PHOTO

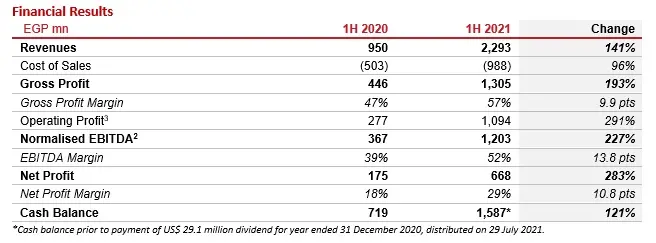

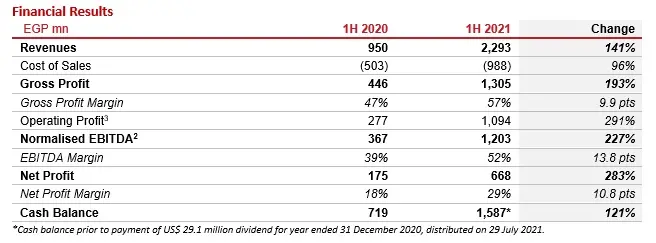

(Cairo and London) — Integrated Diagnostics Holdings (“IDH,” “the Group,” or “the Company”), a leading consumer healthcare company with operations in Egypt, Jordan, Sudan and Nigeria, released today its reviewed financial statements and operational performance for the first half of 2021, recording revenue of EGP 2,293 million, up 141% versus the comparable period of last year. Normalised EBITDA[2] recorded EGP 1,203 million in 1H 2021, representing a 227% year-on-year increase, while net profit expanded 283% year-on-year to reach EGP 668 million for the period. In the second quarter of 2021, revenues reached a new record-high of EGP 1,164 million, up 3% from an already impressive first quarter of the year, with net profit recording EGP 327 million and an associated margin of 28%.

During the six-month period, IDH leveraged a growing branch network, which currently stands at 495 branches, and an expanded house call service to serve 4.7 million patients, 62% above last year’s figure, and conduct 16.3 million tests, up 45% from 1H 2020.

The Group’s remarkable revenue expansion for the six-month period was driven by both its Covid-19-related tests and a sustained recovery in IDH’s conventional test offering. Although strong and rising demand the Group’s Covid-19-related test offering saw it make up nearly half of its consolidated top-line, the Group’s conventional test offering also recorded robust year-on-year growth of 38% of the period.

Commenting on the Group’s performance for the six-month period, IDH Chief Executive Officer Dr. Hend El-Sherbini said: “Halfway through 2021, I am delighted with the Group’s operational and financial performance, which has seen us continue to build on an impressive start to the year to deliver another set of record-breaking results. Our revenues expanded an impressive 141% versus last year on the back of growing patient and test volumes, improved pricing and an increasingly optimised service mix. While top-line growth continued to be bolstered by our Covid-19-related[4] tests, I am happy to report that we have continued to witness robust growth in our conventional test offering for the second quarter in a row, signalling a sustained recovery which we expect to continue even as Covid-19-related volumes begin to taper off. It is particularly important to highlight that the Group’s conventional test volumes in 1H 2021 surpassed pre-Covid-19 levels, coming in 4% higher than test volumes recorded in the same six months of 2019 after adjusting for the impact of the 100 Million Healthy Lives Campaign[5]. This is further evidence of the robust underlying demand for high quality diagnostic services present across our markets of operation, and of our continued ability to service this growing market.””

Growth in conventional business came on the back of a 29% increase in tests performed versus the comparable period of last year. IDH’s consolidated top-line was also supported by its ramped-up house call service in Egypt and Jordan, which contributed to 23% of consolidated revenue in 1H 2021 compared to 18% in 1H 2020. Through its house call service, IDH served more than 646,000 patients in 1H 2021, up 88% versus 1H 2020, performing more than 3.4 million tests, 49% above the figure recorded in the same period a year ago.

“Our house call services represent an important driver of future growth for the Company well beyond the end of the Covid-19 crisis, and as such we are continuing our efforts to expand and further streamline the service. In parallel, we are also seeing growing contributions coming from our radiology venture, Al-Borg Scan, which recorded year-on-year revenue growth of 124%. To capitalise on the attractive growth opportunities offered by the segment, we are currently aiming to launch at least three new Al-Borg Scan branches over the coming twelve months,” El-Sherbini added.

