Financial Highlights:

Sharjah, UAE; March 30, 2016

Bank of Sharjah today reported its financial results for the year ended December 31, 2015.

During the year, the Bank continued to grow its loan book while maintaining the solid structure of its balance sheet, with high levels of both liquidity and Equity.

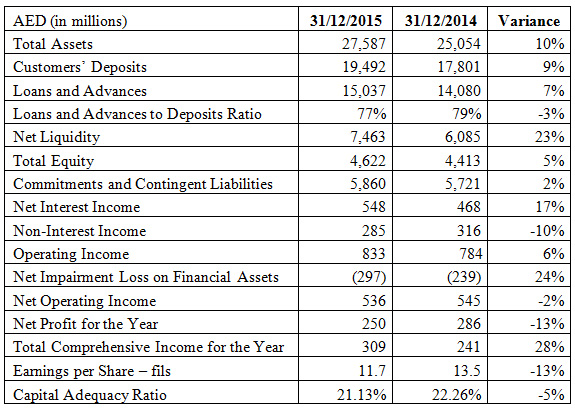

Total Assets reached AED 27,587 million, an increase of 10% over the corresponding 31 December 2014 figure of AED 25,054 million reflecting the growth of the main items of the balance sheet.

Loans and Advances reached AED 15,037 million, 7% above the corresponding figure of AED 14,080 million as at 31 December 2014.

Net Liquidity reached AED 7,463 million as at 31 December 2015, an increase of 23% compared to 2014 year figure of AED 6,085 million.

Total Equity as at 31 December 2015 stood at AED 4,622 million, 5% above the balance for the corresponding year of 2014 after payment of 2014 dividends.

Net Interest Income increased by 17% compared to the corresponding figure of the year 2014.

The 2015 financial year had to bear the burden of a net total non-cash charge of AED 297 million. While the statement of profit or loss of the Bank was affected by this high figure it also proved the resilience and success of its performance model.

All the above led to a decrease in the current year Net Profit to AED 250 million, versus AED 286 million for 2014, i.e. -13%. As a result, earnings per share reached 11.7 fils compared to 13.5 fils in 2014.

However, total Comprehensive Income for the year increased by 28% to AED 309 million versus AED 241 million in 2014.

Capital Adequacy ratio stood at a high of 21.13% in 2015, versus 22.26% end of 2014.

Subject to the ratification of the Shareholders General Assembly, the Board of Directors will propose no cash dividend (versus cash dividend of 3.4% and the distribution of 4.98% "buy back" shares for 2014).

-Ends-

For further information, please contact:

Liam Turner / Tameem Al Kintar

ASDA'A Burson-Marsteller

Dubai, UAE

Tel: +971 4 4507 600

E-mail: liam.turner@bm.com / tameem.alkintar@bm.com

© Press Release 2016