PHOTO

- Outside of hydrocarbons, the country is continuing to diversify and reform in a number of sectors as part of its ambitious Vision 2030. Dina Ting, Head of Global Index Portfolio Management, Franklin Templeton ETFs, highlights developments on the kingdom’s horizon.

Spotlight on Saudi Arabia

- S&P revised Saudi Arabia’s debt outlook to positive, citing an economic rebound from improved oil sector prospects, an accelerated COVID-19 vaccination program and notable government reform policies to attract further investment.1

- Estimates suggest the kingdom’s current-account surplus should grow to 12% of gross domestic product (GDP) this year, up sharply from a previous forecast of 6.3% of GDP by the Economist Intelligence Unit—bolstered by the expansion of both non-oil and oil export revenue anticipated for 2022.2

- Beyond energy, Saudi Arabia has made a big push to diversify its exports and investment potential with major sporting events, tourism, infrastructure and entertainment. The kingdom also leads other Gulf nations in a recent initial public offering (IPO) boom.

Saudi Arabia, the Arab world’s largest economy, is experiencing positive momentum even amid a challenging investment climate and geopolitical tensions that are dampening growth elsewhere. Reflecting expectations of improving GDP growth and medium-term fiscal dynamics, S&P Global Ratings revised its outlook on Saudi Arabia’s debt from stable to positive at the end of March 2022.

“The positive outlook reflects our expectation of improving GDP growth and fiscal dynamics over the medium term, tied to the country’s emergence from the COVID-19 pandemic, improved oil sector prospects, and the government’s reform programs,” S&P said.3

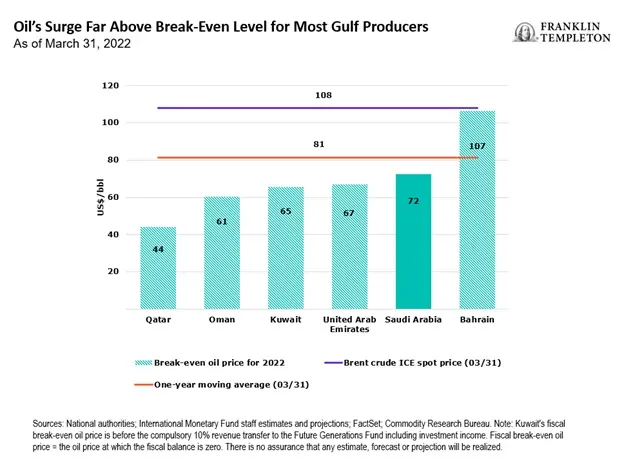

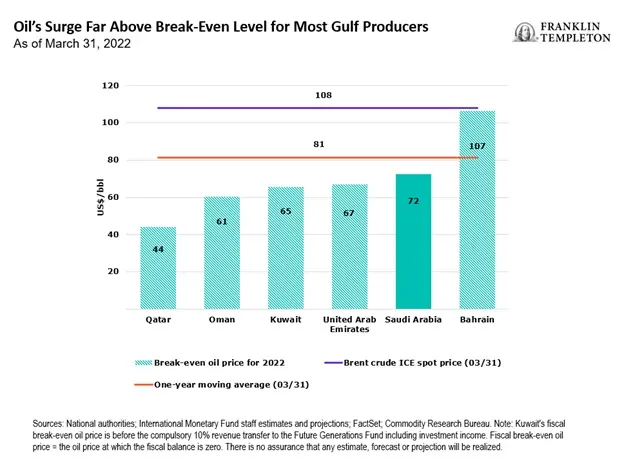

The kingdom’s budget surplus expectations were evident late last year when it raised its revenue forecast even before Russia’s war in Ukraine propelled oil prices higher. Energy revenue still dominates the Saudi economy and those of its Gulf neighbors. Government data shows that break-even levels for Saudi Arabia are far lower than current crude prices, and possible hikes to official selling prices signal the potential for a significant budget boon.

Beyond energy, Saudi Arabia continues to diversify its economy. Seven years ago, the kingdom launched its Vision 2030 program to broaden its exports and investment potential with major sporting events, tourism, infrastructure and entertainment. This included the introduction of tourist visas in late 2019, with government aspirations to create one million additional leisure and tourism-related jobs and attract 100 million annual visits. It recently unveiled futuristic plans for Trojena, an ultra-luxury, year-round ski destination that can double as a venue for sports, art, music and cultural festivals.4

Like any country, there are risks associated with investing in Saudi Arabia. Last month, Yemen’s Houthi rebels attacked an oil depot near the Saudi Arabian Grand Prix Formula One racetrack, an event that was hosted for the second time ever in Jeddah. Additionally, while the kingdom has made substantial progress to diversify away from oil, any significant downturn in oil prices could negatively impact its economy. Saudi Arabia also continues to face scrutiny on human rights issues.

One area of positive development is Saudi Arabia’s ongoing social reforms. Since Mohammed bin Salman became Crown Prince in 2017, the kingdom has reintroduced concerts and movie theatres and lifted a ban on women driving. Saudi women are also being encouraged to enter the workforce with participation rates increasing as roles in various sectors have opened up in recent years, including construction, manufacturing, accommodation and food. Most recently, Saudi’s defense ministry opened military recruitment to women.5

Middle Eastern markets have also stepped up efforts to sell shares in private companies and boost liquidity on their stock markets, and Saudi Arabia is a leader in this IPO boom. China is its largest trading partner and Saudi businesses were recently reported to be in talks to build major foundry projects as well as potentially pricing some oil sales in yuan. The kingdom tends to adjust monetary policy in lockstep with the US Federal Reserve as it pegs its currency, the riyal, to the US dollar. The benefit of this relative stability is important given that foreign exchange in emerging markets can be a source of detraction.

