PHOTO

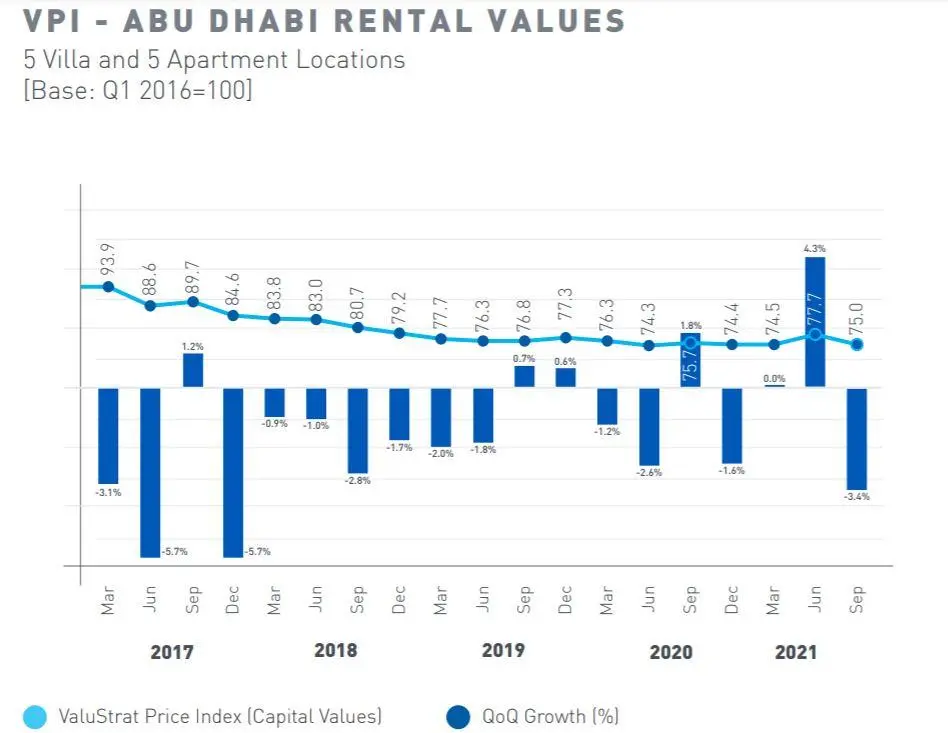

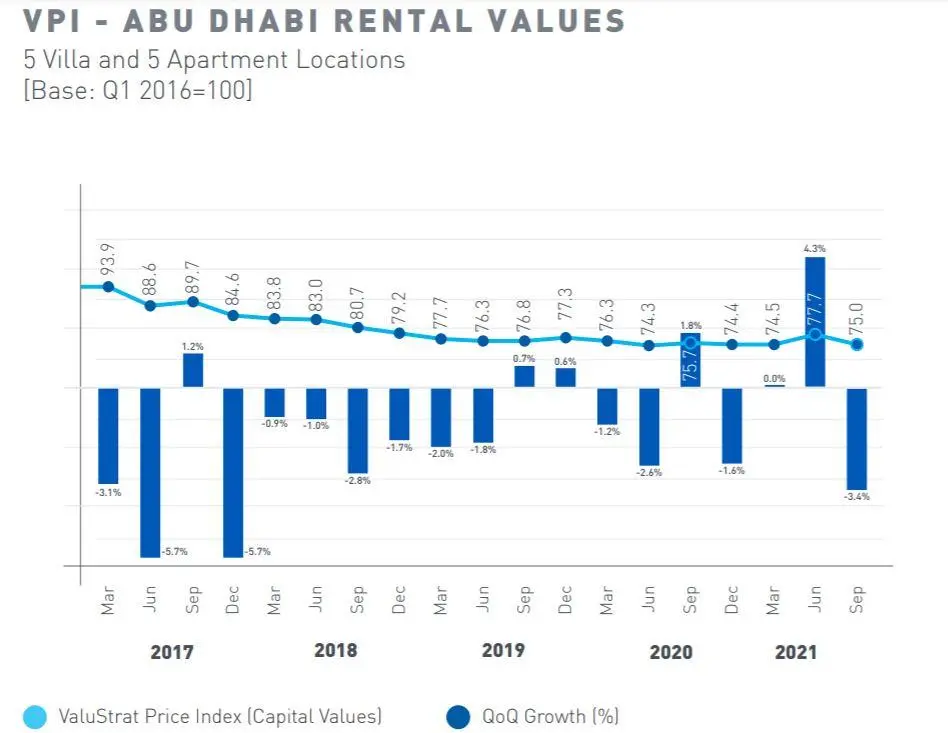

Residential rents in Abu Dhabi have pulled back from their recent gains to reach similar levels of last year, according to new data released by real estate consultancy ValuStrat.

Average rental values for apartments and villas in the emirate dropped by 3.4 percent in the third quarter compared to the previous three months.

So far, the decline is the biggest this year, with rents previously registering a 4.3 percent quarterly jump in Q2 2021 and 1.8 percent in the third quarter of 2020.

With the recent adjustments, citywide rents in Abu Dhabi have returned to similar levels recorded in 2020, according to ValuStrat.

However, Haider Tuaima, head of real estate research at ValuStrat, maintained that rents in Abu Dhabi are still "somewhat stable" when compared with the rental values in the previous year.

He also noted that asking rents for apartments weakened by 2.3 percent, while villa rents dipped only by 1.2 percent when compared to the second quarter. Despite the citywide decline, some locations also saw rental increases, such as Al Reem Island, Al Muneera and Al Raha.

If residential property prices will continue to rise, rents could follow the same trend.

"Generally, due to the nature of annual rental contracts, rental value growth usually lags behind capital growth by 12 to 18 months. Therefore, if prices are to continue to rise, landlords are expected to folluw suit and raise rents of their properties upon renewal of their contracts," Tuaima told Zawya.

Residential supply handovers in Abu Dhabi were earlier forecast to hit their highest level in approximately half a decade. According to real estate consultancy CORE, 2021 could see a “spike” in supply, with more than 7,000 units expected to be completed.

As of the second quarter, at least 2,079 apartments and villas were delivered in Abu Dhabi, according to Asteco. Rents in Abu Dhabi had increased in Q2 2021, mainly driven by the rise in interest for well-developed villa communities on Yas Island, Saadiyat Island and Raha Beach, Asteco had said.

Capital values

While rents have “softened” in Q3 2021, ValuStrat said Abu Dhabi continues to see an improvement in capital values.

The Q3 2021 ValuStrat Price Index (VPI) for capital values in the emirate’s residential investment zones grew 2.3 percent quarterly to 68.8 points.

All the properties monitored by the VPI saw quarterly growth in capital values ranging from 1.8 percent to 2.6 percent.

The weighted average residential value for the third quarter stood at 9,009 dirhams ($2,400) per square metre.

Among the properties tracked for the index, the villas in Al Reef recorded significant gains of 13.9 percent, while units in Al Raha and Saadiyat Island posted increases of 13.3 percent and 11.7 percent, respectively.

(Writing by Cleofe Maceda; editing by Seban Scaria)

Disclaimer: This article is provided for informational purposes only. The content does not provide tax, legal or investment advice or opinion regarding the suitability, value or profitability of any particular security, portfolio or investment strategy. Read our full disclaimer policy here.

© ZAWYA 2021