PHOTO

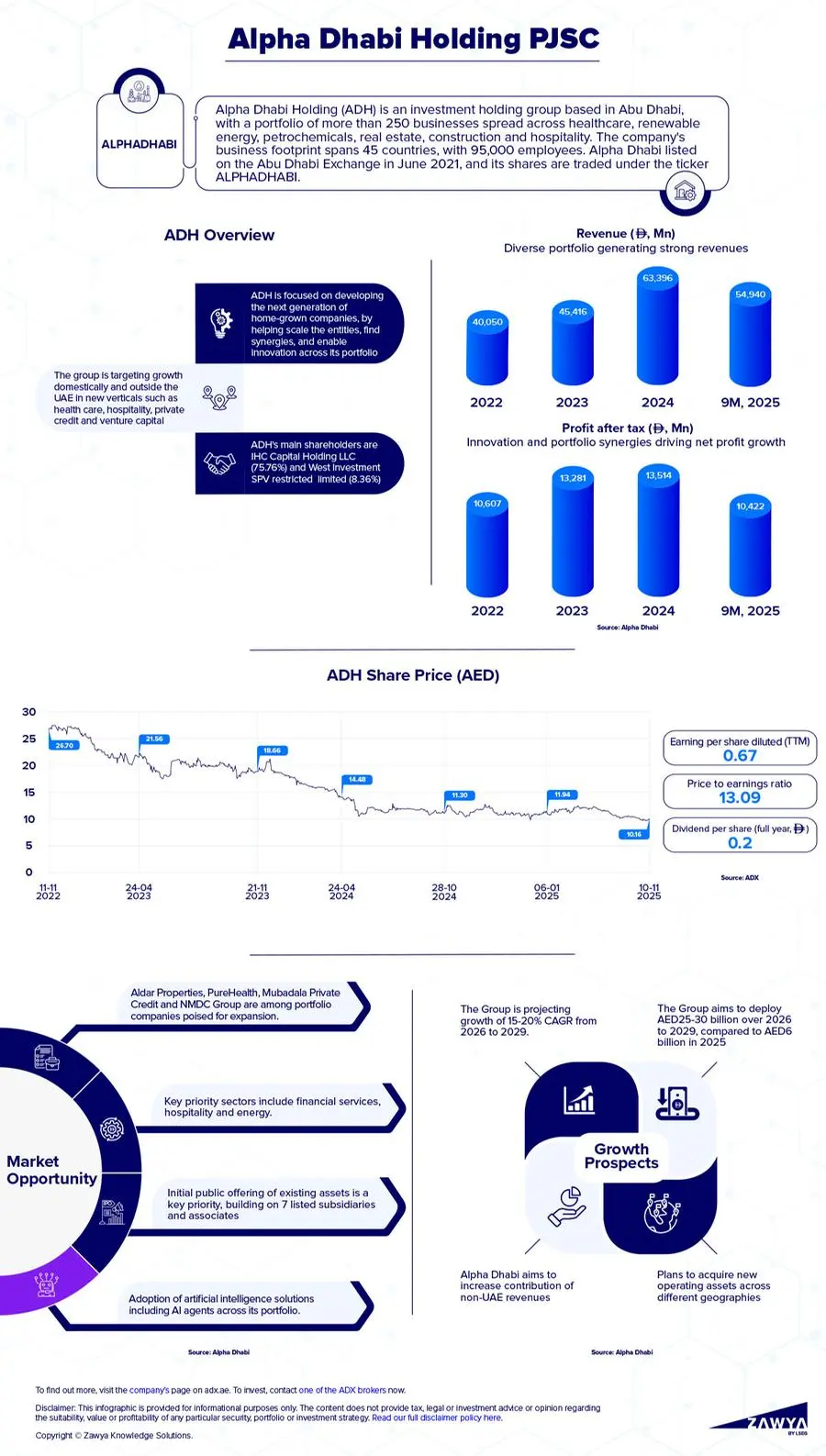

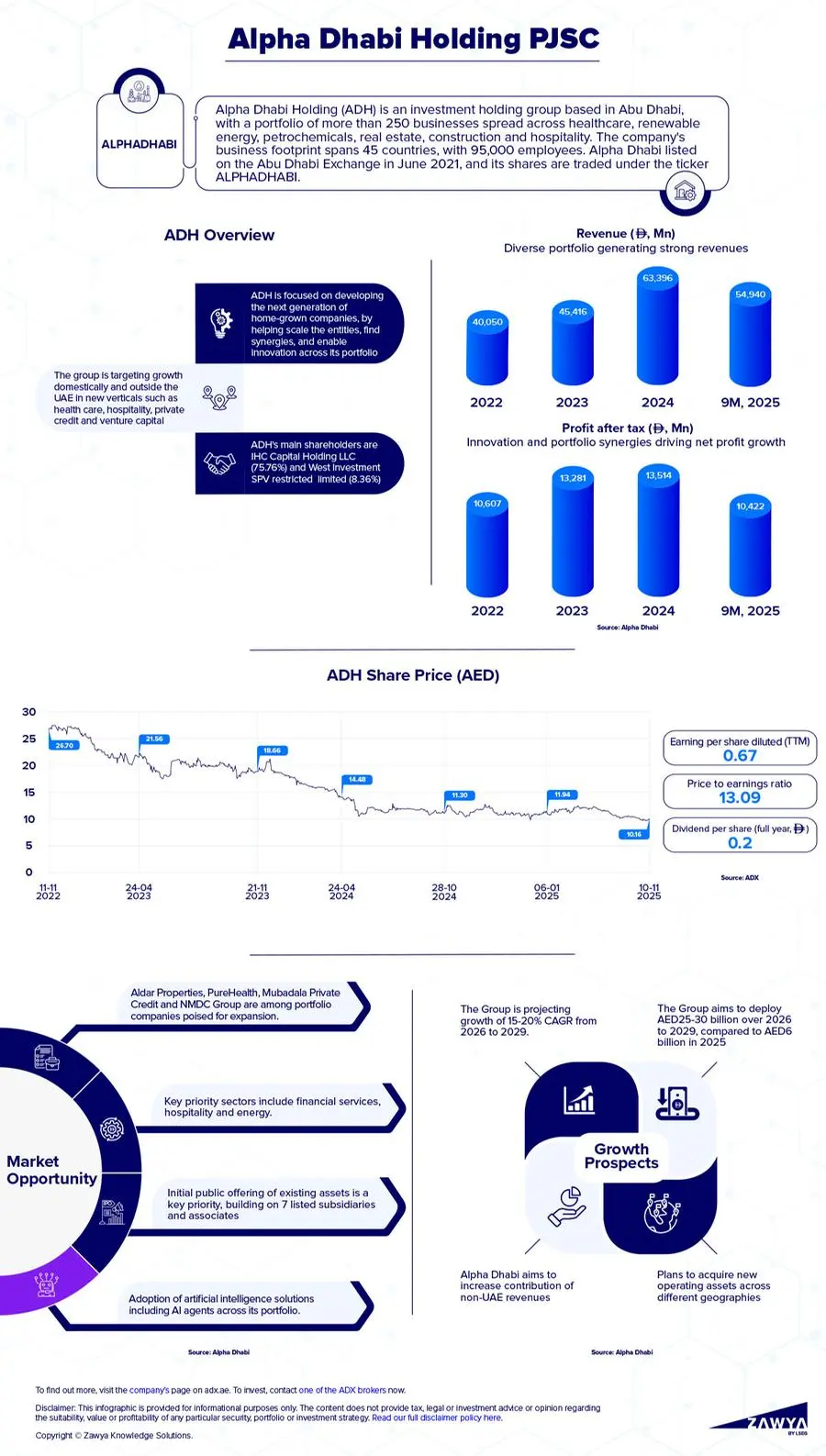

Alpha Dhabi Holding (ADH) is a diversified Abu Dhabi-based investment holding group operating across a wide variety of sectors including real estate, industries, construction, healthcare, services, and investments.

