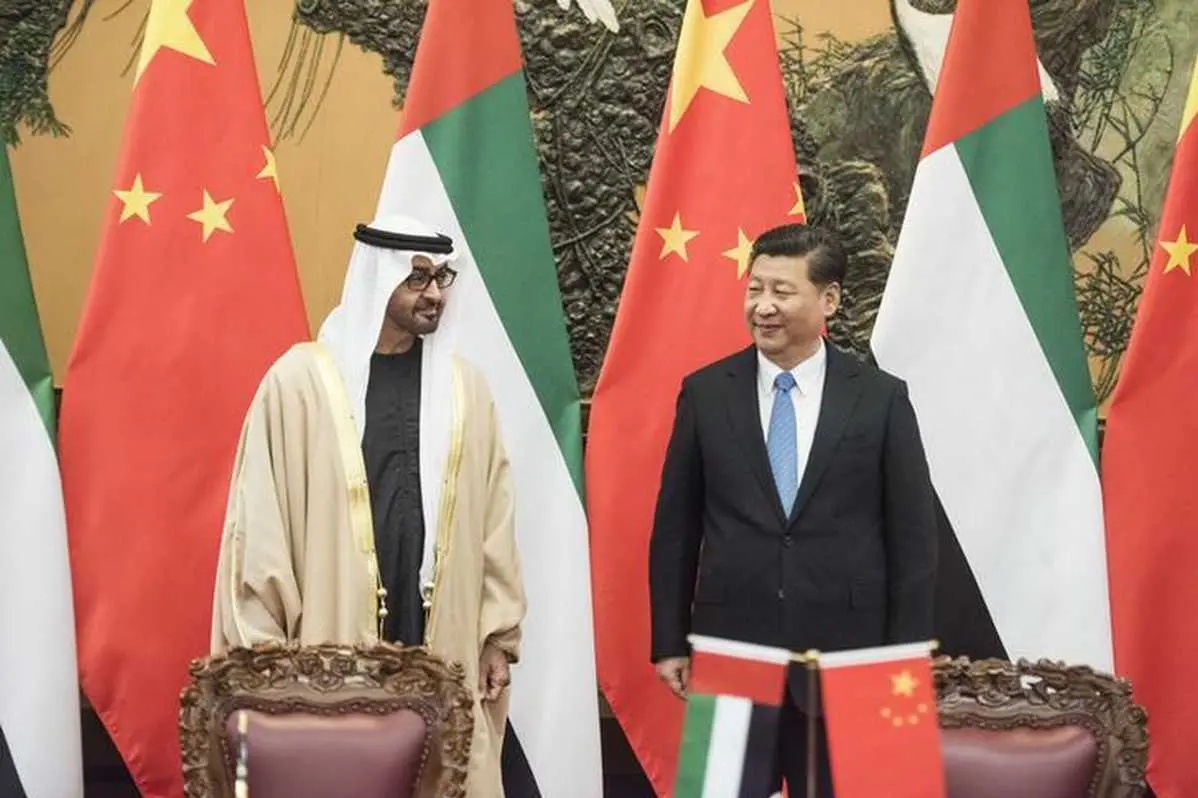

PHOTO

Today, the world is at a crucial juncture. Multilateralism, once spearheaded by the United States, is giving way to unilateralism and polarisation, also led by the United States. Great power equations are changing rapidly. Withdrawals from the world stage by one power are being quickly filled by other aspiring powers. With this background, the state visit of Chinese President Xi Jinping to the UAE marks an important watershed in evolving ties between the two nations. The importance is underlined by the fact that Xi will be the first communist party chief (who also happens in this case to be head of state) to visit these shores.

While trade between the two countries has been growing rapidly in recent years, almost 70 per cent of Chinese exports to the UAE are re-exported to other countries in the GCC, Africa and Europe. Some years ago, a similar situation existed in pre-handover Hong Kong, where the former British colony served as a re-export staging post for a then relatively closed China's trade with the world.

