PHOTO

- Farghaly: Absence of major deals, Demand for “Ready-made properties” and Increases of up to 60% in rents.

- Al-Kaabi: 30% of the deals in 5 emerging zones as a result of the decrease in prices.

- 1251 deals with an average of 3.9 Million Riyals, including 63 residential deals and 15 commercial buildings.

- Al Rayyan Municipality acquired 38.9% of the value of deals worth 1.88 Billion Riyals.

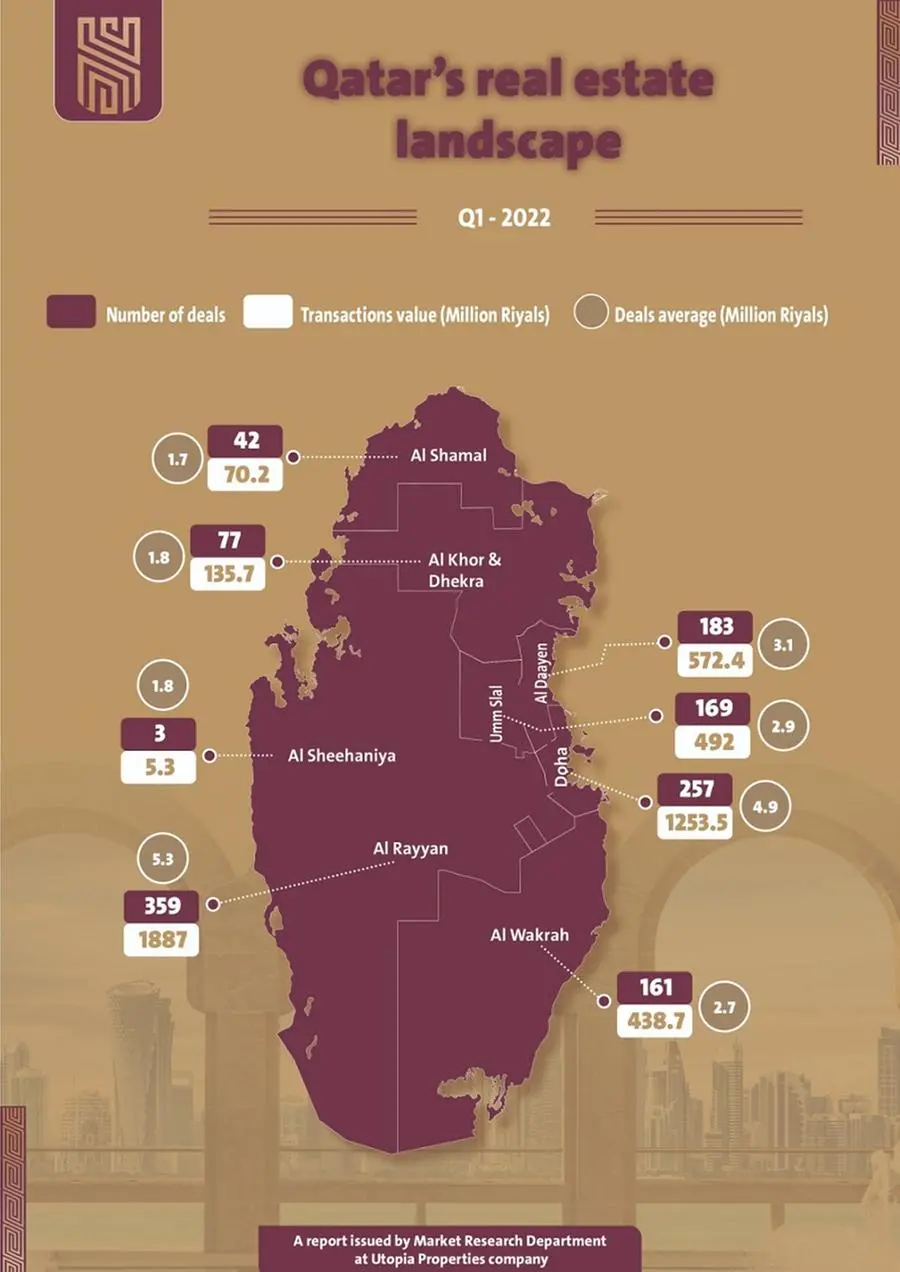

