PHOTO

The U.S. current account deficit narrowed sharply in the third quarter as tariffs weighed on imports and primary income surged.

The Commerce Department's Bureau of Economic Analysis said on Wednesday the current account deficit, which measures the flow of goods, services and investments into and out of the country, contracted by $22.8 billion, or 9.2%, to $226.4 billion, the lowest level since the third quarter of 2023.

Economists polled by Reuters had forecast the current account deficit shrinking to $238.4 billion. The report was delayed by the 43-day shutdown of the government.

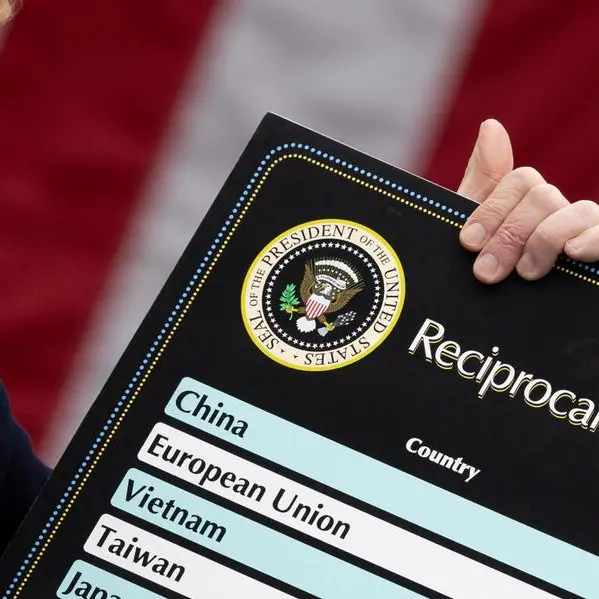

The deficit represented 2.9% of gross domestic product, the smallest since the first quarter of 2020 and down from 3.3% in the second quarter. It peaked at 6.3% in the third quarter of 2006. President Donald Trump's sweeping tariffs have led to an ebb in the flow of imports, helping to narrow the trade deficit.

Imports of goods decreased $5.0 billion to $815.4 billion in the third quarter, pulled down by a decline in consumer goods. But nonmonetary gold imports increased. Imports of services increased $3.1 billion to $225.0 billion.

Goods exports fell $1.9 billion to $548.0 billion, weighed down by nonmonetary gold, though exports of capital and consumer goods increased. Exports of services increased $11.7 billion to $314.2 billion.

The goods trade deficit narrowed to $267.4 billion from $270.4 billion in the prior quarter.

Receipts of primary income increased $16.3 billion to $395.2 billion, led by a rise in direct investment income. Payments of primary income advanced $5.3 billion to $390.0 billion.

Receipts of secondary income decreased $2.0 billion to $44.4 billion. Payments of secondary income declined $2.1 billion to $97.9 billion as general government transfers decreased.

(Reporting by Lucia Mutikani; Editing by Andrea Ricci)