PHOTO

- The Board of Directors approved the distribution of AED 589 million of interim dividends to its shareholders for the first half of 2019 resulting in 13 fils per share

- EITC continues its strategic investments in the business, as it launches 5G and rolls out more sites nationwide. Q2 2019 Capex increased by 93%, compared to the same period last year, to AED 286 million. H1 2019 total capex spend was AED 467 million

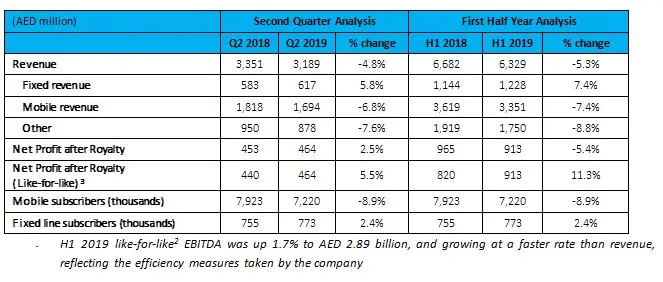

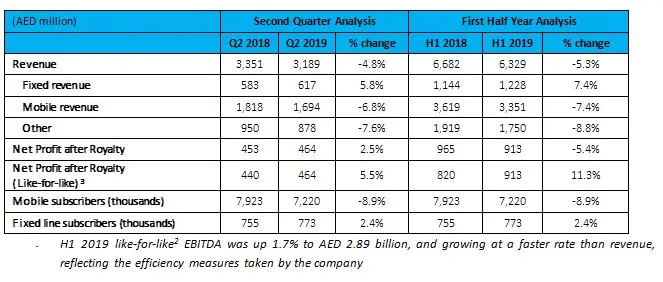

- Q2 2019 fixed revenues increased by 5.8% to AED 617 million, while mobile revenues decreased by 6.8% to AED 1.69 billion, due to continued pressure on voice revenues

- H1 2019 like-for-like2 EBITDA was up 1.7% to AED 2.89 billion, and growing at a faster rate than revenue, reflecting the efficiency measures taken by the company

Dubai, UAE: Emirates Integrated Telecommunications Company PJSC (DFM: “du”) published today its financial results for Q2 2019, reporting AED 3.19 billion revenues, AED 1.47 billion EBITDA and AED 464 million net profit after royalty for the second quarter of the year.

For H1 2019, EITC reported revenues of AED 6.33 billion, EBITDA of AED 2.89 billion representing growth of 1.7% when compared “like-for-like”[2] for the same period 2018 and a net profit after royalty of AED 913 million representing a growth of 11.3% when compared “like-for-like”3.

Commenting on the results, Mohamed Al Hussaini, Chairman of EITC, said:

“Our company achieved in Q2 2019 a good performance as we recorded a 2.5% (5.5% “like-for-like”1) growth in net profit after royalty when compared to the same period last year reaching AED 464 million. I am pleased to announce that our Board of Directors has approved an interim dividend of AED 589 million representing 13 fils per share.

"EITC’s extensive investment in the latest technologies and infrastructure enhances our competitiveness and enables us to continue upgrading our services to meet our customer requirements. In doing so, we actively support the UAE’s ambitious digital transformation agenda as set out by the forward-looking leadership of the nation.”

Commenting on the results, Osman Sultan, EITC’s Chief Executive Officer, said:

“It is clear that our efficiency plan and investments in new technologies to drive forward our digital strategy and prepare our company for the needs of tomorrow allowed us to contain the erosion of EBITDA. The result of this has been a solid EBITDA performance of AED 1.47 billion, which contributed in Q2 2019 to a 2.5% (5.5% “like-for-like”1) improvement in Net Profit after Royalty to AED 464 million, compared to the same period last year.

“Our Revenues were impacted by industry wide challenges particularly, the continued pressure on voice revenues. Q2 2019 revenues were at AED 3.19 billion, compared to AED 3.35 billion in Q2 2018, driven by a 6.8% decrease in mobile revenue to AED 1.69 billion, which was partially offset by the continued strong growth in our fixed revenue of 5.8% to AED 617 million in Q2 2019, compared to the same period last year.

