PHOTO

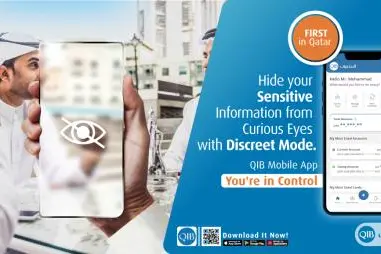

Doha, Qatar : Qatar Islamic Bank (QIB), Qatar’s leading digital bank, has announced the launch of a new, first-of-its-kind ‘Discreet Mode’ feature on its intuitive Mobile App. The innovative new feature allows QIB customers to hide their account and card balances, deposits, and financial details when using the QIB Mobile App in public locations.

The new feature provides QIB Mobile App users more convenience when using the App in public locations, such as in the metro or a busy cafe. The ‘Discreet Mode’ let QIB customers view and manage their accounts while their sensitive data is masked.

There are many ways to enable discreet mode. Before logging in, customer can enable discreet mode from the login screen to mask the information immediately after logging in. Once customers logged into their accounts: they can press on the “eye” icon to mask/reveal their information and they can repeat the process in exactly the same way to return to normal view. Customers can always go to the App setting to enable or disable the discreet mode at any point of time.

Mr. D. Anand, QIB’s General Manager – Personal Banking Group, said: “We are happy to introduce this new feature, which will guarantee more protection and privacy for our customers when they use QIB Mobile App in public settings further enabling them to be in control of their finances. We are always looking at the ways innovation can make banking safer and easier.”

“At QIB, we are committed to implementing new and innovative products, services, solutions, and features that will elevate our customers’ banking experience and increase their convenience.”

The all new QIB Mobile App features easy-to-use English and Arabic interfaces, secure and smart biometric login, self-registration, smart shortcuts, and a combo navigation panel that allows customers to find all the offered products and services in simple steps and get the help they need quickly within the App for a seamless and intuitive customized experience. All transactions can now be completed within a few steps and customers will reap the benefits of the advanced and secured data systems to avoid filling or re-entering pre-registered information.

To download the app, customers can visit the Apple Store or Google Play Store and search for the keyword: QIB Mobile App. Customers can easily self-register using their debit card number and PIN. For more information, please visit www.qib.com.qa/en-mobileapp

-Ends-

© Press Release 2022

Disclaimer: The contents of this press release was provided from an external third party provider. This website is not responsible for, and does not control, such external content. This content is provided on an “as is” and “as available” basis and has not been edited in any way. Neither this website nor our affiliates guarantee the accuracy of or endorse the views or opinions expressed in this press release.

The press release is provided for informational purposes only. The content does not provide tax, legal or investment advice or opinion regarding the suitability, value or profitability of any particular security, portfolio or investment strategy. Neither this website nor our affiliates shall be liable for any errors or inaccuracies in the content, or for any actions taken by you in reliance thereon. You expressly agree that your use of the information within this article is at your sole risk.

To the fullest extent permitted by applicable law, this website, its parent company, its subsidiaries, its affiliates and the respective shareholders, directors, officers, employees, agents, advertisers, content providers and licensors will not be liable (jointly or severally) to you for any direct, indirect, consequential, special, incidental, punitive or exemplary damages, including without limitation, lost profits, lost savings and lost revenues, whether in negligence, tort, contract or any other theory of liability, even if the parties have been advised of the possibility or could have foreseen any such damages.