PHOTO

The Conference Board Gulf Center for Economics and Business Research launched The Conference Board® Global Consumer Confidence Index for the Gulf region in 2020 Q2 in collaboration with Nielsen. It was conducted in May 2020 and polled more than 33,000 online consumers in 68 markets throughout Asia-Pacific, Europe, Latin America, Africa and the Middle East, and North America. The Conference Board® Global Consumer Confidence Index previously included Saudi Arabia and the United Arab Emirates only as part of Africa and the Middle East region. With the addition of the four countries in May 2020: Bahrain, Kuwait, Oman and Qatar, together with Saudi Arabia and the United Arab Emirates, the results of those six countries now constitute a new aggregate for the Gulf region.

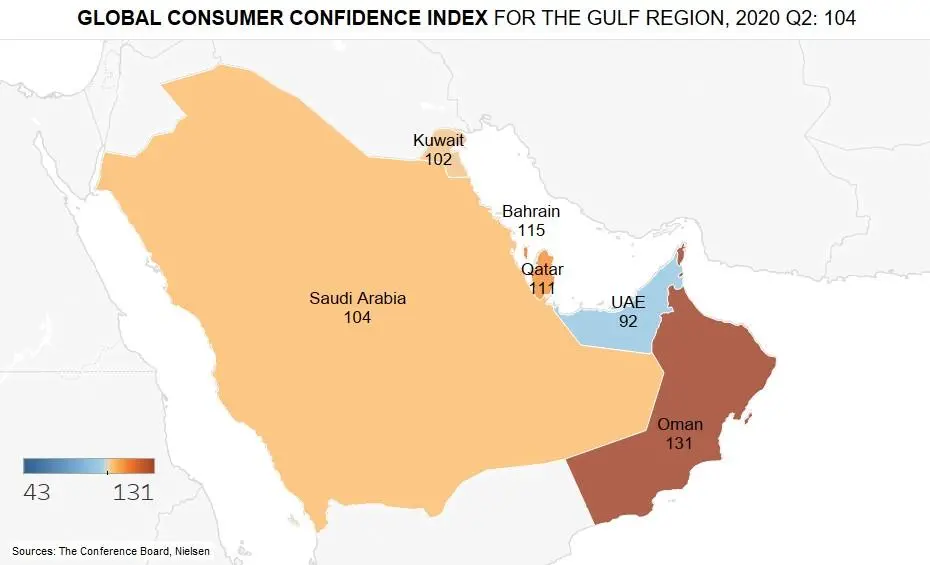

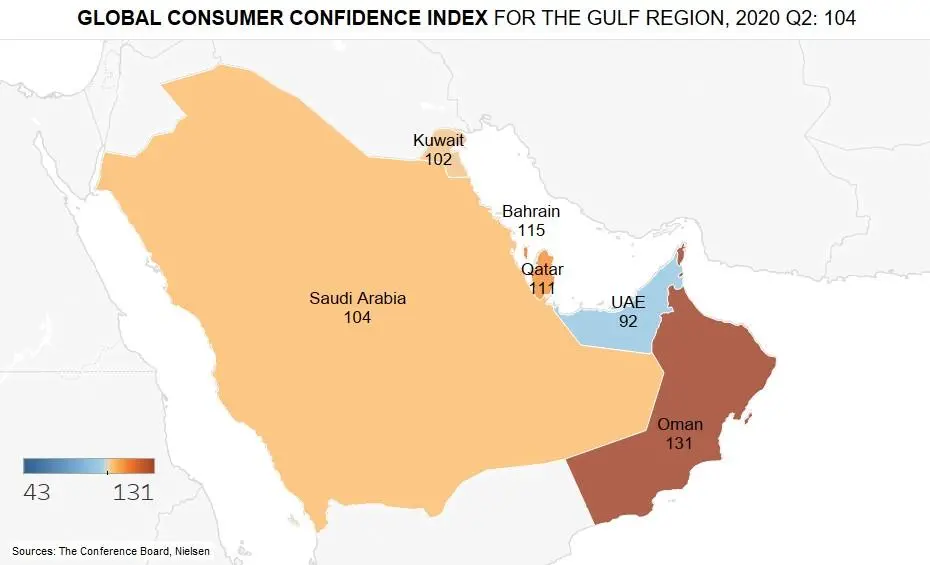

In 2020 Q2, The Conference Board® Global Consumer Confidence Index fell sharply from a near historic high of 106 in 2020 Q1 to 92, indicating there were more pessimistic consumers than optimistic ones globally for the first time since 2016 (a reading below 100 is considered negative), while the Gulf region confidence index stood at 104, the highest of any global region, despite