PHOTO

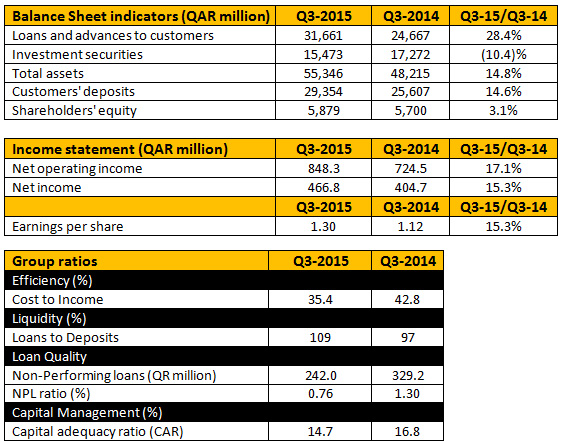

- Net profit of QAR 466.8 million, 15% higher than the same period in 2014

- Total assets grew by 15% to reach QAR 55.3 billion in Q3 2015

- Loans and advances at QAR 31.7 billion, 28% higher year on year

- Deposits increased 15% to QAR 29.4 billion

- Net operating income at QAR 848 million, up 17% on the same period last year

Doha, October 20, 2015

al khalij Commercial Bank(al khaliji) Q.S.C, in Qatar, announced its financial results for the third quarter of 2015, reporting a Net Profit of QAR 164.4 million. This represents an increase of 13% over the same quarter of last year. The Net Profit for the first nine months of this year stood at QAR 466.8 million compared to QAR 404.7 million generated during the first nine months of 2014.

Al Khaliji France S.A.'s net profit was at QAR 57.4 million in Q3 2015 and represents 12% of the Group net income.

al khaliji Bank Chairman and Managing Director His Excellency Sheikh Hamad Bin Faisal Bin Thani Al Thani stated:

"I am very pleased to report record results in the third quarter of this year. These results clearly demonstrate the earnings power of al khaliji and the strength of our diversified business model, with the right mix of wholesale, treasury and personal .Overall, we are extremely pleased with the strong momentum in Qatari Banking, and are also proud that these results were achieved while simultaneously reaching new heights in customer loyalty measures".

Commenting on the strong financial performance, Fahad Al Khalifa, al khaliji's Group Chief Executive Officer said:

"al khaliji's performance during Quarter 3 demonstrates the underlying strength of our business. Year to date Profits of QAR 467m are 15% higher than the same period last year. Our core franchises, of Corporate and HNW Personal Banking, delivered double- digit growth year-on-year in our loan book and deposit base. Our efficiency ratio at 35.4% continues to decrease and reflects ongoing prudent cost control combined with increasing revenues. We continue to focus on diversifying and improving the quality of our funding sources and have made much progress in this regard. The bank is well capitalized, with a CAR of 14.7%, and will continue to maintain strong levels to support future growth plans. We expect this positive business momentum to continue for the remainder of the year and are well placed to achieve our financial targets for 2015."

Income Statement highlights

Net Profit for the third quarter of 2015 is QAR 164.4 million compared to QAR 145.9 million for the third quarter of 2014. Net Profit for the first nine months of this year is QAR 466.8 million compared to QAR 404.7 million for the same period in 2014. Earnings per share were at QAR 1.30 for the first nine months of this year.

For the 9 months ended September 2015, net interest income increased by 26%, to QAR 688.3 million compared with the same period in 2014. Net fee and commission income increased 10% in the same period to reach QAR 140.1 million compared to QAR 127.9 million in the first nine month of 2014.

Balance Sheet highlights

Total assets reached QAR 55.3 billion in the first nine months of 2015, up 15% from Q3 2014 and up 8% from the period ending December 2014.

Al khaliji France S.A.'s assets represented 10 percent of the group's total assets.

Loans and advances grew by 28% compared to same period in 2014 to reach QAR 31.7 billion, and is 18% higher than the period ending December 2014.

Customer deposits grew to QAR 29.4 billion, up 15% compared to the first nine months of 2014 and up 7% from the fourth quarter of 2014.

Capitalization

The bank's capital adequacy ratio was 14.7% as per Basel III.

Provisioning

Non-performing loans ratio is 0.76% at the end of September 2015.

-Ends-

For further information on al khaliji, please visit www.alkhaliji.com

Investor Relations:

Joe Maalouf

Head of Investor Relations Or: investor-relations@alkhaliji.com

© Press Release 2015