PHOTO

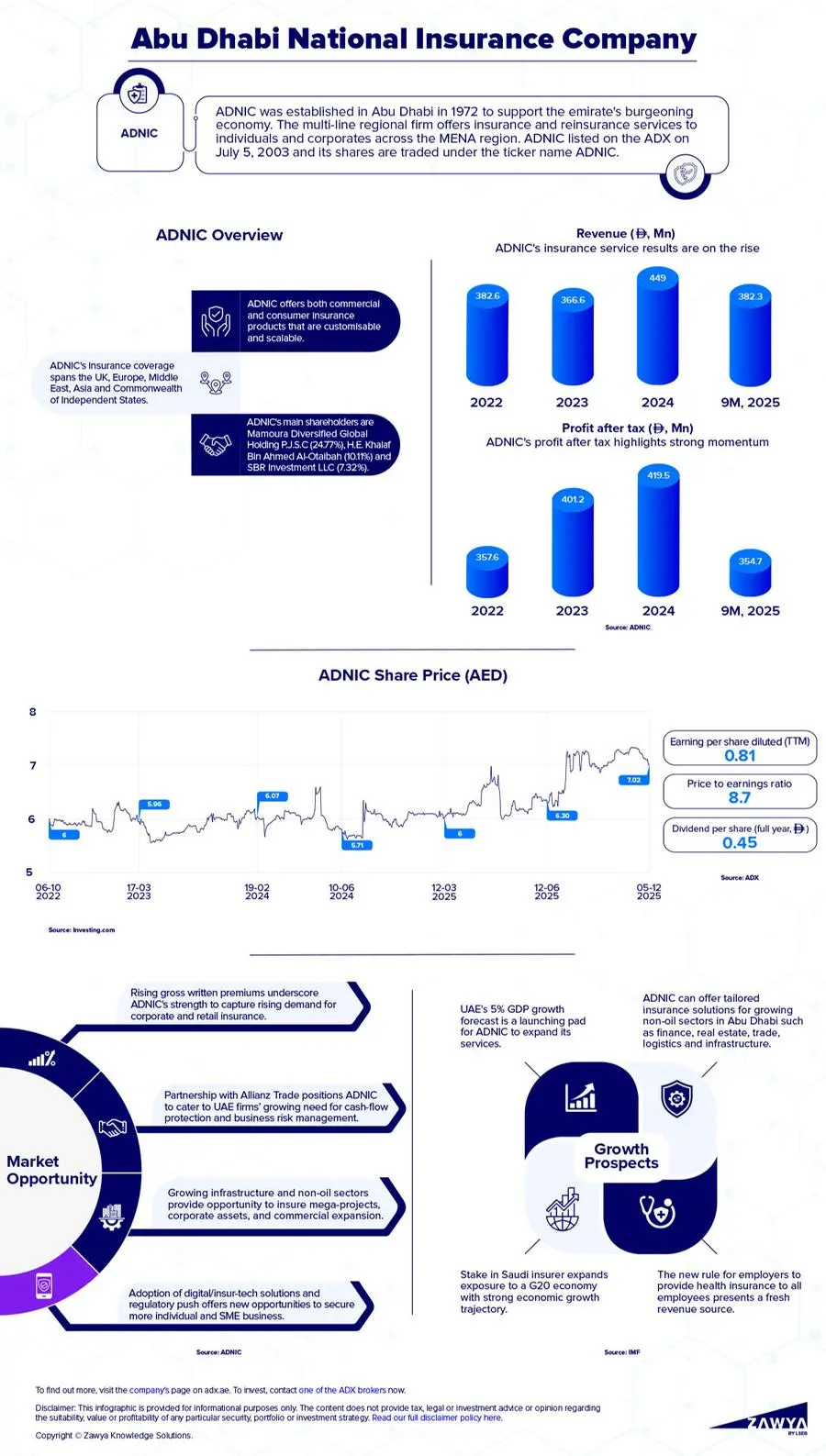

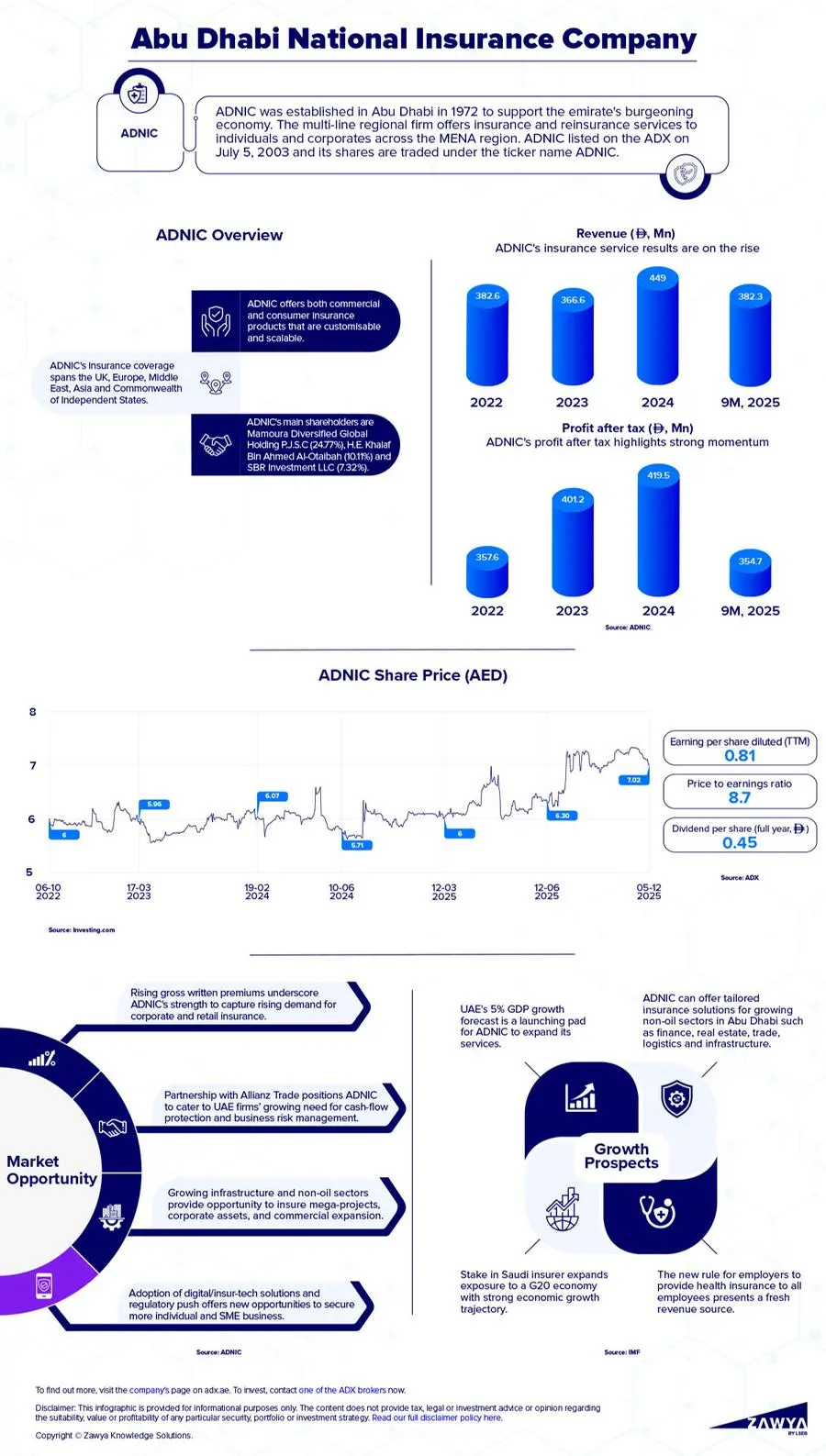

Abu Dhabi National Insurance Company (ADNIC) occupies a strategic position in the UAE’s insurance landscape as one of its oldest and most established underwriters. Founded in 1972 and headquartered in the UAE capital, ADNIC was the first insurer licensed in the emirate, transforming from a domestic provider into a multi-line insurer with retail, corporate, and specialised risk portfolios. It is now one of the country’s largest insurers, with coverage spanning motor, medical, engineering, marine, aviation, liability, and property insurance, supported by an international platform that enables cross-border servicing and reinsurance reach.

Financially, ADNIC benefits from scale, stability, and steady capital discipline. It also holds solid credit ratings – A from both Standard & Poor’s and AM Best – signalling strong underwriting standards.

“ADNIC’s balance sheet strength is underpinned by its risk-adjusted capitalisation, as measured by Best’s Capital Adequacy Ratio (BCAR), at the strongest level,” AM Best noted in its latest assessment of the company.

