PHOTO

Abu Dhabi Commercial Bank (ADCB) confirmed on Tuesday that the terms of its three-way merger with Union National Bank (UNB) and Al Hilal Bank had been agreed and that the merger plans first announced in September last year will progress, subject to approval by both companies' shareholders, as well as by the Central Bank and other regulators in the United Arab Emirates.

In a statement issued to the Abu Dhabi Securities Exchange on Tuesday, the three banks said that the merger would create an entity which would be the third-largest bank in the UAE (behind First Abu Dhabi Bank and Emirates NBD) and the fifth-biggest bank in the Gulf Cooperation Council, with assets of 420 billion UAE dirhams ($114 billion) and around one million customers.

In terms of market share, it will have a 15 percent share of the UAE market in terms of total assets and a 16 percent share of deposits. It would also operate the third-largest Islamic banking franchise, with a 13 percent share of the market, the statement said, citing UAE Central Bank and company data as of September 2018.

All three banks were at least part-owned by the Abu Dhabi government, and it will retain a 60.2 percent share of the combined entity, according to the statement. Its share will be held via Abu Dhabi Investment Council. Other shareholders in ADCB will own 28 percent stake via Abu Dhabi Investment Council, while other UNB shareholders will hold 11.8 percent.

The deal will progress initially by a merger between the two listed entities, ADCB and UNB. It is expected that this will complete in the first half of the year, and would be followed by the combined entity acquiring Al Hilal Bank for one billion dirhams.

The announced terms of the initial merger will see UNB shareholders receive 0.5966 shares in ADCB for each UNB share held, which will be covered by the issue of 1,641,546,697 new ADCB shares, which values UNB at just over 14.5 billion dirhams. This represents a premium of 13.7 percent on UNB's share price at close on September 2 last year, which was the day before news of the potential merger broke, or a premium of 0.6 percent to the closing price on Monday.

Jaap Meijer, head of equity research at Arqaam Capital, said in response to questions from Zawya that the ratio being offered to UNB shareholders was "disappointing in our view, and undervalues UNB".

He said that it had expected a ratio of 0.714-0.769 ADCB shares per UNB share. He also said a proposal to delist UNB shares on the day the merger becomes effective gives shareholders little option but to accept the offer. However, he also noted that the acquisition by the combined entity of Al Hilal Bank for one billion dirhams means they will pick it up for just 20 percent of its book value. As a result, he said the deal should lift the fair value of ADCB by four billion dirhams, or around 5-6 percent, as Arqaam Capital had assumed the Al Hilal Bank would be bought at its book value.

“We remain buyers of ADCB/UNB,” Meijer said.

Charles-Henry Monchau, managing director of investment management at Dubai-based Al Mal Capital, argued the opposite, stating that the deal valued UNB at 0.85 times its book value, “which we think is slightly rich”.

However, he added that the deal offered a number of advantages. Firstly, the combined entity will keep the existing ADCB brand, "thereby limiting rebranding costs", although Al Hilal Bank will retain its own brand and operate as a separate Islamic entity, according to the banks' combined statement.

Monchau also pointed to the fact that the banks have claimed the deals will offer annual cost synergies of 615 million dirhams, or about 13 percent of its combined cost case.

The global benchmark in terms of cost synergies for such domestic bank merger cases is between 8-10 percent, according to the combined statement.

Monchau also said as well as building scale, which offers cross-selling opportunities to each others' customer bases, the deal offers a broader diversification of the bank's customer portfolio.

The merger between the three banks follows on from the merger between National Bank of Abu Dhabi and First Gulf Bank, creating the UAE's biggest lender following its completion in 2017.

