PHOTO

In light of the imminent listing on the Qatar Stock Exchange on April 27th

Qatar, Doha - 26 April 2016

Qatar First Bank L.L.C. (QFB), a leading Shari'ah compliant bank based in Qatar offering investment opportunities and innovative financial solutions with local, regional and international reach, welcomed visitors and media representatives at its private banking lounge, in light of the imminent listing on the Qatar Stock Exchange on April 27th.

The event presented an open platform to showcase a summary of the bank's history and financial performance in addition to the most recent milestones shaping the bank's future.

The gathering was hosted by QFB's Chairman, Mr. Abdulla Bin Fahad Bin Ghorab Al Marri, QFB's Chief Executive Officer, Mr. Ziad Makkawi, and attended by the Chief Executive Officer of Qatar Financial Center (QFC), Mr. Yousuf Mohamed Al-Jaida.

Speaking at the event, QFB's Chairman Mr. Abdulla Bin Fahad Bin Ghorab Al Marri, said:

"Our listing on the QSE was always a top priority, and we are proud to deliver on this promise to our shareholders who have supported us all these years and to the Qatar market in general. It is an opportunity to broaden our shareholder base and offer new investors an opportunity to join us for the next phase of our journey."

He added: "This significant milestone - the first listing of a Qatari entity licensed by the QFC and the first listing for a private entity in 6 years - will enable us to continue exploring and evaluating new opportunities that contribute positively to our shareholders value ".

He concluded: "I would like to take this opportunity to thank the QFMA and QSE leaderships, as well as their respected team members, for all their efforts in making this listing a reality. We look forward to continuing our cooperation with them to further strengthen Qatar's financial market position."

For his part, Yousuf Mohamed Al-Jaida, QFC Authority CEO, said:

"QFB's listing on the Qatar Exchange marks an unprecedented success for the QFC. QFB is our first licensed firm to go public and I am confident that this milestone will trigger more listings. The QFC remains committed to providing the right support to facilitate the success of its firms and empower its business community to further develop Qatar's financial services sector"

QFB's Chief Executive Officer, Mr. Ziad Makkawi, noted:

"The listing will offer QFB the opportunity to join the rest of the banking community on the QSE, this will allow us greater visibility, tap into new client segments, and empowerment to deliver on our business plan."

He added: "the transformation of QFB from an investment focused to an investor focused entity will continue across our main business lines: corporate & institutional banking, private banking & wealth management, treasury & investments, as well as alternative investments with a focus on private equity and real estate."

He concluded: "We are in a new phase of growth for the bank, and the credibility associated with the listing will support us in this effort."

QFB was established as one of the first independent Shari'ah compliant financial institutions licensed by the Qatar Financial Center Regulatory Authority, on September 4, 2008. The Bank's authorized capital amounts to QR 2.5 billion and the issued and paid up capital is QR 2 billion. Since its establishment, QFB has benefited from a strong shareholder base; 50.49% represents institutional investors including banks, pension and governmental funds, and corporates from different business sectors, and 49.51% represents individual investors including high-net-worth individuals from Qatar and across the wider spectrum of the GCC region.

