PHOTO

Positive news surrounding oil prices and optimism over global trade talks saw emerging market shares rise at the end of last week, but the chairman of global ports operator DP World told Reuters in an interview on Sunday that he believes trade wars such as those between the United States and China will make 2019 challenging, but not unmanageable.

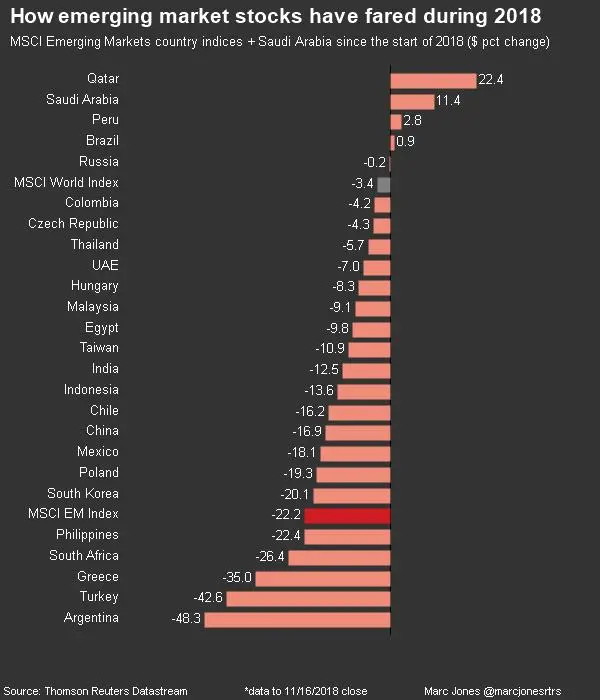

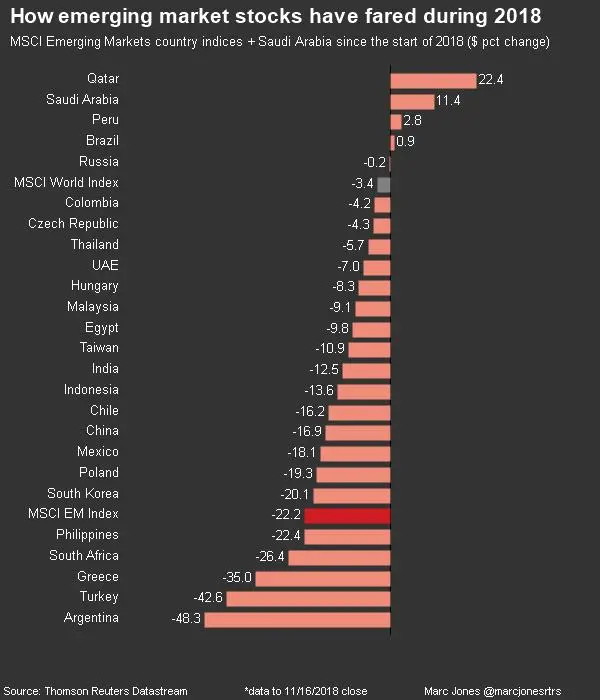

The broader index for emerging markets was on track for a 0.7 percent weekly gain with shares in Turkey and South Africa gaining nearly 1 percent each on Friday. Despite the increase, investors were not optimistic that talks between Presidents Donald Trump and Xi Jinping later this month will lead to an easing of tensions.

“We are of the view the summit will not lead to a trade agreement between the two countries, rollback of existing tariffs, or even a commitment to not implement further tariffs,” Citigroup said in a note. “But the outcome may be similar to the U.S.-North Korean summit... a path to de-escalate tensions going forward.” (Read the full report here).

Sultan Ahmed bin Sulayem, chairman of DP World, told Reuters yesterday he believed the psychological impact of trade tensions between Washington and Beijing were starting to translate into reality. (Read the full interview here).

The Dubai government-controlled ports operator in August reported first-half profit was down 2.1 percent.

Financial institutions were becoming increasingly cautious and taking measures such as tightening lending in reaction to trade tensions, he told Reuters in an interview at the DP World Tour Championship golf tournament in Dubai.

That is likely to negatively impact growth in emerging markets, he said.

“We are finding ways to make sure that we do good in 2019,” he was quoted as saying. “Historically, we have managed worse scenarios than this,” he said of global market conditions, adding that DP World had reached its goals in 2018.

