PHOTO

- Corporate venturing becoming one of the key vectors of the new economy

- Companies embark on innovation push inspired by the world of startups

Dubai: GELLIFY Middle East, a multinational B2B innovation platform managing digital transformation, has released a new corporate venturing-focused study that provides a unique overview of how leading international companies across different industries are developing initiatives that enable them to achieve their strategic objectives, promote an agile approach to processes, and work towards a culture of innovation inspired by the world of startups.

The new study, The 4 W’s of Corporate Venturing, highlights the results of a series of video interviews and qualitative questionnaires conducted with 21 corporate venturing experts, innovation managers, and other C-level managers of 18 market-leading companies in the United Arab Emirates (UAE), Italy, Spain and Switzerland, operating in the services (including telecom and infrastructure), energy, manufacturing, banking, and insurance sectors, and functioning on a global scale.

The study is created and designed by GELLIFY's team under the framework of the 4 W´s of corporate venturing (Why, What, Who, and Where).

The study’s UAE participants include Mohamed Al Qubaisi, Chief Technology Officer of Injazat; Ussama Dahabiyeh, Chief Executive Officer of Injazat; and Kai Ling Ting, Head of Innovation of Etihad Aviation Group.

A majority of the participants in the research (79%) have above 1,000 employees, while 78% have experience with a venturing business unit ranging from 2-5 years, 14% have been in operation for one year or less, and 7% have been in operation for 6-10 years.

As an innovation vehicle, and with corporate venturing becoming one of the key vectors of the new economy, the GELLIFY research team asked the highly skilled and experienced C-level participants four key questions: Why corporate venturing? What type of venturing should be done? Who are the key figures to involve in corporate venturing? And, where should efforts be concentrated?

“The Why.”

Most study respondents reported that the reason they began corporate venturing was in order to create an innovative corporate culture internally. For others, having an internal startup acts as a driving force to attract young talent.

Meanwhile, for other companies, investing in startups that operate in adjacent sectors, or sectors that are far from their core business, has proved to be an opportunity for diversification and allowed them to anticipate the needs of markets in which competitors operate in more traditional ways. Others also see corporate venturing as a growth opportunity to reinvest in their core business.

The research also discovered that large companies have hundreds of thousands of pieces of data that can constitute real business cases for the algorithms of startups, which, in turn, can be used to better respond to the specific needs of millions of customers globally.

"The What.”

There is no single rule as to what type of corporate venturing strategy a company should adopt. The companies surveyed indicate a strategy of diversifying investments between the short, medium and long term, in order to reap the benefits, while diversifying the risks. Some 50% of the leaders interviewed stated that they had worked on projects with startups with an average duration of 2-5 years.

Regarding the size of investments, the GELLIFY study found that around 50% of the well-established companies surveyed provide more than AED43.38 million ($11.81 million) in capital to their CVC (Corporate Venture Capital) each year, while 36% provide less than AED21.67 million ($5.90 million), and 14% provide between AED21.67 million ($5.90 million) and AED43.38 million ($11.81 million).

The success of venturing initiatives can be challenged by excessive internal bureaucracy within large companies, which can cause misalignments with the parent company, conflicts of interest, intellectual property issues, etc. In fact, 43% of the surveyed companies have had unsuccessful experiences with startups.

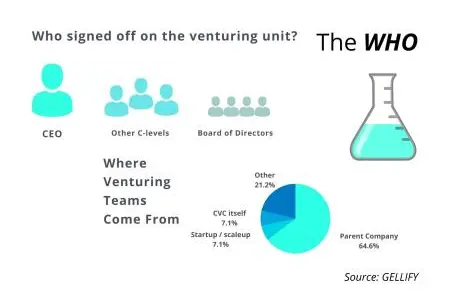

“The Who.”

The involvement of the CEO is crucial to the startup of a new venturing unit, as is the board of directors and other C-level executives in an organisation. Of all the companies surveyed, about 60% reported that their venturing unit team comes from their parent company, about 21% from other sources, 7.1% from the corporate venture capital division itself, and 7.1% from a startup/scaleup.

Another aspect to consider when involving key people from the parent company is the level of risk the company is willing to tolerate. A total of 86% of the respondents answered that their company was only willing to tolerate a medium level of risk - even though these types of investments tend to generate returns over the long term (at least 5-7 years): 7% a high level and the other 7% a low level.

“The Where.”

With the right team on board, an experimental mindset, and resources allocated to venturing, the question remains: Where should the company concentrate their efforts? In response to this question, survey respondents were divided, with 50% hosting calls for startups, 43% searching internally for recommendations from a corporate venture capital or parent company, and 7% relying upon traditional venture capital funds.

The most common investment strategy used by the companies surveyed was direct investments (64.6%), while 7% preferred to invest through co-investments and another 7% through indirect investments.