On a geographic basis, IDH recorded impressive year-on-year growth in both Egypt and Jordan with revenues for 1H 2021 up 140% and 176%, respectively. While demand for Covid-19-related tests in both countries remained high, the Group continued to record robust growth in its conventional test offering, indicating a sustained recovery following last year’s slowdown. In Nigeria, revenue expanded 68% year-on-year supported by growing patient and test volumes. Finally, the Group’s Sudanese operations continued to be impacted by the devaluation of the Sudanese pound earlier in the year. Despite this, the Group was able to deliver a noteworthy 217% year-on-year revenue expansion in local currency terms.

Further down the income statement, IDH reported impressive margin expansions at all levels of profitability supported by strong top-line and the subsequent dilution of IDH’s fixed costs. Gross Profit grew by 193% year-on-year in 1H 2021 to record EGP 1,305 million with an associated margin of 57% versus 47% in the same period last year. Normalised EBITDA[6] reached EGP 1,203 million in 1H 2021, 227% above last year’s figure with a margin of 52%. Finally, net profit expanded nearly fourfold year-on-year to reach a record-high 668 million pounds, with a net profit margin of 29% for the period.

“Heading into the second half of the year, our strategic priorities remain unchanged as we aim to capitalise on the positive momentum witnessed across both our operations and the wider macroeconomic context. In the short-term we will continue to assist governments in Egypt and Jordan in their fight against the Covid-19 pandemic providing our full roster of Covid-19-related services across both our branches and through our expanded house call service. On this front, I am proud of our efforts to secure multiple new partnerships over the last few months to offer PCR testing to travellers in both Egypt and Jordan. This is a key aspect to safeguard the health of passengers and crew members and is further testament to the strong reputation enjoyed by IDH both locally and internationally. Meanwhile, we are working tirelessly to deliver on our post-Covid-19 growth strategy which will see us leverage our expanded patient base, branch network, and service offering to drive new sustainable growth in the years to come. To this end, in the first six months of the year we successfully added 14 new branches in our home market of Egypt, keeping us on track to meet our goal of 30 to 35 new lab rollouts for 2021 and helping us to further cement our leadership position in the country’s private sector diagnostics market. In parallel, we continue to assess potential growth opportunities across new African, Middle Eastern, and Asian markets, and have secured a USD 45 million loan from the International Finance Corporation (IFC) to finance our growth plans in the coming period,” El-Sherbini concluded.

IDH’s full 1H 2021 earnings release for the six-month period ended 30 June 2021 are available at www.idhcorp.com

-Ends-

About Integrated Diagnostics Holdings (IDH)

IDH is a leading consumer healthcare company in the Middle East and Africa with operations in Egypt, Jordan, Sudan and Nigeria. The Group’s core brands include Al Borg, Al Borg Scan and Al Mokhtabar in Egypt, as well as Biolab (Jordan), Ultralab and Al Mokhtabar Sudan (both in Sudan) and Echo-Lab (Nigeria). A long track record for quality and safety has earned the Company a trusted reputation, as well as internationally recognised accreditations for its portfolio of over 2,000 diagnostics tests. From its base of 495 branches as of 30 June 2021, IDH will continue to add laboratories through a Hub, Spoke and Spike business model that provides a scalable platform for efficient expansion. Beyond organic growth, the Group’s expansion plans include acquisitions in new Middle Eastern, African, and East Asian markets where its model is well-suited to capitalise on similar healthcare and consumer trends and capture a significant share of fragmented markets. IDH has been a Jersey-registered entity with a Standard Listing on the Main Market of the London Stock Exchange (ticker: IDHC) since May 2015 with a secondary listing on the EGX since May 2021 (ticker: IDHC.CA). Learn more at www.idhcorp.com

Forward-Looking Statements

These results for the six-month period ended 30 June 2021 have been prepared solely to provide additional information to shareholders to assess the group's performance in relation to its operations and growth potential. These results should not be relied upon by any other party or for any other reason. This communication contains certain forward-looking statements. A forward-looking statement is any statement that does not relate to historical facts and events, and can be identified by the use of such words and phrases as "according to estimates", "aims", "anticipates", "assumes", "believes", "could", "estimates", "expects", "forecasts", "intends", "is of the opinion", "may", "plans", "potential", "predicts", "projects", "should", "to the knowledge of", "will", "would" or, in each case their negatives or other similar expressions, which are intended to identify a statement as forward-looking. This applies, in particular, to statements containing information on future financial results, plans, or expectations regarding business and management, future growth or profitability and general economic and regulatory conditions and other matters affecting the Group.