the supply and demand shock that hit the Gulf economies at the onset of the COVID-19 pandemic. China has been excluded from the 2020 Q1 index due to the country’s restrictive COVID-19 containment measures during that period and re-introduced in 2020 Q2.

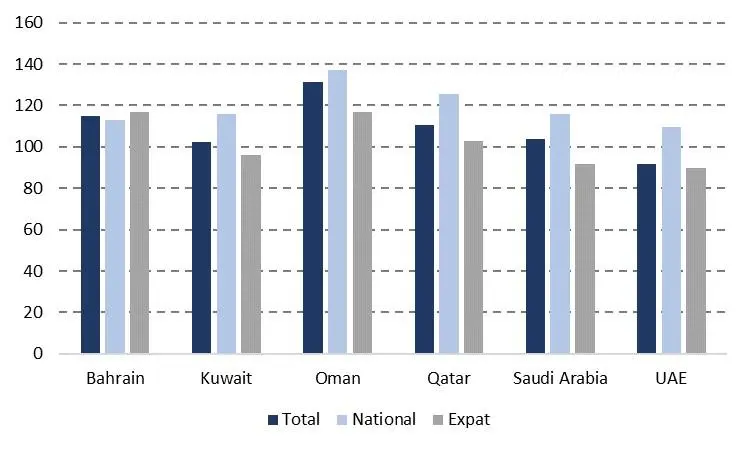

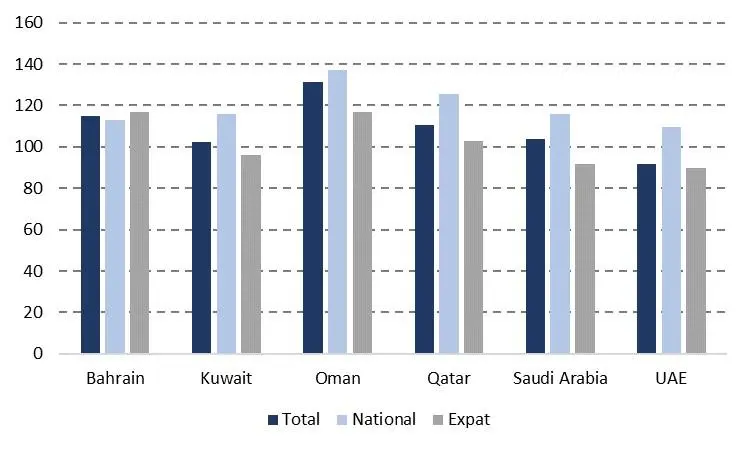

Despite the high level of optimism that reigns in the Gulf region, disparities in terms of confidence level exist between nationals and expats. With the gulf governments pushing their nationalization program even further during the pandemic and guarantying national jobs in the public sector and providing the needed support to the private sector to hire further nationals or retain them amid the hard economic conditions, nationals in the Gulf region, are more confident and optimistic than their expatriates counterparts in terms of job prospects, personal finances and spending intentions.

Given the region’s high dependence on oil exports and the intrinsic dynamics of the Gulf region labor market, the biggest three concerns for the Gulf consumer are the economy, health and job prospects; but not necessarily in the same order between nationals and expats nor across the countries in the region.

