GDP in 2012 to 164 percent of GDP at end-2019.

A third straight year of negative growth is likely. Source: CAS and IIF estimate for 2019 and forecast for 2020

The average inflation is expected to increase to about 20 percent in 2020 due to the pass-through effects of the large parallel exchange rate depreciation.

"The imposition of temporary capital controls by banks in November 2019 was vital to avert a meltdown of the financial sector, but lasting capital controls can create additional headwinds to a recovery of economic activity," IIF noted.

To curtail the rise in inflation and a freefall in real wages, BdL allowed emergence of a dual exchange rate, which is around 40 percent depreciated than the official rate in recent weeks.

"Once the financial situation improves, confidence is restored, and adequate financing from the international community is secured, a relaxation of the official exchange rate peg could be considered," IIF said, adding, "Unification of the two rates during the distressed period may further undermine confidence and lead to further depreciation of the exchange rate, with severe consequences for the poor and middle class, and likely instigating a new round of social unrest.”

Snapshot

According to IIF's Iradian, who has been consulting with the Lebanese government with regard to the design of a macroeconomic program and the government’s potential negotiations with the IMF, below are the reforms required to arrest the country's downward economic spiral and facilitate access to sufficient external financing.

- Reducing further interest rates on dollar deposits and government debt

- Restoring the health of the banking system

- Sustaining fiscal adjustment (including strengthening tax revenue administration and combating pervasive tax evasion)

- Reforming the electricity sector (EdL)

- Seeking an IMF program to anchor reforms and secure additional financing

- Considering debt rescheduling

- Unifying the exchange rates under stable conditions and position of strength

- Privatizing the two mobile companies and other public entities to reduce public debt and improve efficiency

- Reducing corruption

- Establishing a social fund that could be financed by the recovery of stolen public funds

(Reporting by Seban Scaria, editing by Daniel Luiz)

Disclaimer: This article is provided for informational purposes only. The content does not provide tax, legal or investment advice or opinion regarding the suitability, value or profitability of any particular security, portfolio or investment strategy. Read our full disclaimer policy here.

© ZAWYA 2020