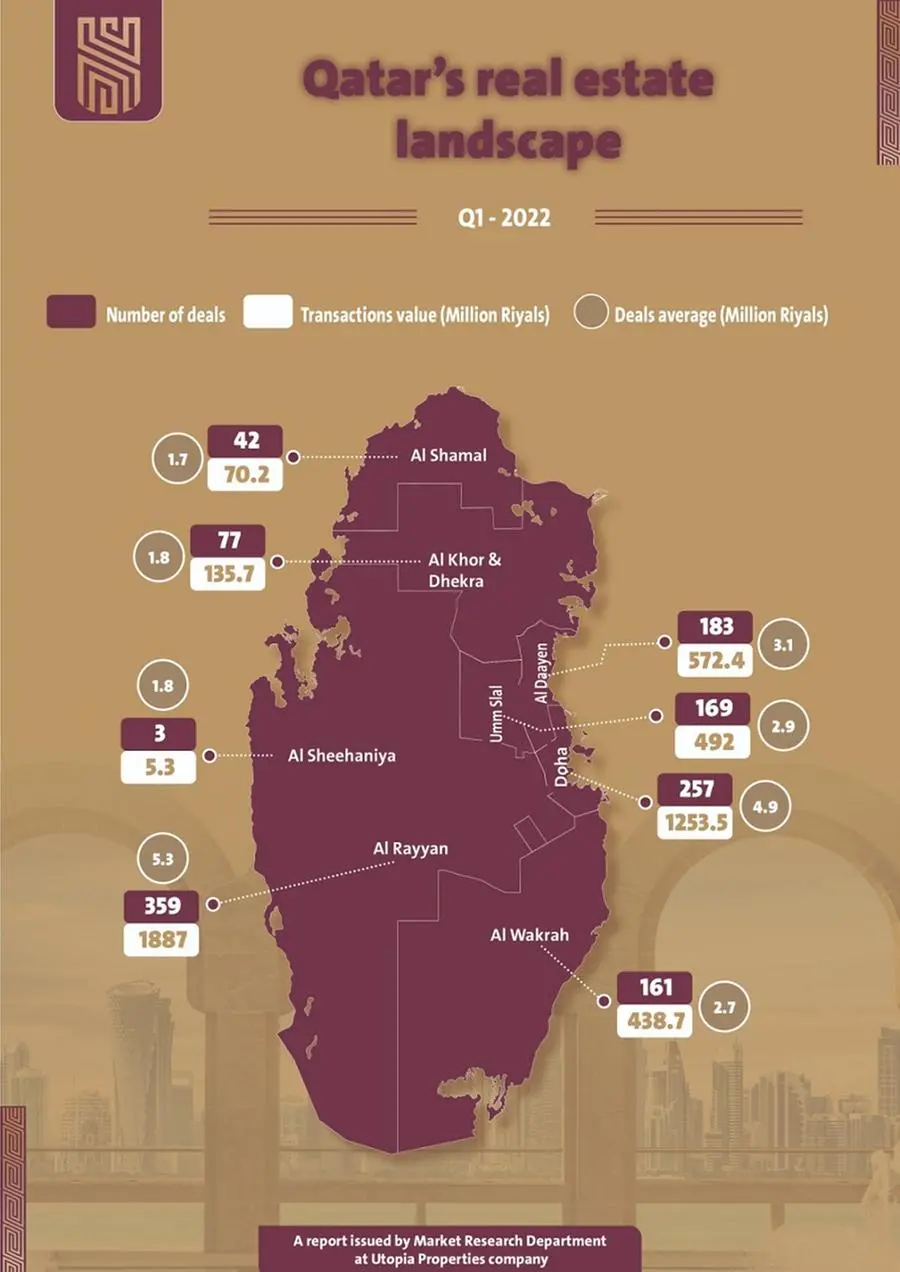

Doha - Qatar: The value of real estate transactions in the State of Qatar recorded 4.85 Billion Riyals during Q1 of 2022 with a quarterly decrease of 4.4% compared to Q4 of 2021, while it decreased annually by more than 31.5% compared to the Q1 of last year, according to the collected data of real estate transactions, whether weekly or monthly issued by the Real Estate Registration Department at the Ministry of Justice.