“Our mobile subscriber mix for Q2 2019 improved, with higher value customers driving up mobile ARPU4, by 3.8% compared to the same period last year. However, our total mobile subscriber number declined due to the continued clean-up of our prepaid base in line with the “My Number My Identity” Campaign. Fixed line subscribers increased by 2.4% during the second quarter of the year.

“We continue investing in our business to meet the needs of tomorrow. Our strong capital position enabled us to increase our capital expenditure to AED 467 million during H1 2019, investing in our network and capabilities, paving the way for the commercial launch of 5G technology and preparing our company for a new era in connectivity. We remain focused on making the right investments in our business to deliver our digital strategy and prepare our company for the future of the telecom business.

“I am delighted to welcome Mr. Kais Ben Hamida to our executive team as Chief Financial Officer. Kais has joined us on July 14th and will play a key role in guiding the organization’s performance improvement, bringing in years of experience in global telecom environment and finance leadership.”

During the quarter, du successfully demonstrated the region’s first-ever Video over LTE (ViLTE) 5G call. The video call was made using the telco’s state of the art commercial 4G and 5G Non-standalone (NSA) network, IMS Core and 5G smartphones. The success of the HD video call demonstration lays a solid foundation for enhancing du’s 5G user experience and marks the maturity of du’s 5G end-to-end ecosystem.

With customers at the heart of du’s connected offerings, the company launched the new Postpaid Power Plans, setting a benchmark for postpaid plans across the UAE and providing best-in-class connectivity with incomparable value. Launched during the second quarter of 2019, the new plans are designed to offer complete digital lifestyle benefits to power the everyday lives for customers.

-Ends-

About Emirates Integrated Telecommunications Company PJSC (EITC)

The Emirates Integrated Telecommunications Company PJSC (EITC) was founded in 2005 as the UAE’s second licensed telecommunications provider. EITC has two telecommunications brands under its umbrella: the du brand was launched in 2007 and serves almost 8 million active subscribers and over 100,000 businesses throughout the UAE; EITC has launched its second brand, Virgin Mobile, the region’s first digital service, in September 2017.

EITC is 50.12 percent owned by Emirates Investment Authority, 10.06 percent by Mamoura Diversified Global Holding PJSC, 19.7 percent by Emirates International Telecommunications and the remaining by public shareholders and National organisation. Listed on the Dubai Financial Market (DFM), the company trades under the name ‘du’.

[1]Like-for-Like means that net profit after royalty for Q2 2018 is adjusted by deducting AED 13 million corresponding to the impact of IFRS-16 on Q2 2019.

[2]Like-for-Like means that EBITDA of H1 2018 is adjusted by deducting AED 169 million corresponding to the impact of the one-off regulatory cost registered in Q1 2018 and adding AED 151 million corresponding to the impact of IFRS-16 on H1 2019.

3 For Q2 2019 Like-for-like means that net profit after royalty for Q2 2018 is adjusted by deducting AED 13 million corresponding to the impact of IFRS-16 on Q2 2019.

For H1 2019 Like-for-like means that net profit after royalty for H1 2018 is adjusted by deducting AED 119 million corresponding to the impact of the one-off regulatory cost registered in Q1 2018 and deducting AED 26 million corresponding to the impact of IFRS-16 on H1 2019.

4Average Revenue Per User

© Press Release 2019Disclaimer: The contents of this press release was provided from an external third party provider. This website is not responsible for, and does not control, such external content. This content is provided on an “as is” and “as available” basis and has not been edited in any way. Neither this website nor our affiliates guarantee the accuracy of or endorse the views or opinions expressed in this press release.

The press release is provided for informational purposes only. The content does not provide tax, legal or investment advice or opinion regarding the suitability, value or profitability of any particular security, portfolio or investment strategy. Neither this website nor our affiliates shall be liable for any errors or inaccuracies in the content, or for any actions taken by you in reliance thereon. You expressly agree that your use of the information within this article is at your sole risk.

To the fullest extent permitted by applicable law, this website, its parent company, its subsidiaries, its affiliates and the respective shareholders, directors, officers, employees, agents, advertisers, content providers and licensors will not be liable (jointly or severally) to you for any direct, indirect, consequential, special, incidental, punitive or exemplary damages, including without limitation, lost profits, lost savings and lost revenues, whether in negligence, tort, contract or any other theory of liability, even if the parties have been advised of the possibility or could have foreseen any such damages.