PHOTO

The Family Office Company B.S.C. (c) is providing its clients with access to exclusive private market investments, that are normally unavailable to individuals in the public domain. The firm is partnering with global asset managers to unlock these exciting alternative investment opportunities for its clients that have the potential to outperform the public markets. After creating their investment portfolio, clients can monitor its performance through a groundbreaking digital platform.

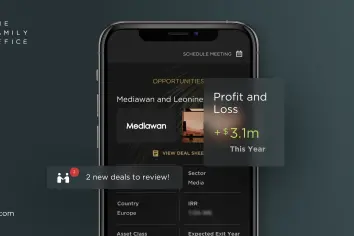

The Family Office has maintained a 17-year track record of preserving and growing clients’ wealth in the region, following an investment philosophy that focuses on the singular needs and financial aspirations of each client, and since 2020 has been adding innovative features to its digital platform, which is the first of its kind in the region within the family office wealth management industry. After embarking on a digital transformation journey in 2020, the firm launched its proprietary digital platform boasting new and exciting features such as fast and secure access to exclusive deals, valuable insights and tailored advisory services delivered by professional and experienced financial advisors. The deals put at the disposal of clients are diversified across geographical locations, industries and asset classes, thus reducing investment risk and optimizing returns. Clients can have their pick from a wide range of investment opportunities, Shariah compliant or conventional, in private asset classes such as private equity, private credit, real estate, financials and more.

Commenting on the merits of this platform, Abdulmohsin Al Omran, Founder and Chief Executive Officer of The Family Office, said:

“We ensure all our clients achieve their set financial goals by building proven portfolios in exclusive alternative investments, diversified over geographies, sectors, and asset classes to mitigate risk and optimize returns.”

The roll-out and continuous improvement of this platform falls in line with The Family Office’s digitalization effort and endeavors to offer clients a more intuitive and digitally based experience. Recognizing the importance of moving away from traditional approaches and embracing a fully digital business model, The Family Office is currently building a new interface that empowers clients and prospects with the simulators, tools, and insights they need to take the driver’s seat on their investment journey. This new digital interface is set to be launched in January 2022.

On this topic, Mr. Al Omran added:

“We are committed to making our clients’ experience as convenient and effortless as possible. All our online platforms aim to provide them with direct access to portfolio performance, exclusive deals, and educational content with an intuitive, user-friendly interface at their fingertips.”

The Family Office is a Bahrain and Riyadh based global wealth manager, regulated by the Central Bank of Bahrain and the Capital Market Authority of Saudi Arabia, serving 200+ ultra-high net worth families and individuals. It offers various services to help clients achieve their wealth goals using custom-made investment strategies that cater to their unique needs.

Join the platform now on: https://tfoco.co/3rS2Dsi

Pre-sign up to the upcoming interface on: https://tfoco.co/3ybjBD3

Disclaimer

The Family Office Co. BSC (c) is a Category 1 Investment Firm regulated by the Central Bank of Bahrain C.R. No. 53871 dated 21/6/2004. Paid Up Capital: US$10,000,000. The Family Office Co. BSC (c) only offers products and services to ‘accredited investors’ as defined by the Central Bank of Bahrain.

The Family Office International Investment is a joint stock closed company owned by one person. Paid-up capital SR20 million. CR No. 7007701696. Licensed by the Capital Market Authority (no. 17-182-30) to carry out arranging, advisory and managing investments and operating funds, with respect to securities.

-Ends-

The Family Office is a wealth management firm with offices in Bahrain and Riyadh, managing $2 billion in tailored portfolio solutions since 2004. The Firm is regulated by the Central Bank of Bahrain and the Capital Market Authority in the region. Petiole Asset Management, the sister company of The Family Office, is a boutique asset manager that provides diversified investment programs targeting mainly alternative investment opportunities. Headquartered in Zurich with offices in New York and Hong Kong, Petiole Asset Management is among 237 institutions licensed in Switzerland, by the Swiss Financial Market Supervisory Authority (FINMA) in 2019.

© Press Release 2021

Disclaimer: The contents of this press release was provided from an external third party provider. This website is not responsible for, and does not control, such external content. This content is provided on an “as is” and “as available” basis and has not been edited in any way. Neither this website nor our affiliates guarantee the accuracy of or endorse the views or opinions expressed in this press release.

The press release is provided for informational purposes only. The content does not provide tax, legal or investment advice or opinion regarding the suitability, value or profitability of any particular security, portfolio or investment strategy. Neither this website nor our affiliates shall be liable for any errors or inaccuracies in the content, or for any actions taken by you in reliance thereon. You expressly agree that your use of the information within this article is at your sole risk.

To the fullest extent permitted by applicable law, this website, its parent company, its subsidiaries, its affiliates and the respective shareholders, directors, officers, employees, agents, advertisers, content providers and licensors will not be liable (jointly or severally) to you for any direct, indirect, consequential, special, incidental, punitive or exemplary damages, including without limitation, lost profits, lost savings and lost revenues, whether in negligence, tort, contract or any other theory of liability, even if the parties have been advised of the possibility or could have foreseen any such damages.