Today, over 4,200 Chinese firms have set up base in the UAE as a gateway to access the Middle East and Africa regions and Dragon Mart in Dubai happens to be the largest trading centre of Chinese products outside mainland China. In addition to this, there are over 200,000 Chinese citizens who are resident in the UAE and Chinese tourists to the UAE have grown to be the fourth largest nationality visiting the country.

With this infrastructure in place, one assumes that the Chinese president and his delegation will push hard for the UAE to play a more active role in China's ambitious Belt and Road Initiative (BRI).

BRI is China's aspiring vision for restructuring the global economy essentially on its terms. Massive amounts of capital - both equity and debt - have been earmarked for recreating a 21st century version of the old Silk Road that was used centuries ago as a conduit for China's trade with the world. This planned economic corridor will eventually consist of ports, airports, road, rail and communications links along a land route (Belt) from western China through Central Asia to Europe and a maritime route (Road) linking China to Europe via the South China Sea, the Indian Ocean and the Red Sea into Europe.

Some of China's geopolitical adversaries, such as Japan and India, have largely stayed out of this initiative, seeing it more as a means of spreading China's influence along the route rather than the touted ostensibly benign desire for free trade.

One of the fallouts of BRI has been the case of smaller, less wealthy countries taking on huge amounts of debt from Chinese state-owned lenders. Cases in point are Sri Lanka's Hambantota port, where debt, unable to be paid off, was converted into equity and Chinese ownership; and the Mattala Rajapaksa International Airport built with Chinese loans (which India has now agreed to buy). Other weak economies like Djibouti, Kyrgyzstan, Pakistan and Laos are also vulnerable to sinking into debt traps.

The UAE should be welcoming Chinese direct equity investment into ports, e-commerce and other infrastructure areas. As the world's largest oil importer, China will be looking to cement ties to assure supply channels even as it takes major steps to move into renewable and sustainable energy. Energy will probably figure near the top of the agenda during Xi's visit.

China is the world's largest producer of solar photovoltaic (PV) panels and also leads the world in installed PV capacity. At the same time, it continues to rely heavily on fossil fuels like oil and coal for its energy needs. The UAE is a major oil exporter and is focused on moving away from the use of hydrocarbons and into renewable and clean energy. The synergies present for both countries are clear and obvious.

The financial sector is also expected to gain from the Chinese president's visit. The top four largest Chinese banks are all represented in Dubai's DIFC and have now become full-fledged branches. There is significant interest evinced in China in Islamic banking and there is no better place to get started in this area than the UAE. Chinese banks will be looking to get into financing the re-exports that go out of Dubai into Africa and beyond.

In 2017, at the sixth Joint Economic Committee session held in Beijing, the two nations identified 13 key areas of cooperation, some of which have been discussed above. One area that deserves special attention is that of "SMEs and innovative industries." The UAE, and Dubai in particular, has been focused on innovation and startups with a number of accelerators set up to create an ecosystem that nurtures innovation by small enterprises.

The one thing still needing further development in this area is a network of committed angel investors and venture capital. If, in addition to investing in large infrastructure projects, capital from successful Chinese e-commerce startups like Alibaba, Tencent and Baidu, who are hungry for overseas investment opportunities, could find its way into this SME/startup ecosystem, it could go a long way in boosting innovation and risk-taking in the UAE.

Trade, investment, finance and energy are likely to be the key topics for this upcoming summit but strategic considerations are also likely to figure in the discussions. The UAE is not situated directly on either the "Belt" or the "Road" but its geopolitical juxtaposition (in between both) and stability will prove to be attractive to China. Above all else, China and the Chinese leadership values and places great store on stability. In a highly unsteady and volatile part of the world, the UAE's political and economic solidity and diverse population stand out as a beacon.

One thing, however, is clear. When Xi comes calling, it could mark the beginning of a new chapter in Sino-UAE economic cooperation that could hugely benefit both countries.

Sanjay Modak is Chair, Graduate Programs & Research and professor of Economics at the Rochester Institute of Technology, Dubai

Copyright © 2018 Khaleej Times. All Rights Reserved. Provided by SyndiGate Media Inc. (Syndigate.info).