What Are the Risks?

All investments involve risks, including possible loss of principal. The value of investments can go down as well as up, and investors may not get back the full amount invested. Stock prices fluctuate, sometimes rapidly and dramatically, due to factors affecting individual companies, particular industries or sectors, or general market conditions. Investments in emerging markets, of which frontier markets are a subset, involve heightened risks related to the same factors, in addition to those associated with these markets’ smaller size, lesser liquidity and lack of established legal, political, business and social frameworks to support securities markets. Because these frameworks are typically even less developed in frontier markets, as well as various factors including the increased potential for extreme price volatility, illiquidity, trade barriers and exchange controls, the risks associated with emerging markets are magnified in frontier markets. To the extent a strategy focuses on particular countries, regions, industries, sectors or types of investment from time to time, it may be subject to greater risks of adverse developments in such areas of focus than a strategy that invests in a wider variety of countries, regions, industries, sectors or investments.

Companies and/or case studies referenced herein are used solely for illustrative purposes; any investment may or may not be currently held by any portfolio advised by Franklin Templeton. The information provided is not a recommendation or individual investment advice for any particular security, strategy, or investment product and is not an indication of the trading intent of any Franklin Templeton managed portfolio.

For actively managed ETFs, there is no guarantee that the manager’s investment decisions will produce the desired results.

ETFs trade like stocks, fluctuate in market value and may trade above or below the ETF’s net asset value. Brokerage commissions and ETF expenses will reduce returns. ETF shares may be bought or sold throughout the day at their market price on the exchange on which they are listed. However, there can be no guarantee that an active trading market for ETF shares will be developed or maintained or that their listing will continue or remain unchanged. While the shares of ETFs are tradable on secondary markets, they may not readily trade in all market conditions and may trade at significant discounts in periods of market stress.

-Ends-

Important Legal Information

This material is intended to be of general interest only and should not be construed as individual investment advice or a recommendation or solicitation to buy, sell or hold any security or to adopt any investment strategy. It does not constitute legal or tax advice. This material may not be reproduced, distributed or published without prior written permission from Franklin Templeton.

The views expressed are those of the investment manager and the comments, opinions and analyses are rendered as at publication date and may change without notice. The underlying assumptions and these views are subject to change based on market and other conditions and may differ from other portfolio managers or of the firm as a whole. The information provided in this material is not intended as a complete analysis of every material fact regarding any country, region or market. There is no assurance that any prediction, projection or forecast on the economy, stock market, bond market or the economic trends of the markets will be realized. The value of investments and the income from them can go down as well as up and you may not get back the full amount that you invested. Past performance is not necessarily indicative nor a guarantee of future performance. All investments involve risks, including possible loss of principal.

Any research and analysis contained in this material has been procured by Franklin Templeton for its own purposes and may be acted upon in that connection and, as such, is provided to you incidentally. Data from third party sources may have been used in the preparation of this material and Franklin Templeton (“FT”) has not independently verified, validated or audited such data. Although information has been obtained from sources that Franklin Templeton believes to be reliable, no guarantee can be given as to its accuracy and such information may be incomplete or condensed and may be subject to change at any time without notice. The mention of any individual securities should neither constitute nor be construed as a recommendation to purchase, hold or sell any securities, and the information provided regarding such individual securities (if any) is not a sufficient basis upon which to make an investment decision. FT accepts no liability whatsoever for any loss arising from use of this information and reliance upon the comments, opinions and analyses in the material is at the sole discretion of the user.

Products, services and information may not be available in all jurisdictions and are offered outside the U.S. by other FT affiliates and/or their distributors as local laws and regulation permits. Please consult your own financial professional or Franklin Templeton institutional contact for further information on availability of products and services in your jurisdiction.

Issued in the U.S. by Franklin Distributors, LLC, One Franklin Parkway, San Mateo, California 94403-1906, (800) DIAL BEN/342-5236, franklintempleton.com – Franklin Distributors, LLC, member FINRA/SIPC, is the principal distributor of Franklin Templeton U.S. registered products, which are not FDIC insured; may lose value; and are not bank guaranteed and are available only in jurisdictions where an offer or solicitation of such products is permitted under applicable laws and regulation.

CFA® and Chartered Financial Analyst® are trademarks owned by CFA Institute

1. Source: S&P Global Ratings, “Outlook on Saudi Arabia Revised to Positive on Improving Fiscal and Economic Growth Dynamics,” March 2022.

2. Source: Economist Intelligence Unit, Saudi Arabia Country Report, March 2022. There is no assurance any estimate, forecast or projection will be realized.

3. Source: S&P Global Ratings, “Outlook on Saudi Arabia Revised to Positive on Improving Fiscal and Economic Growth Dynamics,” March 2022.

4. Source: Gulf Business, “Trojena: All you need to know about Saudi’s new mega tourism project,” March 8, 2022.

5. Source: “Vision 2030: The changing roles of women in the Saudi workforce,” July 19, 2021