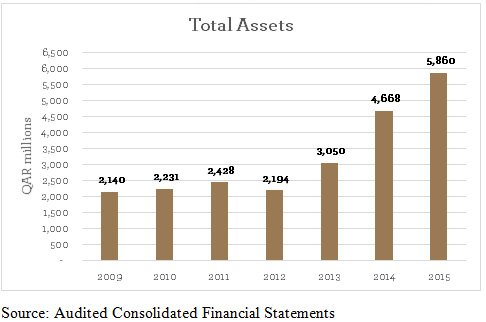

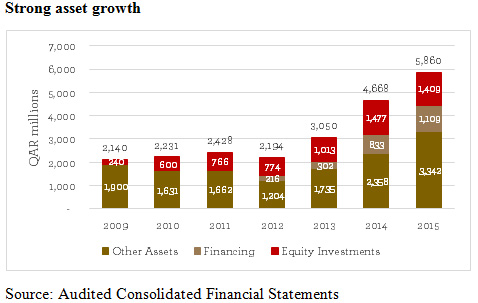

QFB income generating businesses offer innovative Shari'ah compliant solutions ranging from corporate & institutional banking, private banking & wealth management, treasury & investments, as well as alternative investments with a focus on private equity and real estate. Between 2010 and 2014, net income grew at a 19.4% CAGR (compounded annual growth rate). Despite the volatile market conditions and uncertainties, and the management investment decisions to grow and expand the bank's offerings and product ranges, QFB maintained a strong financial performance in 2015 with a total income of QAR 336.5 million and a net income of QAR 66 million. Total assets have grown over the past three year (3Y CAGR 38.7%) driven mainly by the Bank's new strategy of focusing on enhancing its banking operations to include deposit taking and lending facilities. The key growth drivers of total assets in FY15 were cash and cash equivalents, investments carried at amortised cost (sukuk) and financing assets led by the increase in deposits.

Since establishment QFB has strived to maximize return on shareholders' investment and has participated in more than 20 transactions as of December 2015 of which seven have been successfully exited and generated attractive returns to shareholders.

Additionally, QFB has closed a number of successful transactions across Qatar, the GCC, Turkey, UK, and other cities in various sectors including healthcare, energy, consumer, finance, real estate, industrial and insurance sectors with c. QAR 1.3 billion in invested capital. The carrying value of these investments as of December 2015 was in excess of QAR 1.8 billion.

Building on its successful investments, the Bank expanded its offering to banking services resulting in substantial growth in assets at 39% CAGR between 2012 and 2015 to c. QAR 5.9bn.

QFB's upcoming plans stand on major developments during 2015, which included the unveiling of its new brand which encapsulates its commitment to delivering excellence, the launch of its exclusive Private Banking business line, symbolized by the opening of its lounge. This new activity provides innovative wealth management solutions at the highest standards of governance and transparency.

Reaping the benefits of the Bank's strategy and successful results across all business lines, QFB has been exclusively named 2016's 'Best Up-and-Coming Islamic Financial Institution' in Global Finance magazine's ninth annual awards for the World's Best Islamic Financial Institutions. Additionally, the bank's Alternative Investments division has been awarded 'Best Shari'ah Alternative Investment Platform 2016' from Wealth & Finance International Magazine Alternative Investments Awards marking the hard work and efforts of the QFB team. Finally, The Asset, Asia's leading financial publication for issuers and investors, honored QFB the awards of 'Bank of the Year, Qatar' and 'Best Private Bank, Qatar' from The Asset Triple A Islamic Finance Awards 2016. The esteemed internationally recognized awards came on the heels of QFB's several milestones across its businesses during 2015.

Looking ahead, QFB's management envisions that the global economic backdrop will remain challenging specifically as the GCC region adjusts to lower oil prices and slowing economic growth. In spite of these challenges, the bank will continue adopting an opportunistic outlook to source viable investment opportunities that surface in such market conditions in order to generate sound returns for the Bank and create value for shareholders. The long awaited listing of QFB is bound to have a positive impact as the QFB brand gains more credibility and a wider recognition.

QFB continues to have an attractive pipeline of deals targeted for completion during 2016 and 2017. The team of banking professionals continue focusing on identifying and seizing new, attractive opportunities, deliver excellence for both private and corporate clients, build a strong brand, and provide shareholders with robust returns.

-Ends-

Visit our website, www.qfb.com.qa, to download the listing prospectus, Fatwa and the annual report 2015.

For information, please contact:

QFB: Mohamed Imran, Marketing Officer on:

Email: marketing@qfb.com.qa

GREY Doha: Denise Yammine Chouity, Group Account Director on:

Tel: + 974 4428 3111

Mobile: + 974 33318761

Email: denise.yamine@greydoha.com

About QFB:

Qatar First Bank (QFB) is one of the first independent Shari'ah compliant financial institutions regulated by the Qatar Financial Centre Regulatory Authority. Launched in 2009 as an investment bank, QFB has since evolved to broaden its offering to combine the best of a private bank with bespoke investment solutions tailored for the protection, preservation and growth of wealth. QFB has a diversified shareholder base of prominent individuals and institutions from Qatar and the GCC. QFB's team of professionals have the knowledge and expertise to provide world class, exclusive and cutting edge financial solutions underpinned by the Bank's commitment to deliver excellence in all aspects of business.

