PHOTO

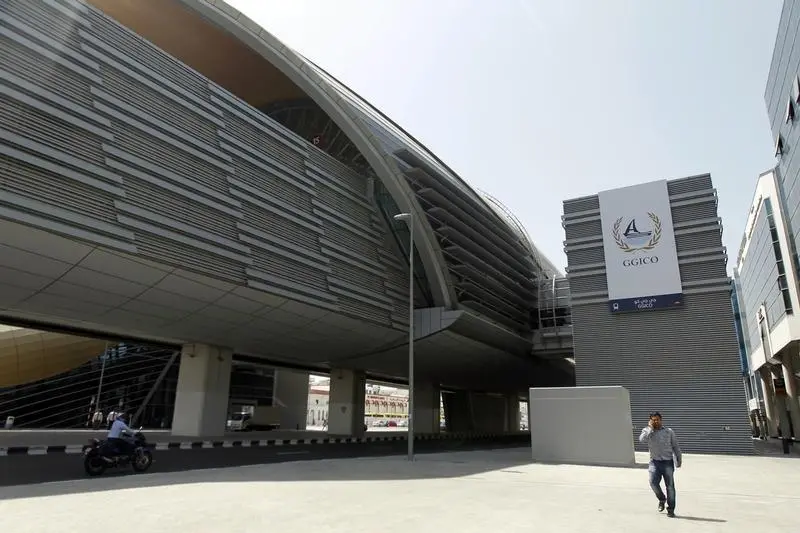

DUBAI- Gulf General Investment Company (GGICO) is in talks with lenders to restructure loan and credit facilities after defaulting on a payment linked to 2.15 billion dirhams ($585.5 million) of debt at the end of last year, the Sharjah-based firm said on Sunday.

The company, which has investments spanning financial services, property, hospitality, manufacturing and retailing, previously restructured its debt in September 2017 and before that in July 2012.

It said in December 2017 it defaulted on a principal payment of 24.4 million dirhams related to the restructured debt. Despite the default, GGICO said that as banks had not served a notice as required by the agreement, it believed the bank facility would continue as per the restructured agreement.

It also said it was in the process of negotiating with its lenders to restructure certain existing loan and credit facilities to meet its payments as they fall due.

The company, which has total borrowings of 2.42 billion dirhams, has struggled as a result of subdued local economic conditions.

Separately, GGICO said some of its entities, which it did not name, were in talks with banks to restructure their existing borrowing facilities totalling 210.3 million dirhams in principal and 74.9 million dirhams in interest. A portion of that amount was subject to legal proceedings initiated by the lenders.

It also said one of the group's entities, which it also did not name, had not complied with a certain bank covenant.

Lastly, the company said it was in talks with a financial institution to restructure a 257 million dirhams credit facility due for repayment on Sept. 30, 2016.

($1 = 3.6724 UAE dirham)

(Reporting by Tom Arnold; Editing by Mark Potter) ((Tom.Arnold@thomsonreuters.com; +97144536265; Reuters Messaging: tom.arnold.thomsonreuters.com@reuters.net))