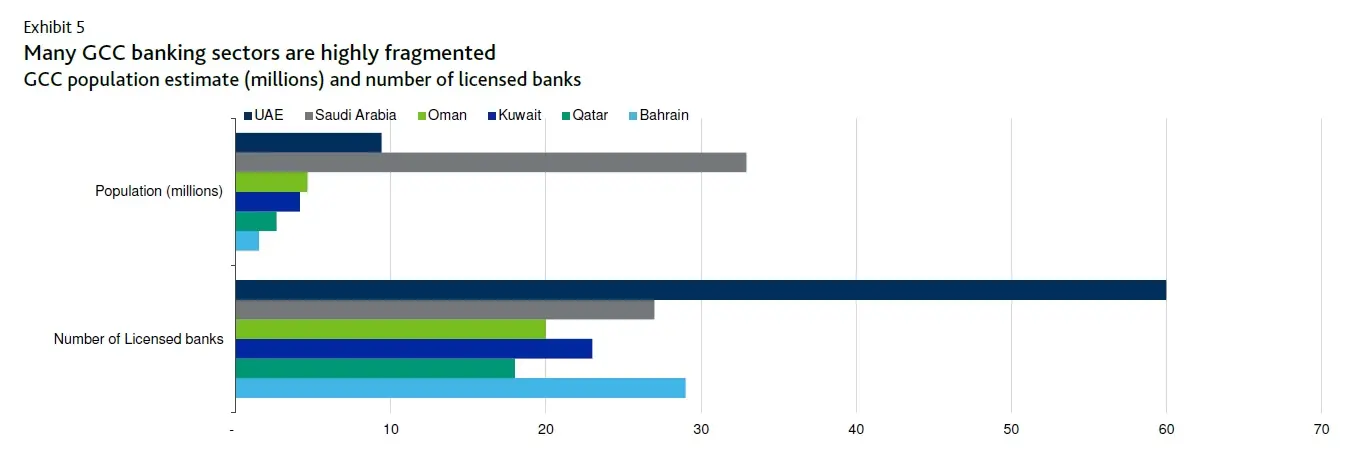

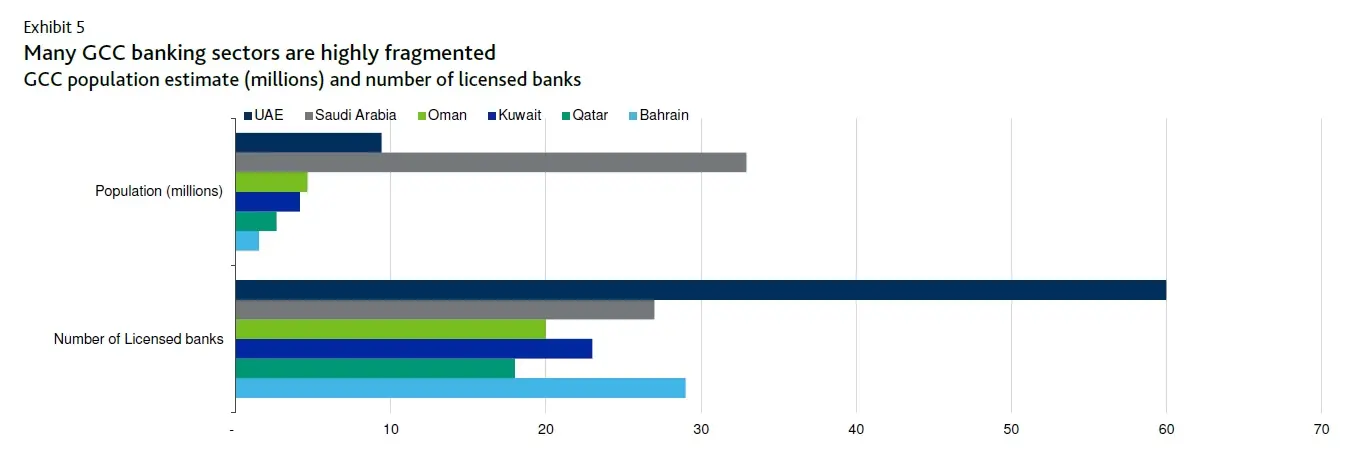

Source: Moody’s Investor Service, central bank reports, national authorities

Pietro Castronovo, a Dubai-based managing director at financial services consultancy Alvarez and Marsal, said in an emailed comment to Zawya that the merger represented a "critical step for strengthening the banking sector".

He added that "the real value of this merger will depend on the ability to extract value out of the deal".

"In our experience, this will require a clear and detailed plan on how to realise commercial, operational and cultural integration, along with very tight execution capabilities," Castronovo said.

A note from ratings agency Moody's on the GCC banking sector remarked that the UAE's banking system is fragmented. Although the three biggest banks have a share of more than 50 percent of the market, the remainder is fought over by a remaining 57 banks.

Also on Tuesday, ADCB announced a full-year net profit for 2018 of 4.84 billion dirhams, a 13 percent increase on its profit for 2017. The bank also declared an 8 percent year-on-year increase in total net interest income and Islamic financing income of 7.22 billion dirhams.

Further reading:

- Three Abu Dhabi lenders agree to merge, creating a $114bln bank

- ADCB's chairman, CEO to fill top positions in new Abu Dhabi merged bank-sources

- UAE stocks gain $2bln following potential bank merger reports

- GCC may see $300bln bank merger deals

- More UAE bank mergers in near future: Central Bank governor

(Reporting by Michael Fahy; Editing by Anoop Menon)

(michael.fahy@refinitiv.com)

Our Standards: The Thomson Reuters Trust Principles

Disclaimer: This article is provided for informational purposes only. The content does not provide tax, legal or investment advice or opinion regarding the suitability, value or profitability of any particular security, portfolio or investment strategy. Read our full disclaimer policy here.

© ZAWYA 2019