PHOTO

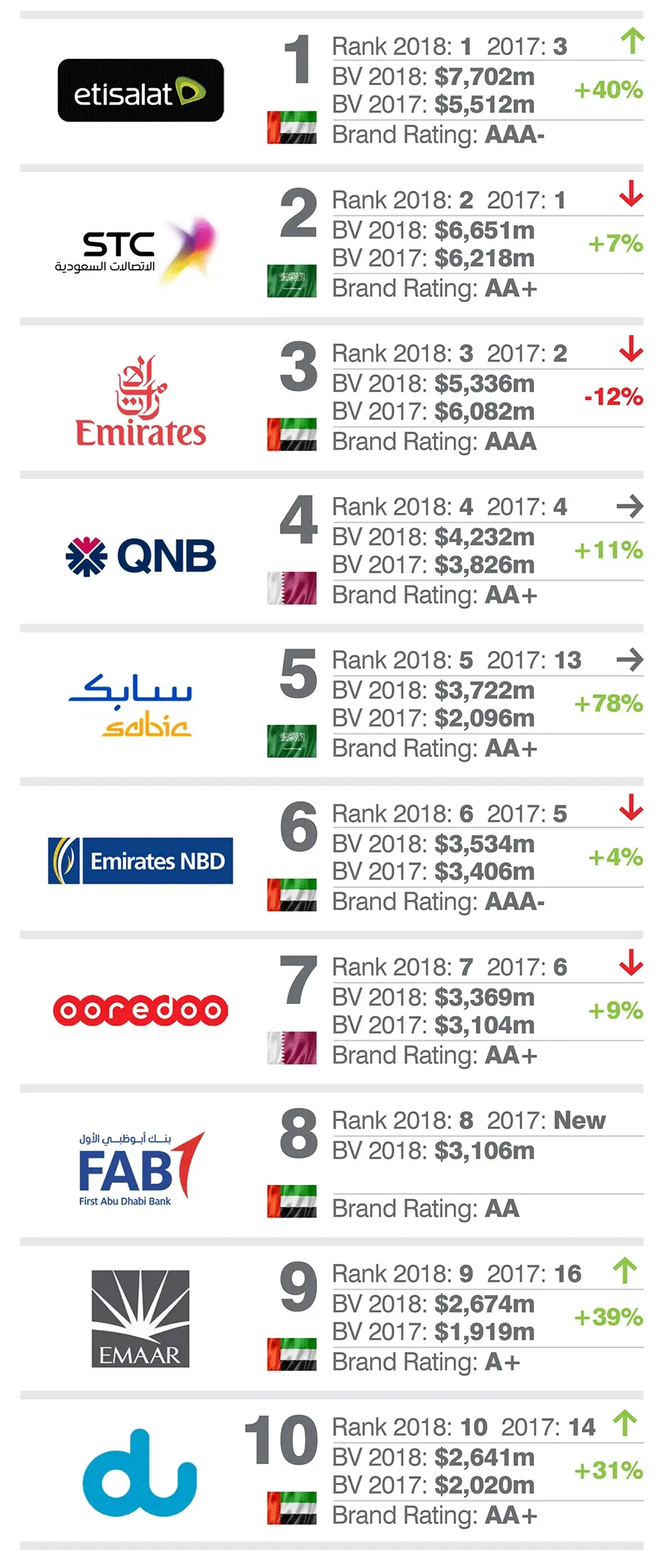

Etisalat has been named as the Middle East's most valuable brand, usurping Saudi Telecom at the top of the table of Brand Finance's annual Middle East 50 rankings released on Sunday.

Etisalat's brand has climbed in value by 40 percent over the past 12 months and is now worth $7.7 billion, according to Brand Finance - a London-based brand valuation consultancy.

Saudi Telecom has held onto second place in the ranking, with its brand growing by 7 percent in value over the past 12 months to $6.65 billion, but Dubai’s Emirates airline saw the value of its brand decline by 12 percent to $5.3 billion

In a telephone interview with Zawya on Saturday, Andrew Campbell, Middle East managing director of Brand Finance, explained that its rankings are based on a number of factors, including a company's brand strength, the present value of expected future brand earnings, the theoretical royalties it might generate and the amount a company invests in it.

He said that Emirates is still considered to have the strongest brand in the region, but added that its value had declined because of the issues faced by the airline industry generally, plus region-specific problems such as the ban on laptops and other large electrical items imposed by United States authorities on flights from 10 major regional airports, including Dubai.

Middle East's most valuable brands in 2018 by brand value

Brand Finance also marked down the value of the Qatar Airways and Etihad Airways brands by 11 percent. Qatar Airways was the 17th-most valuable brand at $1.9 billion, while Etihad Airways was 20th-most valuable at $1.4 billion.

One airline which bucked the trend, however, was Saudi Arabian Airlines (Saudia), whose brand gained 30 percent in value to $927 million, pushing it to 25th place.

"That's part of the Saudi (growth) story, but they're also doing good work in terms of commercialising and repositioning," Campbell said.

He said that Etisalat's 40 percent increase was due in part to the positive outlook for the UAE economy, but also a result of direct research it had carried out into telecoms and bank brands in both the UAE and Saudi Arabia.

"That threw up some interesting things around Etisalat - particularly that their point of presence and their retail stores are well-received. The customer satisfaction scores are strong and up on previous years," Campbell said.

The brand which witnessed the biggest fall in value in the survey was Mobily - the Saudi mobile telecoms firm in which Etisalat owns a stake of almost 28 percent. The company is still recovering from a corporate governance scandal uncovered in 2014 which has led to billions of dollars being wiped off its market value. (Read more).

"They've struggled to recover from that, and at the same time STC was really motoring in the Saudi market. So they were hit with internal disruption and probably distracted from the fundamentals of the business, and lost market share and market positioning to STC," Campbell explained.

The company which witnessed the biggest percentage gain in its value was Saudi Basic Industries Corporation (SABIC), which climbed to 5th (from 13th) in the table due to a 78 percent uplift in brand value to $3.7 billion.

"It has been a giant in the petrochemicals industry, but what we've seen over the past 18 months is a real revitalisation and focus on the brand, looking to position themselves as a global petrochemicals business," Campbell explained.

Qatar National Bank was the most valuable bank brand, in fourth place overall with a value of $4.2 billion.

Further reading:

- Saudi's Mobily Q4 losses widen customers decline

- Saudi Telecom in Cisco alliance to develop 5G

- Etisalat Group Reports Consolidated Net Profit before federal royalty

- Emirates airline will be ready for any traffic surge from new stopover visa, says official

- Qatar Airways to report very large loss for current fiscal year - CEO

- Abu Dhabi's Etihad drops more flights as review continues

- Winners and losers: The best and worst performers in GCC equity markets last year

- Apple, Google see reputation of corporate brands tumble in survey

(Reporting by Michael Fahy; Editing by Shane McGinley)

(michael.fahy@thomsonreuters.com)

Our Standards: The Thomson Reuters Trust Principles

Disclaimer: This article is provided for informational purposes only. The content does not provide tax, legal or investment advice or opinion regarding the suitability, value or profitability of any particular security, portfolio or investment strategy. Read our full disclaimer policy here.

© ZAWYA 2018