PHOTO

Children are being targeted by scammers trying to extract information about their parents’ credit cards, it has emerged at a special seminar highlighting the latest dangers posed by fiendish fraudsters.

Experts offered advice and used the opportunity to raise awareness at yesterday’s Bahrain Chamber of Commerce and Industry session aimed at helping people protect their bank accounts.

National Bank of Bahrain (NBB) chief information security officer Ali Al Majed has said that phishing fraud cases are on the rise not just in Bahrain but across the region.

“The scammers pretend to be an organisation such as BenefitPay and invent a problem that aims to scare you into giving away your money,” he said.

“They use applications to change their phone numbers to impersonate an organisation and send a text message using their name, which is intentionally misspelt.

“They also send a link which takes you to a site that looks very similar to a genuine website, but it is only a mirror of it.”

Phishing is a strong attack method because it is done at a large scale.

By sending massive waves of emails under the name of legitimate institutions or promoting fake pages, malicious users increase their chances of success in their hunt for innocent people’s credentials.

He urged people to stay vigilant, as scammers are coming up with new methods of deceit every day.

“Of course, the BenefitPay scam is very common right now, but there are also WhatsApp scams where they pretend to be someone you know, ask for money, then disappear off your feed when they get it.”

He also urged parents to be vigilant, saying that while most scams appear to target senior citizens, a good number are now focusing on children.

“There have been cases in Bahrain where children have been blackmailed online by scammers into giving up their parent’s credit card information,” he revealed at the meeting in Sanabis.

“They ask to exchange pictures, especially inappropriate ones, then exploit the children by using those pictures to threaten them.”

Experts continue to warn the public to exercise caution and not give out any personal information, with one senior bank official saying that around 98 per cent of victims in Bahrain had fallen prey to phishing scams by SMS or text messages leading to them clicking on malicious links.

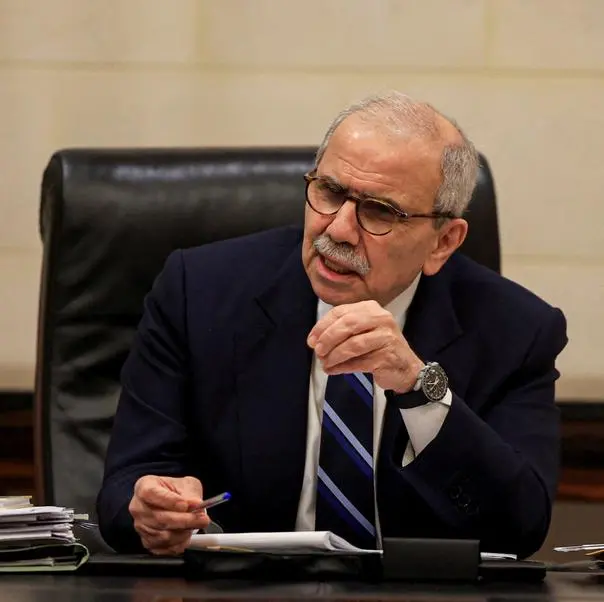

During the event yesterday the Interior Ministry’s Anti-Corruption and Economic and Electronic Security, Major Al Abdulla highlighted other methods scammers used to lure victims into giving up their hard-earned money.

“They commonly target people through emails using inheritance scams, stating that the person has inherited a lot of money which required a fee to be transferred,” he explained.

“There is also a lottery scam which is becoming more common too, where they claim that you have won a large amount of money and it works the same way.”

Major Al Abdulla says that even though some of these scams have become common knowledge, people still fall for them periodically.

“They use sob stories, they talk to you, they build trust, and this may go on for days before they finally ask for any money, making you second guess yourself,” he said.

He also highlighted a ‘comments scam’ which is commonplace on several social media sites.

“These comments are not real people, they are bots,” he warned. “They comment automatically on popular social media pages, can talk to you and even pretend to be someone else to try to convince you to transfer money.”

Also present at the seminar was Telecommunications Regulatory Authority of Bahrain (TRA) officer Abdulla Al Noami, who explained how the Covid-19 pandemic had witnessed an increase in the number of scammers operating worldwide.

“With the pandemic, came remote working, which meant more people online,” said Mr Al Noami.

“This saw a rapid industry growth and expansion of online services, which has seen more opportunities for scammers.

“There was a significant increase in cases of identity theft at the time.”

The experts urged people in Bahrain to exercise caution and use common sense to protect themselves.

“The bank has all the information necessary, so it will never ask you for anything, not even a One Time Password or OTP” said Mr Al Majid.

“You would not give away your house key to someone else, so why would you give a stranger access to your money?”

“Also, look out for foreign numbers, a Bahraini based bank will never call you from abroad.”

Major Al Abdulla urged victims to report cases via the 24 hour hotline at 992, visit the nearest police station or email at aecd@interior.gov.bh.

Copyright 2022 Al Hilal Publishing and Marketing Group Provided by SyndiGate Media Inc. (Syndigate.info).