Forward-looking statements reflect the current views of the Group's management ("Management") on future events, which are based on the assumptions of the Management and involve known and unknown risks, uncertainties and other factors that may cause the Group's actual results, performance or achievements to be materially different from any future results, performance or achievements expressed or implied by these forward-looking statements. The occurrence or non-occurrence of an assumption could cause the Group's actual financial condition and results of operations to differ materially from, or fail to meet expectations expressed or implied by, such forward-looking statements.

The Group's business is subject to a number of risks and uncertainties that could also cause a forward-looking statement, estimate or prediction to differ materially from those expressed or implied by the forward-looking statements contained in this communication. The information, opinions and forward-looking statements contained in this communication speak only as at its date and are subject to change without notice. The Group does not undertake any obligation to review, update, confirm or to release publicly any revisions to any forward-looking statements to reflect events that occur or circumstances that arise in relation to the content of this communication.

[1] Covid-19-related tests include both core Covid-19 tests (Polymerase Chain Reaction (PCR), Antigen, and Antibody) as well as other Covid-19-related tests which include a bundle of routine inflammatory and clotting markers (which witnessed strong demand following the outbreak of Covid-19) such as Complete Blood Picture, Erythrocyte Sedimentation Rate (ESR), D-Dimer, Ferritin and C-reactive Protein (CRP), among others.

[2] Normalised EBITDA is calculated as operating profit plus depreciation and amortization and minus one-off fees incurred in 1H 2021 (EGP 29 million) related to the Company’s EGX listing completed in May 2021.

[3] Operating Profit excludes one-off fees incurred in 1H 2021 (EGP 29.0 million) related to the Company’s dual listing on the EGX completed in May 2021.

[4] Covid-19-related tests include both core Covid-19 tests (Polymerase Chain Reaction (PCR), Antigen, and Antibody) as well as other Covid-19-related tests which include a bundle of routine inflammatory and clotting markers (which witnessed strong demand following the outbreak of Covid-19) such as Complete Blood Picture, Erythrocyte Sedimentation Rate (ESR), D-Dimer, Ferritin and C-reactive Protein (CRP), among others.

[5] The 100 Million Healthy Lives Campaign ran from November 2018 through June 2019. As part of the Campaign, the Group performed 2.4 million tests in 1H 2019.

[6] Normalised EBITDA is calculated as operating profit plus depreciation and amortization and minus one-off fees incurred in 1H 2021 (EGP 29 million) related to the Company’s EGX listing completed in May 2021.

© Press Release 2021

Disclaimer: The contents of this press release was provided from an external third party provider. This website is not responsible for, and does not control, such external content. This content is provided on an “as is” and “as available” basis and has not been edited in any way. Neither this website nor our affiliates guarantee the accuracy of or endorse the views or opinions expressed in this press release.

The press release is provided for informational purposes only. The content does not provide tax, legal or investment advice or opinion regarding the suitability, value or profitability of any particular security, portfolio or investment strategy. Neither this website nor our affiliates shall be liable for any errors or inaccuracies in the content, or for any actions taken by you in reliance thereon. You expressly agree that your use of the information within this article is at your sole risk.

To the fullest extent permitted by applicable law, this website, its parent company, its subsidiaries, its affiliates and the respective shareholders, directors, officers, employees, agents, advertisers, content providers and licensors will not be liable (jointly or severally) to you for any direct, indirect, consequential, special, incidental, punitive or exemplary damages, including without limitation, lost profits, lost savings and lost revenues, whether in negligence, tort, contract or any other theory of liability, even if the parties have been advised of the possibility or could have foreseen any such damages.