PHOTO

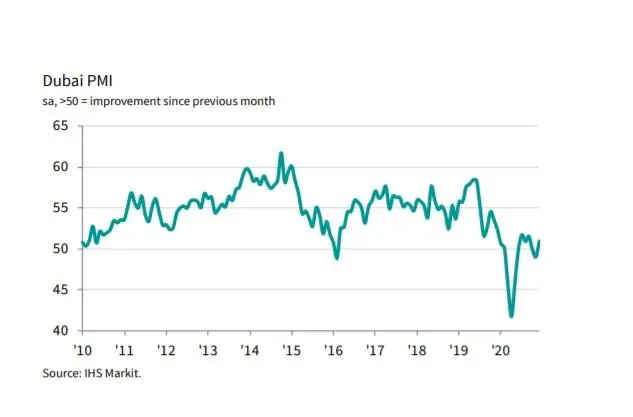

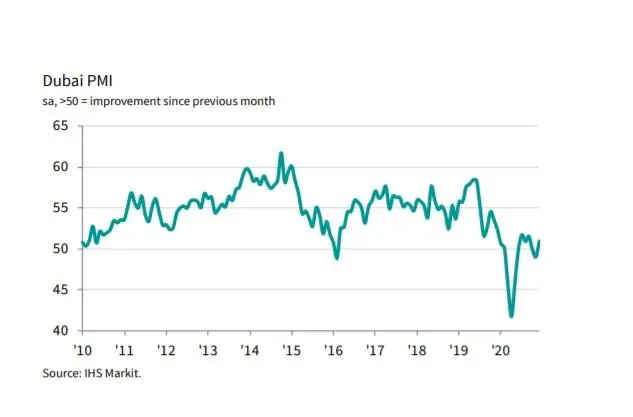

A strong rise in business activity and a faster increase in new work have prompted Dubai's non-oil private sector businesses to return to growth at the end of 2020, according to the latest Purchasing Managers' Index (PMI) data from IHS Markit. However, employment numbers continued to fall as expectations for 2021 were still subdued.

The seasonally adjusted IHS Markit Dubai Purchasing Managers' Index (PMI) rose above the 50.0 no-change mark in December, posting 51.0 (from 49.0 in November) to indicate a modest expansion in the non-oil economy, and the first seen for three months.

Video: Dubai’s non-oil sectors return to expansion in December 2020

Non-oil private sector businesses in Dubai saw a renewed fall in activity in November, as the impact of COVID-19 appeared to worsen amid rising global cases.

Cost pressures were weak in December, supporting a further drop in selling prices, albeit at the slowest rate since May. The improvement in the headline PMI was largely driven by a sharp rise in business activity in December, after Dubai non-oil firms curtailed output midway through the final quarter. The rate of expansion was the second-quickest throughout 2020, bettered only by July's uptick, IHS Markit noted.

David Owen, Economist at IHS Markit, said: "An increase in output and new orders led to a renewed improvement in the health of the Dubai non-oil sector in December, shown by the headline PMI rising back above the 50.0 neutral mark. At 51.0, however, the index signalled only a slight expansion in Dubai's economy, as falling employment, lower stocks of purchases and shorter delivery times all acted as drags on the headline reading."

Firms related the rise in output to higher sales during the month, which increased at the strongest rate since September.

According to the IHS Markit survey, there were renewed expansions in new work across the travel and tourism and construction sectors, but growth was quickest in the retail and wholesale category.

Output expectations for 2021 returned to positive territory in December, after firms gave a negative forecast in November for the first time since sentiment data were collected in April 2012. That said, the overall outlook remained subdued, with many respondents expecting output to remain unchanged by the end of 2021.

"Looking ahead, firms continued to present a highly subdued outlook for business activity in December, despite some confidence that the confirmed

effectiveness of COVID-19 vaccines should help a global economic recovery in 2021," Owen said.

Some survey respondents were skeptical of an economic recovery in the near-term due to the continued impact of COVID-19 on business turnover.

"Businesses noted that the after-effects of the pandemic will continue to be felt across the non-oil sector, particularly as hiring remains weak and containment measures continue to stem export demand," he added.

(Reporting by Seban Scaria; editing by Daniel Luiz)

Disclaimer: This article is provided for informational purposes only. The content does not provide tax, legal or investment advice or opinion regarding the suitability, value or profitability of any particular security, portfolio or investment strategy. Read our full disclaimer policy here.

© ZAWYA 2021