The quarterly real estate index issued by the Market Research Department at Utopia properties company, indicated that the real estate deals that were executed during Q1 included 1251 deals. The average value of deals settled at 3.9 Million Riyals per deal during the Q1 of 2022, compared to 4.2 Million Riyals during the Q4 of 2021.

Real estate deals

As Utopia index, the real estate deals that were executed during the Q1 varied to include 572 houses deals, 571 deals of vacant land, 63 deals of residential buildings, five apartment complexes, 15 commercial buildings, 16 Multi-Purpose Vacant Lands and 9 multi- purpose buildings.

Utopia properties index revealed that 38.9% of the value of real estate transactions recorded during Q1 were concentrated in Al Rayyan Municipality, with a value of 1.88 Billion Riyals, through the execution of 359 deals, with an average of 5.25 Million Riyals per deal. Doha Municipality ranked second (25.3%) with a value of 1.25 Billion Riyals through the execution of 257 real estate deals, with an average of 4.87 Million Riyals per deal. Then Al Daayen Municipality, which recorded transactions worth more than 572.3 Million Riyals through the execution of 183 deals, with an average value of 3.12 Million Riyals per deal.

In terms of selling prices during Q1 2022, the average sale of vacant land deals amounted to 287 Riyals per square foot, while the average selling price of houses deals amounted to 431 Riyals per foot, and the average sale of residential building deals was 1255 Riyals per foot, Utopia Index stated.

Transactions direction

Mr. Mohamed Farghaly, CEO of Utopia properties company, said: “Calmness was the dominant feature of the Q1 transactions, amid the disappearance of major deals of houses, except the personal transactions. The average of vacant land deals amounted to 2.91 Million Riyals, while the average recorded 3.14 Million Riyals for houses deals. This slight difference between them is due to the absence of exceptional deals”.

He added, “The multi-use buildings deals also recorded only 9 deals with a total value of 88.2 Million Riyals, compared to 18 deals that were executed during the same period in 2021. The deals of Q1 2022 were distributed to include the sale of 6 buildings in Doha Municipality, and one building in each of Al Rayyan, Al Wakra and Umm Salal Municipalities”.

Farghaly explained that the technical analysis of Q1 deals also revealed that ready-made properties acquired more than 52% of the total number of deals and about 60% of the total value of the executed deals during the first three months of this year, this means that it is a sought-after real estate product, especially with the approach of the 2022 FIFA World Cup Qatar.

Although Utopia Index does not monitor rent values and the number of new lease contracts and their values due to the lack of official data, the Market Research Department in Utopia properties has monitored increases in rates ranging between 30-60% in terms of rents, in areas such as The Pearl, where rental rates increased by around 50%, especially with the availability of services and the western lifestyle, which is a major attraction for visitors to the country during the 2022 World Cup, Farghaly said.

Emerging zones

Mr. Rashid Fahd Al-Ajlan Al-Kaabi, General Manager of Utopia properties, said that the quarterly index data indicated that the average selling prices in Al Daayen Municipality exceeded their counterparts in Al Wakrah Municipality, which is a new variable on the market as a result of the great momentum that the city of Lusail in Al Daayen Municipality as well as future expectations related to it Whether in terms of vacant land or ready-made properties.

Al-Kaabi added: "The transactions of the first three months of 2022 showed that 5 zones (Al-Wukair - Umm Qarn - Umm Al-Amad - Muaither - Al-Khor) acquired 30% of the total number of real estate deals and only 17% of the total transactions value during that period. These are the zones that accounted for 13% of the number of deals and 9% of the transactions value during Q1 of 2021, and this is due to the decrease in the average price of real estate in those emerging zones”.

In terms of residential complex transactions, only five deals were executed for residential complexes with a total value of 119.5 Million Riyals, compared to the execution of 15 deals worth 341.5 Million Riyals during the same quarter of 2021. Q1 of 2022 witnessed the execution of three deals of complexes in Al Rayyan Municipality and a complex in each of Al Daayen and Umm Slal Municipalities.

-Ends-