PHOTO

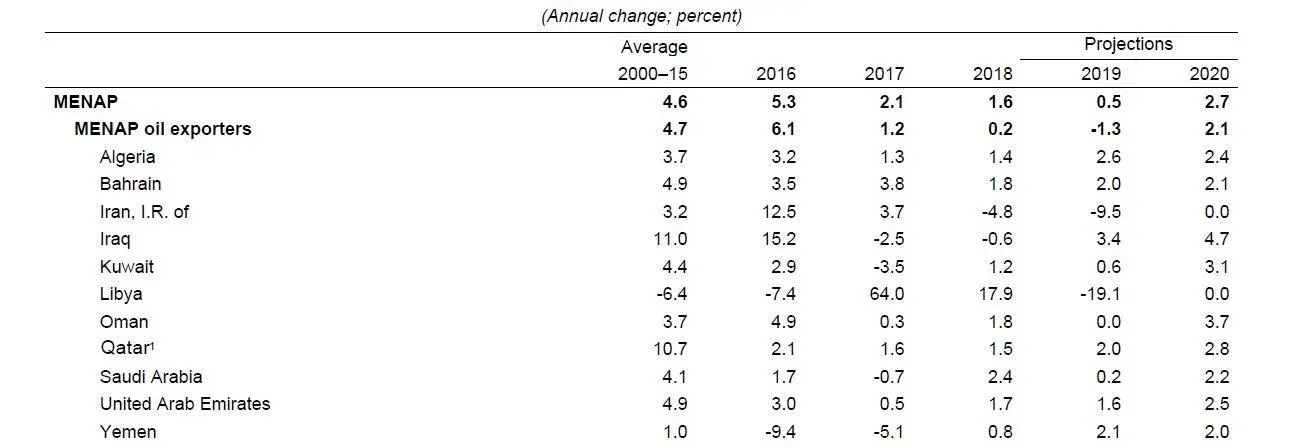

Growth in Gulf Cooperation Council (GCC) countries is projected to decelerate to 0.7 percent in 2019 from 2 percent in 2018, due to oil production cuts in line with OPEC+ agreements, according to the International Monetary Fund (IMF).

In April, IMF had forecast 2.1 per cent growth in 2019.

However, growth in 2020 is expected to rebound to 2.5 percent, driven by a recovery in real oil GDP growth of 1.9 percent (compared to –1.4 percent in 2019 and 2.5 percent in 2018), the IMF said in its October 2019 Regional Economic Outlook (REO) report for the Middle East, North Africa, Afghanistan and Pakistan (MENAP), launched in Dubai on Monday.

The report said the recovery in 2020 reflects a mix of rising oil production in Kuwait and Saudi Arabia, the Jizan refinery becoming fully operational (Saudi Arabia), and a pickup in gas output in Oman and Qatar. However, there is uncertainty on whether the OPEC+ agreement will expire by March 2020.

Real GDP Growth.

Source: IMF

Meanwhile, the report noted, infrastructure spending in Kuwait, the UAE and Qatar is forecast to lift non-oil GDP growth from 2.4 per cent this year to 2.8 per cent in 2020. The UAE expects a boost in tourism from Expo 2020, and Qatar is expecting the same given its preparations towards hosting the 2022 FIFA World Cup.

However, global trade uncertainties and rising geopolitical tensions continue to affect the prospects of oil exporters in the region.

Jihad Azour, Director of the IMF’s Middle East and Central Asia Department, said: “To pave the way for higher growth in the face of a challenging global environment, countries of the region should accelerate structural reforms that boost private sector activity and lift productivity."

There are growing concerns of trade tensions between China and the United States and potential for a disorderly Brexit as it will reduce demand from countries such as Morocco and Tunisia which share close ties with Europe.

(Writing by Seban Scaria seban.scaria@refinitiv.com, editing by Anoop Menon)

Our Standards: The Thomson Reuters Trust Principles

Disclaimer: This article is provided for informational purposes only. The content does not provide tax, legal or investment advice or opinion regarding the suitability, value or profitability of any particular security, portfolio or investment strategy. Read our full disclaimer policy here.

© ZAWYA 2019