PHOTO

As National Central Cooling Co. (Tabreed) expands its capacity targets after strong 2018 financial results, the United Arab Emirates-based district cooling firm will focus on growing both its local and Saudi presence, according to its chief executive, who voiced confidence that the firm will override any ‘perceived’ slowdown in 2019.

Speaking to Zawya at Tabreed’s offices at Abu Dhabi’s Masdar City, Jasim Thabet said that outside of the UAE, the firm’s most important market is Saudi Arabia.

“We highly believe in the strong market potential in Saudi. There are so many opportunities in the kingdom at different fronts, whether in the form of concessions, BOT (Build-Operate-Transfer) among others. And I would say that there is a lot of potential all over Saudi from Riyadh, Jeddah, Khobar, to Dammam,” he said.

In May last year, Tabreed announced the acquisition of a significant stake in its Saudi Arabian associate, Saudi Tabreed, by the IDB Infrastructure Fund II, managed by ASMA Capital Partners.

On the rationale of decreasing its stake in the Saudi associate, Thabet said: “Yes, we reduced our stake in Saudi Tabreed from 25 to 20 percent, as we saw an opportunity to bring in a strategic investor, to help grow the business which will give us access to more opportunities, projects, and a bigger piece of the pie since Saudi is a key market for district cooling.”

Saudi Arabia’s district cooling (DC) market is set to exceed $1 billion by 2024, according to consultancy Global Market Insights, with the industry’s growth likely to be stimulated both by increased residential and commercial construction activity, along with government adoption of tighter green building standards.

Thabet noted that Tabreed is currently the only district cooling company that is listed on the Dubai stock market, and it is the only district cooling company that has operations across most Gulf Cooperation Council (GCC) countries.

“Abu Dhabi is by far our largest market, and we’re the biggest player in the emirate with over 75 percent market share. In Dubai, we are the fourth-biggest cooling provider, and we have a 10 percent market share,” he said.

“We also have the highest market share in three other GCC countries - in Saudi, Qatar and Oman,” he added.

Commenting on the impact of softening real estate markets in the UAE on Tabreed, Thabet said: “Our numbers show that we continue to grow even in challenging market conditions.”