For a corporate venturing initiative to succeed Ussama Dahabiyeh, CEO of Injazat, said: “It’s all about managing risks, being steadfast and staying cheap; hence fostering an experimental, failure tolerant mindset becomes really important” with Mohamed Al Qubaisi, Chief Technology Officer of Injazat, adding: “You need to provide the right environment and get the right talent in the right place.”

Offering advice to corporations seeking to embark on corporate venturing initiatives, Kai Ling Ting, Head of Innovation at Etihad Aviation Group, said: “It’s tempting to want to leap to results from day one but it is important to recognise that this is a long-term investment which requires patience, and often, a culture change within the organisation. For the initiatives to be successful and sustainable, you’ll need strong advocates on the leadership team who will not only help champion the cause but also walk the talk by sponsoring projects within the innovation space so you can have concrete success stories for the rest of the organisation to get excited about and want to be involved in.”

Commenting on the study’s findings, Michele Giordani, Managing Partner and Founder of GELLIFY, said: “Two fundamental aspects emerge that all companies will have to take into account more and more. First of all, if they do not want to run the risk of losing relevance to new fully digital players, they will have to innovate; starting collaborations with external startups. The second important aspect concerns the culture of innovation in a company and its perception on the market in terms of innovation.”

“Corporate venturing initiatives give a great impetus to both of these strategic levers and also provide a benchmark on the speed and dynamics emerging in the market,” Giordani added.

The study was produced by Pedro Irujo, Managing Director of GELLIFY Iberia and expert in corporate venturing, in collaboration with Amanda Whitmore, Corporate Storyteller of GELLIFY, and Rebecca Mini and Federico Collarin, GELLIFY Innovation Consultants.

The GELLIFY study was produced in association with Accenture Italy, the law firm Gianni & Origoni, Kaspersky Innovation Hub, and the tax consulting firm Studio Pirola Pennuto Zei & Associates.

-Ends-

About GELLIFY

GELLIFY is an innovation platform that connects high-tech B2B startups with traditional companies to innovate their processes, products, and business models. With headquarters in Italy and offices in Spain and the United Arab Emirates, the company’s success is based on its unique model that infuses companies with the most advanced B2B startup technologies and GELLIFY’s expertise. The platform accompanies startups from their “gaseous” or “liquid” embryonic state to a reliable and scalable “solid” state through its exclusive and proprietary growth program, GELLIFICATION. This growth is financed through smart investments implemented by GELLIFY and its co-investors.

GELLIFY has also created a community called EXPLORE where entrepreneurs, innovators, and professionals can connect on any digital device. Through the app, downloadable from the App Store and Google Play Store, subscribers can have phygital experiences that alternate between the physical and digital world, participate in events, and infuse their companies with the most advanced startup technologies and GELLIFY skills.

GELLIFY consists of 3 business units:

- GELLIFY for Startups, which is dedicated to the gellification of startups that have already expressed traction in the market. The gellification program provides more complex services than the mentorship and basic business creation services typical of incubators. It lasts 6-24 months and involves all areas of the company.

- GELLIFY for Companies, which is focused on open innovation services for SMEs and large corporations that want to build new innovative business paths. This division specializes in corporate venturing, innovation strategies, sales and marketing digitization, Industry 4.0 and digital operations, digitization, and workforce empowerment.

- GELLIFY for Investors, which provides investment advisory services and manages a GELLIFY Investment Fund for selected innovative B2B tech startups.

Partners of GELLIFY for 2021 include the tax consulting firm Pirola Pennuto Zei & Associati with Partner Stefano Tronconi and Associate Partner Luca Neri; the law firm Gianni & Origoni with Partner Federico Dettori and Associate Partner Rodrigo Boccioletti, as part of the activities of the Gop4Venture practice; and T.T. Tecnosistemi, a company focused on advanced IT solutions.

Website: www.gellify.com

For any further information, please contact,

PR Contact: Mukesh Dua

© Press Release 2021

Disclaimer: The contents of this press release was provided from an external third party provider. This website is not responsible for, and does not control, such external content. This content is provided on an “as is” and “as available” basis and has not been edited in any way. Neither this website nor our affiliates guarantee the accuracy of or endorse the views or opinions expressed in this press release.

The press release is provided for informational purposes only. The content does not provide tax, legal or investment advice or opinion regarding the suitability, value or profitability of any particular security, portfolio or investment strategy. Neither this website nor our affiliates shall be liable for any errors or inaccuracies in the content, or for any actions taken by you in reliance thereon. You expressly agree that your use of the information within this article is at your sole risk.

To the fullest extent permitted by applicable law, this website, its parent company, its subsidiaries, its affiliates and the respective shareholders, directors, officers, employees, agents, advertisers, content providers and licensors will not be liable (jointly or severally) to you for any direct, indirect, consequential, special, incidental, punitive or exemplary damages, including without limitation, lost profits, lost savings and lost revenues, whether in negligence, tort, contract or any other theory of liability, even if the parties have been advised of the possibility or could have foreseen any such damages.