PHOTO

Saudi Arabia's economy may have recovered in 2018 after a contraction last year, but growth has been "sub-optimal" due to a number of factors including lacklustre credit growth, the introduction of value-added tax and the net loss of around one million expat workers, according to a new note from National Bank of Kuwait.

An analysis of the Saudi economy by NBK's analysts published on Saturday predicted growth of 2.3 percent for the Saudi economy this year, compared with a contraction of 0.9 percent last year.

It is forecasting slower growth next year of 2 percent, but this is largely due to the fact that oil-related growth is likely to be lower given the recent production cuts agreed by members of the OPEC+ group in Vienna earlier this month.

The note stated that Saudi Arabia's "non-oil sector will increasingly take the lead, with annual average gains of 3.2 percent expected thanks to elevated government spending, private sector stimulus and ongoing Vision 2030 business reforms".

However, it also warned that oil prices are likely to be softer next year, which could cause the country's fiscal deficit to widen.

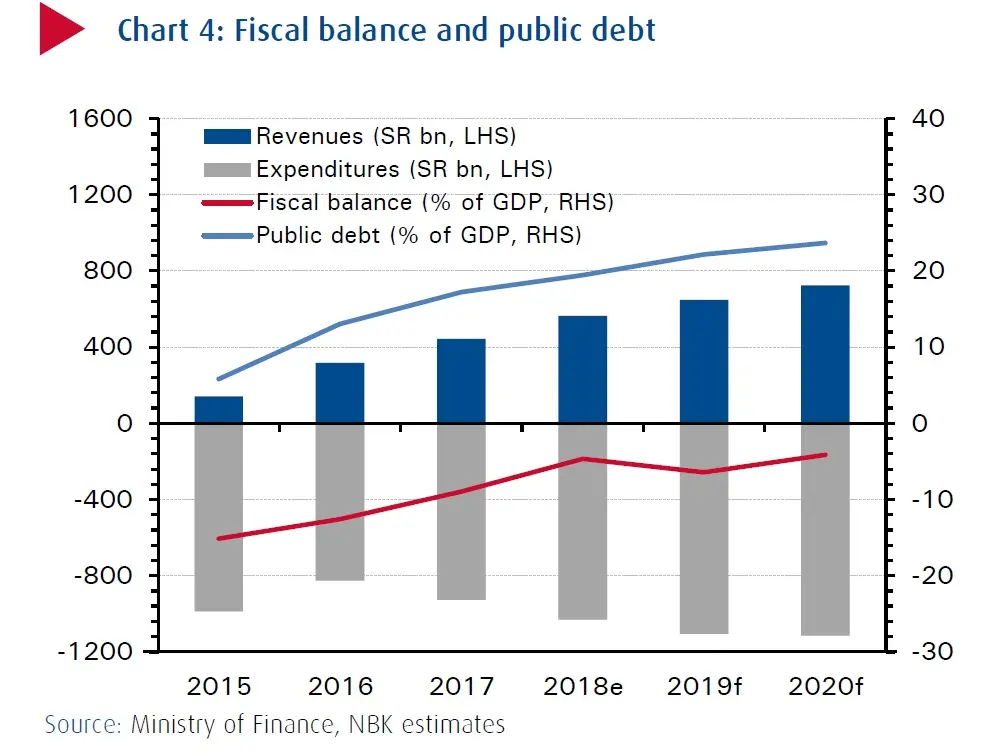

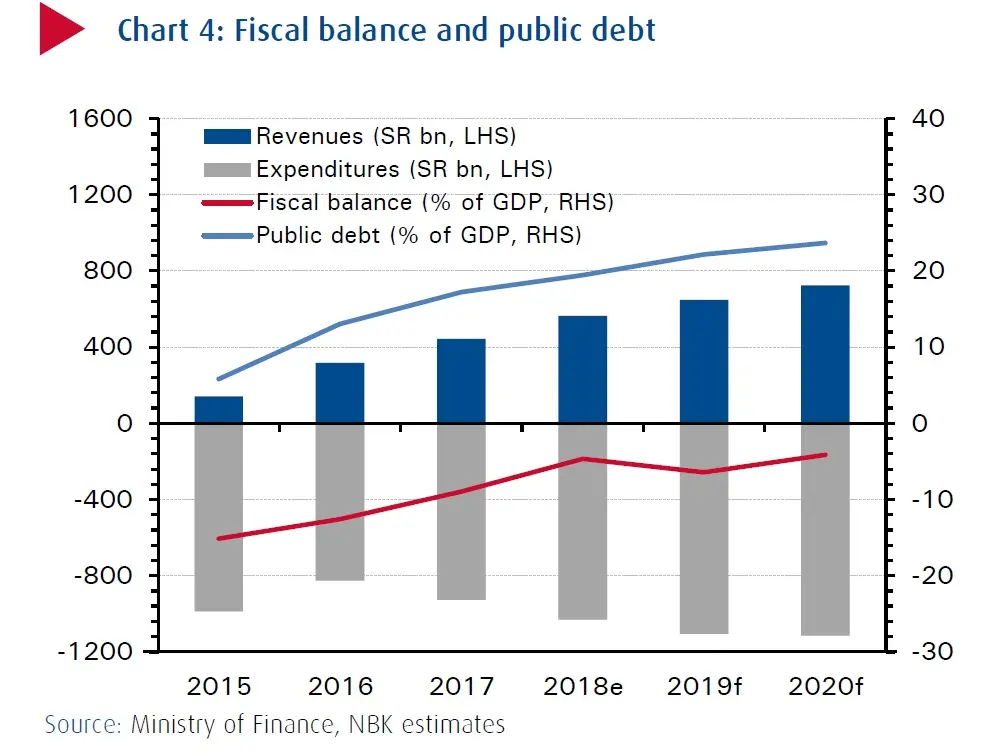

This year, Saudi Arabia's fiscal deficit narrowed, given that higher oil prices (up 35 percent year-on-year to an average of $71 per barrel, NBK estimated) meant government revenues increased by 29 percent year-on-year to an estimated 895 billion Saudi Arabian riyals ($238.7 billion), outpacing the kingdom’s 11 percent increase in expenditure, to just over 1.03 trillion riyals.

On December 18, the Saudi government set a budget of 1.107 trillion riyals for 2019, which is 7 percent higher than anticipated expenditure at the end of this year. The government said it expects a narrower deficit of 131 billion riyals, or 4.2 percent of GDP, next year. However, this appears to be based on an assumption of average oil prices of $80 per barrel, which one analyst has described as "wishful thinking".

NBK said that the kingdom remains "broadly" on track to achieve its target of balancing its budget by 2023, but said the deficit is likely to widen next year, not narrow.