About QFC:

The Qatar Financial Centre (QFC) is an onshore business and financial centre located in Doha, providing an excellent platform for firms to do business in Qatar and the region. The QFC offers its own legal, regulatory, tax and business environment, which allows 100% foreign ownership, 100% repatriation of profits, and charges a competitive rate of 10% corporate tax on locally sourced profits.

The QFC welcomes a broad range of financial and non-financial services firms.

For more information about the permitted activities and the benefits of setting up in the QFC, please visit qfc.qa

@QFCAuthority | #Facilitatingsuccess

Milestones for 2015

QFB Private Banking Lounge:

In December 2015 QFB launched its exclusive Private Banking and Wealth Management business symbolized by its Private Banking Lounge which is a testament to the Bank's commitment to assure its clients that they will enjoy Private Banking services in a unique environment that evokes trust, professionalism, privacy and exclusivity. Located at 231, Suhaim bin Hamad Street, in Al Sadd, QFB's Private Banking Lounge serves as an icon in enhancing the bank's image amongst its stakeholders.

Investments Portfolio:

NEW INVESTMENTS

Cambridge Medical & Rehabilitation Centre

QFB acquired a 15.6% stake in Cambridge Medical & Rehabilitation Centre ("Cambridge Medical") based in Abu Dhabi.

Cambridge Medical caters for those in need of non-acute rehabilitation with a high level of physiotherapy as well as treatment for a broad range of conditions including spinal cord injuries, neuromuscular diseases and birth defects. Cambridge Medical is affiliated with US-based Spaulding Rehabilitation Network and Joslin Diabetes Centre, both Harvard Medical School affiliate training centres.

EXITED INVESTMENTS

QFB exited three investments in 2015, with IRRs ranging from 20% to 50%. These were:

Al Noor Hospitals

QFB sold its remaining shares in Al Noor Hospitals ("Al Noor"), which listed on the London Stock Exchange in 2014.

QFB realized total proceeds of US$ 146m and profit of US$ 106m throughout its investment in Al Noor resulting in an IRR of 49%.

Westbourne House, London

In August 2015, QFB completed the Westbourne House project. QFB and a group of GCC investors acquired Westbourne House in 2012; The project has won an architectural design award. During 2015, 85% of the apartments were sold to GCC investors. It is expected that when fully exited the investment will deliver an IRR of 20%.

Dubai Land Plot

QFB sold the plot of land near Burj Khalifa, Dubai, in which it had owned a 50% stake. The sale realised proceeds of ~US$ 18m, profit of ~US$5m and return on capital of 34%.

INVESTMENT PORTFOLIO UPDATES

Memorial Healthcare Group

Memorial continues to successfully expand its geographic footprint as revenue ramps up from its new hospitals: Ankara's revenue more than doubled during 2015, while the combined revenue of Kayseri, Dicle and Diyarbakır increased at more than 30% year over year, resulting in a total EBITDA increase of ~55% in 2015. Furthermore, significant progress has been made in the construction of the new hospital in Bahçelievler. This is expected to be one of the largest private hospitals in Istanbul, comprising 300 beds and a closed area of ~75,000 sqm.

English Home

English Home continued its aggressive expansion plans, adding 93 stores (57 in Turkey and 36 in international markets) to reach a total of 344 stores (272 in Turkey and 72 in international markets). This resulted in a ~45% increase in revenue for 2015 compared with 2014. High growth has been achieved as a result of various initiatives introduced by the new CEO to optimize operations, enabling English Home to dominate the Turkish textile retail market and further expand the company's regional footprint.

© Press Release 2016