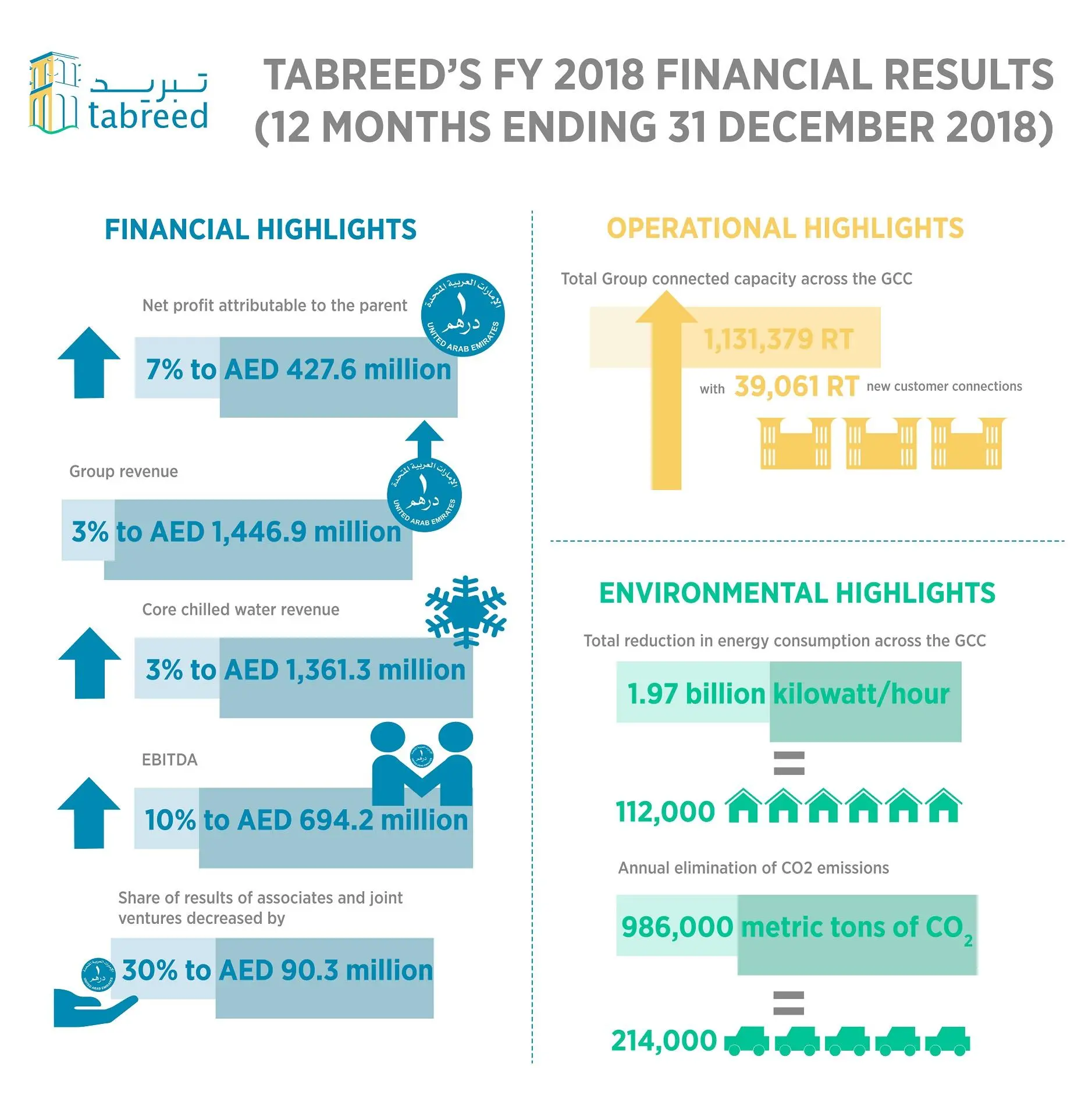

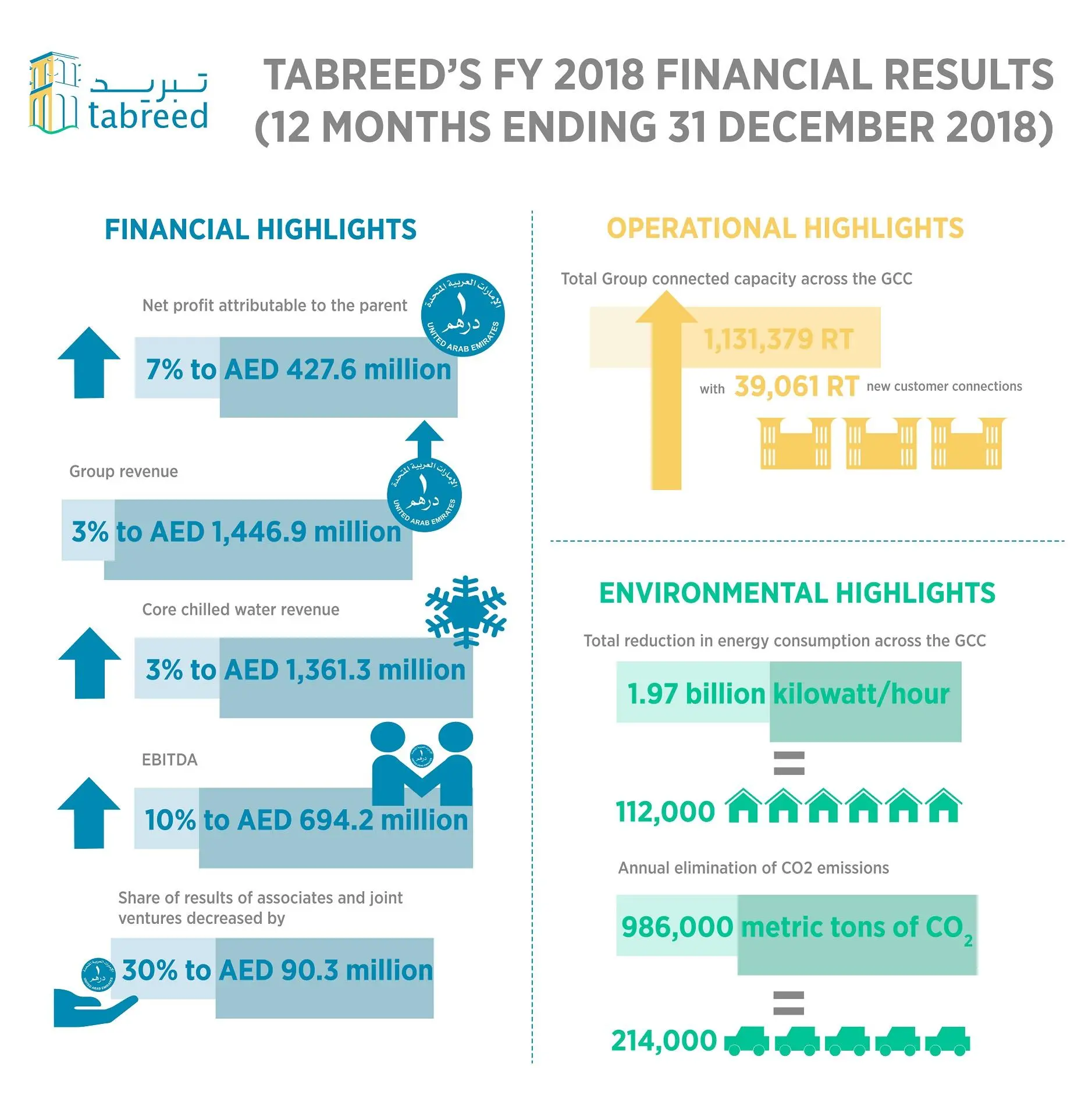

For 2018, Tabreed reported a net profit increase of 7 percent to 427.6 million UAE dirhams ($116.4 million) by adding 39,061 refrigeration tons (RTs) of new connections, resulting in the delivery of over 1.1 million RTs of cooling capacity.

“Even with a slowdown, if there is a perceived slowdown, governments and private sector entities will still be looking for ways to be more efficient and cost effective,” Thabet said.

“Populations will continue to grow, and there will always be a need for world class infrastructure projects, so there will always be strong demand for district cooling, with its technology that can provide 50 percent more energy savings than conventional cooling,” he added.

Though Kuwait is the only GCC country in which Tabreed currently has no presence, the firm looked at opportunities in the past, according to the CEO, but “they were not attractive and did not add value to our shareholders”.

“Nevertheless, we are still looking at Kuwait, and if the right opportunity arises, we’ll certainly consider it,” Thabet said.

On expanding beyond the GCC, Thabet noted that “Egypt is a growing economy with increasing urbanisation and rising demand for air conditioning”.

“We’re also seeing growth at the retail front with new malls opening, which requires district cooling. So Egypt is a market that we’re looking at and there is a lot of upside there. We just need to find a deal that fits the investment appetite of Tabreed,” he said.

Egypt’s growth is expected to accelerate to 6.5 percent in its next fiscal year, in comparison to 5.3 percent in the previous year, Zawya reported last month, citing the country’s finance minister.

A recent survey also noted that Egypt was named as the second-most important foreign market for 2019 expansion, right after Saudi Arabia, among CEOs in the Middle East region.

“We have set a target of 65,000 RTs over the next two years for the markets we are already present in, so if we decide to do anything in Egypt, it’ll be on top of that target,” Thabet added.