The group’s strategic agenda focuses on acquisitions, geographic expansion (including non-UAE revenue growth), robust corporate governance, and implementation of artificial intelligence (AI) solutions across its portfolio.

A subsidiary of the International Holding Company (IHC), ADH made its market debut on the Abu Dhabi Securities Exchange in June 2021. Its portfolio spans more than 250 companies, with a workforce of over 95,000 people, and presence in more than 45 countries.

ADH focuses on developing the next generation of home-grown companies by helping scale the businesses, find synergies, and enable innovation across its portfolio. It offers investors access to a diverse collection of premium assets covering eight primary pillars and geographies: climate capital, real estate, healthcare, industries, construction, hospitality, energy, and investments.

Click here to download infographic

The group invests in countries with a compelling vision for the future of their economies and leverages its scale and agility to capitalise on markets and investment opportunities to drive value across the platform, expand its portfolio, and generate future alpha. ADH and its companies are also helping to drive forward the vision of Abu Dhabi and the UAE.

GROWTH OPPORTUNITIES

The industrial segment is now ADH’s largest contributor to revenue and shows strong upside. As the holding group moves into large-scale fabrication yards (e.g., for energy infrastructure in Saudi Arabia) and offshore energy performance certificate (EPC) services, the potential for meaningful margin expansion and geographic diversification is high.

Meanwhile, with nearly half of its profit deriving from real estate, ADH benefits from a prominent position in the emirate’s real estate ecosystem through stakes in Aldar Properties. Further monetisation and recycling of assets (such as divestment of prior holdings) free up its capital for reinvestment while unlocking shareholder value. The group’s growth also reflects the contribution of strategic acquisitions and investments, along with year-on-year expansion in its operations.

In addition, ADH is integrating AI into core operations and portfolio companies, providing a competitive advantage in a rapidly digitising regional economy. This is expected to yield efficiency gains across sectors, including industrial, real estate, and services.

Finally, the group is targeting growth outside the UAE, as well as into new verticals such as healthcare, hospitality, private credit, and venture capital. The diversification will help spread risks but also leverage multiple growth sectors in the broader Middle East and North Africa (MENA) region.

INVESTMENT OUTLOOK

For investors, ADH provides exposure to the UAE economy. With its parent company IHC, its diversified portfolio gives investors access to growth in key UAE sectors including industrial, real estate, construction and hospitality. In addition, investments in technology, particularly AI, allows it the opportunity to capitalise on growth in the new digital economy.

Looking ahead, ADH’s management has outlined several forward-looking strategic initiatives to strengthen its position across key sectors and geographies. Capital allocation will prioritise areas such as financial services, hospitality, and energy, supported by the IPO of selected assets to unlock value and enhance liquidity. The group also plans to expand its exposure to venture capital and private credit, signalling an increasing emphasis on high-growth, innovation-driven opportunities.

A key pillar of its strategy is geographic expansion, with a goal to increase the contribution of non-UAE revenues, positioning ADH as a regional, and eventually, global investment powerhouse. To support this expansion, the group is diversifying funding sources by increasing the number of lending banks and optimising its capital structure. While it aims to modestly raise leverage, the management intends to maintain a net debt-to-EBITDA ratio below 3x, ensuring financial prudence and balance sheet resilience.

Portfolio synergy and integration is central to ADH’s operational model. It continues to enhance the value of its acquisitions through closer inter-company collaboration, shared services, and integrated business platforms. Its management has reiterated a commitment to support and enhance core investment activities through three main pathways: acquiring new operating assets to fuel expansion and diversification; embedding robust corporate governance to ensure disciplined, transparent growth; and accelerating the implementation of AI solutions, including AI agents across its affiliated companies.