PHOTO

Index increase is based on citizens’ expectations rather than on shift in housing market outlook

Byblos Bank Headquarters: Byblos Bank issued today the results of the Byblos Bank Real Estate Demand Index for the third quarter of 2018.

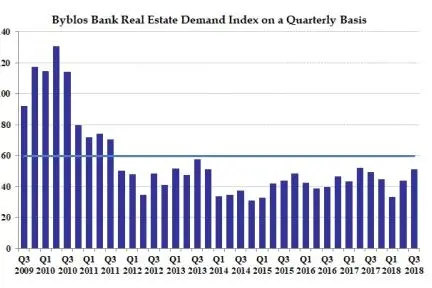

The results show that the Index posted a monthly average of 51.4 points in the third quarter of 2018, constituting an increase of 17.4% from 43.7 points in the second quarter of 2018 and a growth of 3.7% from 49.6 points in the third quarter of 2017. The Index decreased by 19.3% in July and by 14.2% in August, but increased by 26.3% in September.

Commenting on the results, Mr. Nassib Ghobril, Chief Economist and Head of the Economic Research and Analysis Department at the Byblos Bank Group, said: “the increase of the Index in the third quarter of the year followed the Lebanese Parliament’s vote in September to allocate LBP 100 billion, or USD 66 million, to subsidize interest rates on housing loans, given the suspension of subsidies since the beginning of the year. As a result, the new law raised the expectations of citizens that subsidized mortgages will resume, which triggered the jump of the Index in September.''

However, Mr. Ghobril cautioned that ”the increase of the Index in the third quarter should not be viewed as a change in the current dynamics of the housing market, as the improvement comes from a low base following the first and second-quarter results, and is only based on the expectations of citizens.” Further, the Index’s average monthly score in the third quarter of 2018 is 61% lower from the peak of 131 points registered in the second quarter of 2010, and remained 53.2% below the annual peak of 109.8 points posted in 2010. Also, it was 14% lower than the Index's monthly trend average score of 59.8 points since the Index’s inception in July 2007.

The answers of respondents to the Index's survey questions in the third quarter of 2018 show that 5.8% of Lebanese residents had plans to either buy or build a residential property in the coming six months compared to 4.9% in the second quarter of the year and to 5.6% in the third quarter of 2017. In comparison, 6.7% of residents in Lebanon, on average, had plans to buy or build a residential unit in the country between July 2007 and September 2018, with this share peaking at nearly 15% in the second quarter of 2010.

Mr. Ghobril considered that ''Lebanese citizens need to see the recently-enacted law translated into concrete measures that will lead to the resumption of mortgage subsidies, in order to convert this pent-up demand into actual transactions.'' He added that ''it remains the responsibility of the executive branch to not only cover interest subsidies on housing loans for limited-income citizens, but also to take the lead in developing a comprehensive housing policy that stimulates demand for all segments of the residential housing market in Lebanon, given that buying a house constitutes one of the most important investment decisions for the Lebanese, and the value of a house is usually the single most important non-financial asset for Lebanese residents."

The results of the Index show that demand for housing was the highest in the South in the third quarter of 2018, as 9.1% of its residents had plans to build or buy a house in the coming six months, compared to 7.8% in the second quarter of 2018. The Bekaa followed with 6.3% of its residents planning to build or buy a residential unit in the coming six months, up from 6% in the preceding quarter; while 5.5% of residents in Mount Lebanon had plans to buy or build a house, relative to 4.6% in the previous quarter. In addition, 4.7% of residents in the North intend to buy or build a house, up from 4% in the preceding quarter, while 4% of residents in Beirut had plans to build or buy a residential unit, up from 3% in the second quarter of 2018. In parallel, real estate demand increased among all income brackets in the third quarter of 2018.

The Byblos Bank Real Estate Demand Index is a measure of local demand for residential units and houses in Lebanon. The Index is compiled, implemented and analyzed in line with international best practices and according to criteria from leading indices worldwide. The Index is based on a face-to-face monthly survey of a nationally representative sample of 1,200 males and females living throughout Lebanon, who reflect the demographic, regional, religious, professional and income distribution of Lebanon. The surveyed persons are asked about their plans to buy or build a house in the coming six months. The Byblos Bank Economic Research and Analysis Department has been calculating the Index on a monthly basis since July 2007, with November 2009 as its base month. The survey has a margin of error of ±2.83%, a confidence level of 95% and a response distribution of 50%. The monthly field survey is conducted by Statistics Lebanon Ltd, a market research and opinion-polling firm.

For further information, please contact:

Nassib Ghobril

Chief Economist

Head of Group Economic Research & Analysis Department

Byblos Bank, Beirut, Lebanon

Phone: (961) 1 338 100 ext. 0205

Fax: (961) 1 217 774

E-mail: nghobril@byblosbank.com.lb

© Press Release 2018Disclaimer: The contents of this press release was provided from an external third party provider. This website is not responsible for, and does not control, such external content. This content is provided on an “as is” and “as available” basis and has not been edited in any way. Neither this website nor our affiliates guarantee the accuracy of or endorse the views or opinions expressed in this press release.

The press release is provided for informational purposes only. The content does not provide tax, legal or investment advice or opinion regarding the suitability, value or profitability of any particular security, portfolio or investment strategy. Neither this website nor our affiliates shall be liable for any errors or inaccuracies in the content, or for any actions taken by you in reliance thereon. You expressly agree that your use of the information within this article is at your sole risk.

To the fullest extent permitted by applicable law, this website, its parent company, its subsidiaries, its affiliates and the respective shareholders, directors, officers, employees, agents, advertisers, content providers and licensors will not be liable (jointly or severally) to you for any direct, indirect, consequential, special, incidental, punitive or exemplary damages, including without limitation, lost profits, lost savings and lost revenues, whether in negligence, tort, contract or any other theory of liability, even if the parties have been advised of the possibility or could have foreseen any such damages.