"This is because we expect both oil prices to be softer than in 2018 and the government to continue with its expansionary fiscal policy."

It warned that the government may have to pare back some of its spending commitments to keep the deficit in check and said it expects the kingdom to continue raising debt via external capital markets, through the issuance of new bonds and sukuk.

"Public debt reached an estimated 19.4 percent of GDP (SR563bn) at the end of 2018, and is forecast to rise to 22.2 percent of GDP in 2019 and to 23.7 percent of GDP by 2020," NBK's note said.

"We put the government’s financing requirement at around SR188bn ($50.3bn) in 2019, higher than the government’s own forecast of SR118bn ($31.5bn), due to our lower oil price estimate."

A note published by Jadwa Investment on December 19 following publication of the Saudi budget highlighted the kingdom's plan to continue growing capital expenditure, which is set to rise by 20 percent to 249 billion riyals next year, which the firm said was “a clear sign that there has been a particular effort to raise the level of the growth enhancing aspect of government expenditure in order to support development and lift the overall investment profile of the private sector”.

However, it added that although current spending is expected to increase by 4 percent year-on-year in 2019, to a total of 860 billion riyals, the country's wage bill is expected to decrease by 4 percent, to 456 billion riyals.

Further reading:

- Saudi Arabia: Government reshuffle was expected as its four-year term was up

- Saudization of grocery stores to create 35,000 jobs and save billions in remittances

- Saudi Public Investment Fund boosts investments in 2018

- Saudi 2019 budget boosts spending in bid to spur sluggish economy

- Gulf Arab economies to accelerate modestly through 2020

Our Standards: The Thomson Reuters Trust Principles

Disclaimer: This article is provided for informational purposes only. The content does not provide tax, legal or investment advice or opinion regarding the suitability, value or profitability of any particular security, portfolio or investment strategy. Read our full disclaimer policy here.

(Writing by Michael Fahy; Editing by Shane McGinley)

© ZAWYA 2018