While we still do not know how much this pandemic has impacted and altered consumer behavior consumers in the Gulf preferred to save more and pay off debt and credit cards once they have covered their essential living costs, while shying away from investing in stocks, mutual and retirement funds. This may be a reflection of consumers’ new reality of spending more time at home and categories like groceries and utility expenses being pillars of pandemic life. At the same time, lingering virus-related restrictions on stores, restaurants, and other venues as well as financial concerns are keeping spending on discretionary categories down.

Kuwait’s consumer confidence index ranked 12th globally and fourth in the Gulf region at 102 points. Kuwaiti consumers are optimistic, at 116, 20 index point higher than the expats in the country. In general, nationals were more satisfied with the job prospects and personal finances in the 12 months and more than half had the intention to spend, supported by the government nationalization program and the fiscal stimulus packages.

With this gloomy outlook in mind, consumers in Kuwait are putting their spare cash into savings and paying off debt while limiting their purchases of new technology products and clothing. During the pandemic and the lockdown period, 42% of consumers in Kuwait cut down on take away meals and 35% spent less on new clothes while around a quarter are delaying paying on big ticket items like electronics, furniture and annual vacations. However consumers in Kuwait feels that this situation is only temporary and when conditions improve, they will go back somehow to their previous spending pattern while continuing to cut down on take-away meals while only 10% of consumers will cut down on short breaks and annual vacation. In fact the government, and in support of the SME sector which was badly hurt by the pandemic, is paying the equivalent of 6 salaries in compensation to around 13 thousand Kuwaitis in July totaling KD 58.3 million. This payment will definitely boost consumer spending in Q3 2020.

Omani and Qatari consumers among the most confident in the region

Source: The Conference Board Global Consumer Confidence Survey

Declining confidence in job prospects, personal finances and spending intentions pulled down the consumer confidence in Saudi Arabia and the UAE sharply. In fact, consumer confidence in Saudi Arabia declined from an all-time high of 121 in Q1 2020 to 104 in Q2. Consumers in United Arab Emirates on the other hand are among the least optimistic in the region. The UAE consumer confidence index fell below the 100 “optimistic mark” to 92 points, the lowest since Q4 2009. The index declined by 23 points quarter on quarter in Q2 2020.

Oman’s consumer confidence index ranked first globally and in the Gulf region at 131 points. Omani nationals as well as the expats living in Oman are pretty optimistic in comparison to other nationals and expats in the region. Omani consumer confidence index stood at 137, 20 index point higher than the expats in the country. Bahrain’s consumer confidence ranked fourth globally and second in the Gulf region at 115 points. Bahrain’s economy is less oil dependent than the other gulf countries with oil GDP share not exceeding 19 percent of total GDP in 2019. Bahraini consumers are the only nationals that are slightly less optimistic than their expat counterparts. Qatar’s consumer confidence index ranked 6th globally and third in the Gulf region at 111 points, supported by high confidence from the Qatari nationals. Qatari consumer confidence index stood at 125, compared to 103 for the expats in the country.

-Ends-

© Press Release 2020

Disclaimer: The contents of this press release was provided from an external third party provider. This website is not responsible for, and does not control, such external content. This content is provided on an “as is” and “as available” basis and has not been edited in any way. Neither this website nor our affiliates guarantee the accuracy of or endorse the views or opinions expressed in this press release.

The press release is provided for informational purposes only. The content does not provide tax, legal or investment advice or opinion regarding the suitability, value or profitability of any particular security, portfolio or investment strategy. Neither this website nor our affiliates shall be liable for any errors or inaccuracies in the content, or for any actions taken by you in reliance thereon. You expressly agree that your use of the information within this article is at your sole risk.

To the fullest extent permitted by applicable law, this website, its parent company, its subsidiaries, its affiliates and the respective shareholders, directors, officers, employees, agents, advertisers, content providers and licensors will not be liable (jointly or severally) to you for any direct, indirect, consequential, special, incidental, punitive or exemplary damages, including without limitation, lost profits, lost savings and lost revenues, whether in negligence, tort, contract or any other theory of liability, even if the parties have been advised of the possibility or could have foreseen any such damages.