The global credit rating agency expects ADNIC’s risk-adjusted capitalisation to remain comfortably at the strongest level, underpinned by sufficient organic capital generation to support its business plans.

Click here to download infographic

ADNIC’s growth prospects are closely tied to Abu Dhabi’s structural economic evolution. With non-oil sectors now accounting for the majority of the emirate’s GDP and expanding at pace, demand for commercial insurance – from infrastructure build-out to SME and trade credit cover continues to be enhanced. At the same time, rising expatriate populations and regulatory push in health and motor lines provide recurring retail premium streams.

STRATEGIC GROWTH DRIVERS

The company aims to support Economic Vision 2030, Abu Dhabi’s long-term economic blueprint, which rests on nine strategic pillars and designed not just to guide growth, but to reshape the emirate’s social and institutional foundations.

At its core is the ambition to build a large, empowered private sector. That shift plays directly to ADNIC’s advantage: as corporates expand and new enterprises emerge, demand for commercial insurance, liability cover and risk-transfer solutions is set to rise in tandem. A growing private economy needs protection and insurers become part of the enabling infrastructure.

The government’s emphasis on fostering a sustainable, knowledge-based economy, and ensuring an optimal, transparent regulatory environment also supports the evolution of the insurance market. As high-value sectors such as advanced manufacturing, information and communications technology (ICT), clean energy, and research clusters scale up, specialised and technical insurance products – from cyber to industrial and trade credit – become increasingly important lines of growth for ADNIC.

Similarly, Abu Dhabi’s investment in premium education, healthcare and infrastructure aligns with ADNIC’s strongest business lines. A best-of-class healthcare system expands medical insurance penetration, while rapid civil development and mega-projects underpin engineering, property, and construction insurance. In addition, international and domestic security, along with continued diplomatic engagement, preserves the stability global insurers rely on for long-term underwriting.

These strategic pillars are supported by four execution priorities: accelerating economic development, investing in human capital and social outcomes, building resilient infrastructure under environmental sustainability principles, and improving government efficiency. Each creates new insurance touchpoints – from environmental risk cover and ESG-linked products to workforce benefit schemes.

ADNIC is positioned not just as a beneficiary of Abu Dhabi’s transformation, but as a financial instrument enabling it, becoming a private sector partner in a state-led development strategy.

The company is also expanding its regional footprint. In 2024, it acquired a 51% shareholding of Allianz Saudi Fransi Cooperative Insurance Company (subsequently renamed to Mutakamela Insurance Company), a mid-tier insurer in Saudi Arabia. The acquisition enhanced ADNIC’s geographical diversification, and partly contributed to a 55% growth in its reported insurance revenue to AED 7.2 billion.

INVESTMENT OUTLOOK

With total assets of AED 10.6 billion and shareholders’ equity of AED 3.6 billion as of the first nine months of 2025, ADNIC is positioned for further growth. For investors, the story remains one of steady expansion in a maturing but still structurally underpenetrated regional insurance market.

ADNIC reported another solid performance during the period, as it posted a 15.3% increase in profit before tax to AED 395 million, supported by strong underwriting income, disciplined cost management and steady investment returns. Gross written premiums rose 17.4% year on year to AED 7.2 billion, reflecting continued momentum across medical, corporate, engineering and specialty lines. The combined ratio remained at a disciplined 93.2% signalling that growth has not come at the expense of pricing or underwriting quality.

A key strategic development this year was ADNIC’s long-term partnership with Allianz Trade. The move allows the insurer to capture rising demand for trade credit insurance as the UAE grows its reputation as a hub for regional manufacturing, logistics, and export. The partnership blends ADNIC’s domestic reach with Allianz’s credit-risk analytics. This combination will likely appeal to SMEs and corporates seeking balance sheet protection in a volatile global trading environment.

Alongside commercial expansion, ADNIC has continued to invest in digitisation and automation, including the deployment of artificial intelligence (AI) to improve claims handling, pricing and customer experience – aligning with the UAE’s drive toward a high-productivity, technology-enabled financial sector.

For investors, ADNIC presents an exposure to Abu Dhabi’s surging economy, which is poised to continue its upward trajectory. Earlier in 2025, Fitch Ratings reaffirmed Abu Dhabi’s long-term foreign-currency rating at AA with a stable outlook, highlighting the emirate’s exceptionally strong fiscal buffers, low government debt, and vast sovereign wealth.

That sound footing is reflective of ADNIC’s profile, which aims to expand in tandem with Abu Dhabi’s robust economy.