PHOTO

- Mubadala and HDBI closed first transaction under the extended agreement with a co-investment in a Greek ventures fund

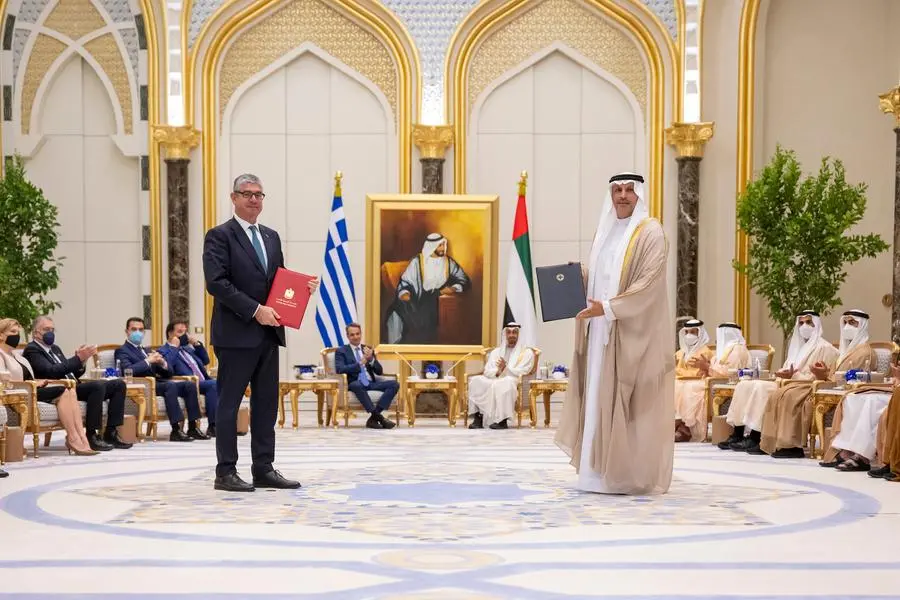

Abu Dhabi, UAE/Athens, Greece: During Greek Prime Minister Kyriakos Mitsotakis’s official state visit to the United Arab Emirates, Abu Dhabi-based sovereign investor, Mubadala Investment Company (“Mubadala”) and Hellenic Development Bank of Investments[1] (“HDBI”), the sovereign fund of funds of Greece, signed an agreement to extend their €400 million co-investment partnership to include venture capital (“VC”) and private equity (“PE”) investments in top performing Greek funds that are focused on high growth sectors. The Mubadala-HDBI co-investment partnership was first established in 2018 with an initial focus on minority direct PE investments in Greek businesses.

Additionally, Mubadala and HDBI closed their first co-investment under the newly extended agreement to Athens-based VentureFriends Fund III, an early-stage tech investor.

Waleed Al Mokarrab Al Muhairi, Mubadala’s Deputy Group CEO, said: “Over the years, the economy of Greece has not only demonstrated its resilience, but it also now presents some very exciting growth opportunities. Our extended partnership with HDBI will enable Mubadala to accelerate its investments in Greece, capitalizing on an increasingly active innovation and entrepreneurial landscape across multiple sectors. We look forward to our continued collaboration with HDBI in the months and years ahead as we collectively seek to tap into Greece’s burgeoning innovation driven sectors.”

Dr. Haris Lambropoulos, HDBI’s President, said: “Our collaboration with Mubadala is based on mutual trust and understanding. The extension of our strategic co-investment partnership is the beginning of a new era, in full alignment with the investment principles and values of our respective organizations. It also provides a unique opportunity to further promote our bilateral relations, leveraging the dynamism of the Greek economy and its resilience in the face of global challenges and uncertainties.”

Antigoni Lymperopoulou, HDBI’s CEO, added: “Our co-investment approach has been delivering solid results by promoting the Greek investment ecosystem, which is focused on talent and innovative entrepreneurship.”

VentureFriends focuses on scalable B2C and B2B startups that can develop a sustainable moat over time, with a track record of successful investments in PropTech, Fintech, Marketplaces and SaaS. VentureFriends targets investments in Greece, throughout Europe and selectively around the world, including the UAE, where it has been an early investor in Instashop since 2016 and most recently an early investor in Huspy.

George Dimopoulos, Founding Partner of VentureFriends, said: “We are very excited to welcome Mubadala and HDBI as LPs in VentureFriends III. We are looking forward to building on this partnership, and with the help of these two organizations, continue to support founders and companies that will become leaders in their respective spaces, including Blueground (Proptech), Belvo (Fintech), and Instashop (B2C).

“Through the co-investment partnership, Mubadala and HDBI have jointly reviewed a number of investment opportunities over the past four years, with further direct and fund investment opportunities currently under review.”

-Ends-

About Mubadala Investment Company

Mubadala Investment Company is a sovereign investor managing a global portfolio, aimed at generating sustainable financial returns for the Government of Abu Dhabi.

Mubadala’s $243.4 billion (AED 894 billion) portfolio spans six continents with interests in multiple sectors and asset classes. We leverage our deep sectoral expertise and long-standing partnerships to drive sustainable growth and profit, while supporting the continued diversification and global integration of the economy of the United Arab Emirates.

Headquartered in Abu Dhabi, Mubadala has offices in London, Moscow, New York, and Beijing.

For more information about Mubadala Investment Company, please visit: www.mubadala.com

Press contact for Mubadala:

Salam Kitmitto

sakitmitto@mubadala.ae

About Hellenic Development Bank of Investments

The Hellenic Development Bank of Investments SA (HDBI, ex TANEO) is the Sovereign Fund of Funds of Greece. The main activity of HDBI is to manage state and/or EU funds for the purpose of procuring and investing these resources to participate along other investors in Venture Capital and Private Equity Funds. The company’s mottos are #WeInvestForGrowth and #FinancingInnovation. Currently, the funds under management by HDBI amount to €2.1 billion.

For more information about HDBI and its investment programs, please visit: www.hdbi.gr

Press contact for HDBI: media@hdbi.gr

About VentureFriends

We are a European Venture Capital fund founded by ex-entrepreneurs and angel investors, based in Athens with presence in London and Poland. We launched VentureFriends in early 2016, and through 3 funds totaling c. $200M we have invested so far in 60 startups based in Europe, MENA and LatAm

We are seeking globally aspiring tech-enabled companies at the Seed & Series A stage. Our initial ticket ranges from €500K to €2.5 million and we can double down on portfolio companies through follow-ons that can bring total investment in a company up to €10 million.

We are focusing on scalable B2C and B2B startups that can develop a sustainable moat over time, with a sweet spot for Consumer as well as PropTech, FinTech, Marketplaces and SaaS

For more information about VentureFriends please visit: www.venturefriends.vc

Press contact for VentureFriends:

Pavlos Pavlakis

Pavlos@venturefriends.vc

[1] Hellenic Development Bank of Investments was formerly known as New Economy Development Fund (“TANEO”)