Listed on the Dubai Financial Market (DFM), Tabreed has investment grade credit ratings from Moody’s and Fitch of Baa3 and BBB respectively.

Tabreed CEO Jasim Husain Thabet

Solid performer

Michel Said, a research analyst at Cairo-based CI Capital, told Zawya via emailed comments that Tabreed had “solid operations”.

“The district cooling provider continues to deliver resilient operational performance, however, with a feeble 2018 top line growth of 3.4 percent, mainly stemming from S&T consolidation,” he said, referring to Tabreed’s acquisition in March last year of the 50 percent stake in S&T Cool District Cooling it did not already own.

The company acquired Aldar Properties’ 50 percent stake in S&T Cool District Cooling Company, which serves Abu Dhabi’s Reem Island, in a transaction that valued the firm at 348 million UAE dirhams. The acquired plant was the sixth in Tabreed’s portfolio that provide district cooling to Aldar entities.

The company’s 2018 bottom line increased by 7 percent, mimicking the growth in the company’s gross profit, Said noted.

The increase in its bottom line has led Tabreed’s board of directors to recommend increasing its dividend by 19 percent to 9.5 fils per share.

“Dividends recommendation positively surprises, and there is more room for a higher-than-expected dividend payment going forward, in our view,” Said argued.

Said also said that the firm has an improving debt profile as the management highlighted that the $500 million sukuk raised in October last year will be used to refinance 2.8 billion dirhams worth of current corporate debt, thereby improving balance sheet efficiency.

On the prospects of new sukuk in 2019, Thabet told Zawya “We do not have any requirements to issue new sukuk at this time, but if the market changes, and there is opportunity in the market for a new acquisition, we could potentially be looking at new issuance”.

Adding capacity

Last year, Tabreed added 39,000 refrigeration tons (RTs) across the region, with key additions during the fourth quarter being Pearl Qatar (3,259 RTs) and Oman’s Araimi Mall (6,225RT).

“There is no plan for us to reduce our number of plants anywhere in the GCC and they’re all important markets for us,” Thabet noted.

Harshjit Oza, vice president of research at Shuaa Capital, said that the increase in capacity and a one-off gain from the 43 million dirham disposal of a 5 percent stake in its Saudi associate, offset a “30 percent YoY (year-on-year) contraction in Tabreed’s associates’ profit share and impact of IFRS 15,” he told Zawya in emailed comments. IFRS 15 is a new accounting standard which came into force last year which determines how companies recognise revenue from contracts with costumers.

Oza said that Shuaa Capital remains “optimistic on the outlook as we view Tabreed as stable cash flow generating business with high earning visibility in growing market,” he said.

“The company also has unutilised financing facility of AED 600 million, which we believe will be used to finance expansions,” he added.

“In terms of our short term financing strategy, we believe we have the right capital structure in place, and the right liquidity,” Thabet told Zawya. “We have around 250 million dirhams of cash and on top of that we have 600 million dirhams of facilities if required for new projects.”

Thabet affirmed Tabreed’s obligation as a company to contribute to the sustainability of the countries it operates in.

“Through the 1.13 million refrigeration tons that we contracted that we supply, Tabreed directly contributed to the reduction of 2 bilion kilowatt hours of energy,” he said. “In terms of environment, that led to a reduction of almost 1 million tons of CO2 emissions,” Thabet said.

Governments are moving away from power and water subsidies, and they’re also looking at ways on how to be more efficient in energy consumption, Thabet said.

“The biggest component of energy consumption in the GCC is cooling, which represents 70 percent of the peak power requirement. With district cooling being 50 percent more energy efficient, it contributes a lot to the government savings,” he said.

(Reporting by Nada Al Rifai; Editing by Michael Fahy)

Our Standards: The Thomson Reuters Trust Principles

Disclaimer: This article is provided for informational purposes only. The content does not provide tax, legal or investment advice or opinion regarding the suitability, value or profitability of any particular security, portfolio or investment strategy. Read our full disclaimer policy here.

© ZAWYA 2019