PHOTO

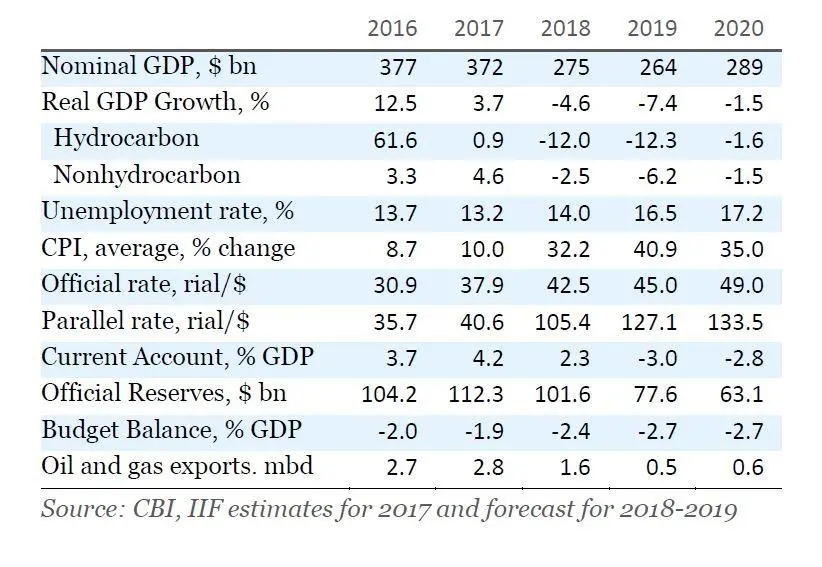

Institute of International Finance (IIF) estimates that the Iranian economy has contracted by 4.6 percent in fiscal year 2018/19 (ending March) as a result of the sanctions. IIF expects the contraction to deepen to 7.2 percent in the current fiscal year, 2019/2020.

Tight US sanctions have virtually wiped out Iran’s ability to sell crude oil and condensates, pushing the economy into deep recession for a second consecutive year and raising annual inflation to 50 percent, the global financial institution said in its research report.

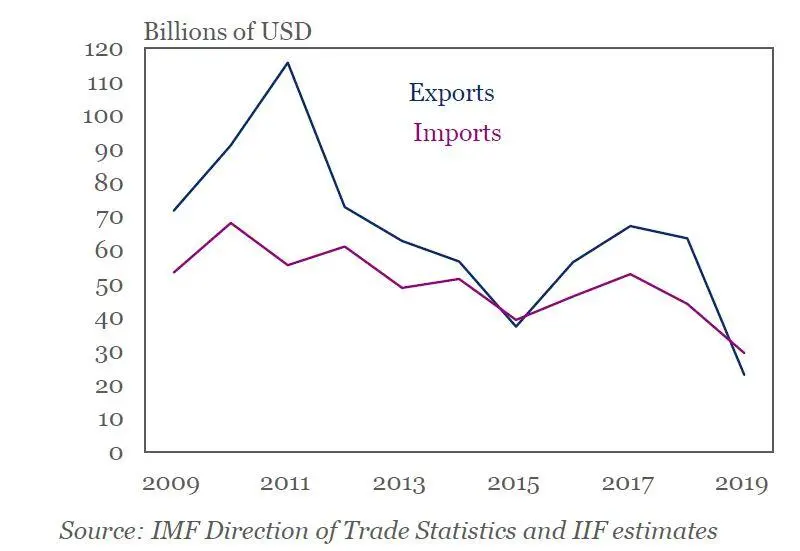

Most of the contraction is due to the sharp decline in volume of exports of crude oil and condensates, which dropped from a peak of 2.8 million barrels a day in May 2018 to less than 0.4 mbd in recent months. However, this official figure may understate actual deliveries, as the Iranian authorities and their clients may have sought to avoid tracking of tankers, IIF noted.

The fall in imports has only partly offset the drastic decline in exports. As a result, the current account balance has shifted to a small deficit for the first time since 1998. Iran’s official reserves are likely to decline further to $73 billion by March 2020 – a loss of nearly $40 billion in just two years.

"We also estimate a decline in nominal GDP of $97 billion to $275 billion in FY 2018/19. The unemployment rate has increased to 17 percent, with youth unemployment of around 30 percent. Meanwhile, a collapse in the parallel market rate has triggered a spike in prices to 50 percent, year-on-year, in recent months – the highest rate in the past two decades," said Garbis Iradian, IIF Chief Economist for MENA.

According to IIF sanctions will weigh heavily on Iran's budget and has aggravated problems in Iran’s already-fragile banking system.

With hydrocarbon revenues falling by about 70 percent, the budget for the FY 2020/21 (which starts on March 20 of this year) is very tight.

"We expect total spending to de-cline further to 14 percent of GDP in FY 2020/21, as compared with 19.5 percent in FY 2017/18. Government salaries will increase only by 15 percent, well below the average CPI inflation of 30 percent," Iradian said, adding, "Even with higher taxes and a reduction in fuel and electricity subsidies, the fiscal deficit could remain around 2 percent of GDP because of lower revenues from oil and gas."

The US sanctions and poor management resulted in an increase in the non-performing loans of banks, which crossed 20 percent of total loans in 2019. The capital adequacy ratio has continued to decline from 8.5 percent in 2012 to slightly less than 6 percent in 2018.

The sanctions in May 2018 has disconnected Iranian banks from the SWIFT electronic payments system, leading to further isolation of the banking system. Private businesses are finding difficulties in accessing loans as banks are hit with limited liquidity and are very cautious on lending, IIF said.

Discontent to continue

Iranian authorities have increased taxes and cut energy subsidies, which exert a heavy burden on the budget in order to reduce dependence on hydrocarbon exports and revenues.

However, this has led to violent unrest in November 2019, which prompted a severe crackdown. The protests declined for a while, but resumed on January 11, after the authorities admitted shooting down mistakenly a Ukrainian passenger aircraft carrying 176 passengers, mostly Iranians.

The protests called for a change in leadership.

Last week, the US imposed new sanctions on Iran following attacks on US and allied troops in Iraq. The new curbs by the US is set to target multiple sectors of Iranian economy, including construction, manufacturing, textiles and mining.

According to IIF, the US is likely to tighten sanctions on Iran for the foreseeable future.

However, Iran is still reluctant to renegotiate the nuclear deal, including regional and defense policies, with the Trump administration, until they get relief from sanctions.

Iran’s foreign minister, Mohammad Javad Zarif, recently stated that Iran could reverse steps towards developing a nuclear weapon if the Trump administration ended the sanctions that have crippled its economy.

(Reporting by Seban Scaria; editing by Daniel Luiz)

Disclaimer: This article is provided for informational purposes only. The content does not provide tax, legal or investment advice or opinion regarding the suitability, value or profitability of any particular security, portfolio or investment strategy. Read our full disclaimer policy here.

© ZAWYA 2020