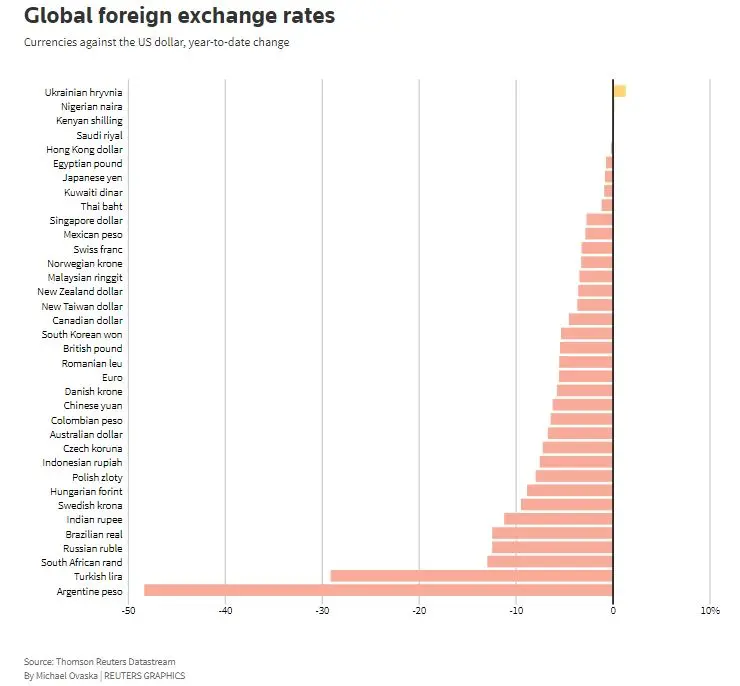

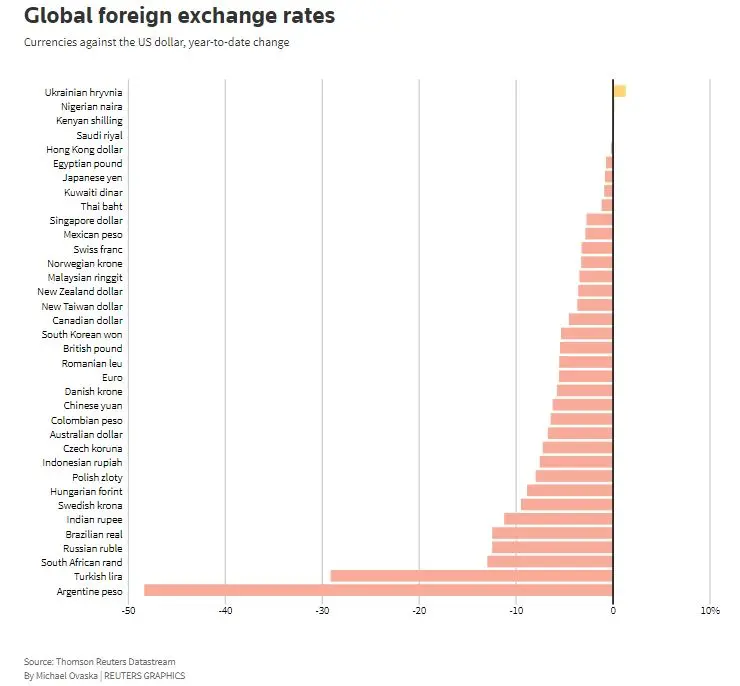

Richard Clarida, the Fed’s newly appointed vice chair, cautioned on Friday over the global growth outlook, sending the dollar index, which measures the greenback against a basket of six major currencies, to 96.441, down from 97.693. (Read ZAWYA's daily market morning briefing here).

The weakening of the U.S. currency will give some slight relief to emerging markets. Policy makers in Indonesia and The Philippines hiked interest rates on Thursday as central banks in developing countries face the fallout from the strong dollar.

Data compiled by Reuters shows interest rate rises by major emerging market central banks outstripped rate cuts for a sixth straight month in October - the longest such run since the summer of 2011. (From India and Mexico to Bahrain and the UAE, click here for a list of emerging market economies that have recently raised interest rates.)

The Reserve Bank of India’s central board will meet today, (November 19), the South Africa Reserve Bank starts its three-day monetary policy committee meeting tomorrow (November 20), while on November 30 the Bank of Korea will hold its monetary policy meeting to announce interest rates and the Central Bank of the Republic of Turkey will release its Financial Stability Report. (Click here for a list of all the major events likely to impact emerging markets until the end of the year).

Further reading:

• Emerging market shares rise, on track for winning week

• DIARY: Emerging Markets - Economic Events to Dec 28

• Emerging banks hike interest rates to battle inflation, weak currencies

• DP World chairman says trade tensions will make 2019 challenging

• Monday outlook: Oil prices rise market, sentiment remains weak

• Egypt keeps interest rates on hold, says inflation contained

• DP World cautions on trade posts 21% drop in H1 net profit

• Greenback kickback: What does the surging dollar mean for emerging markets, Dubai's real estate and tourism sectors?

• Emerging markets spur FDI flows into Africa

(Writing by Shane McGinley; Editing by Michael Fahy)

(shane.mcginley@refinitiv.com)

Our Standards: The Thomson Reuters Trust Principles

Disclaimer: This article is provided for informational purposes only. The content does not provide tax, legal or investment advice or opinion regarding the suitability, value or profitability of any particular security, portfolio or investment strategy. Read our full disclaimer policy here.

© ZAWYA 2018