PHOTO

- Madinet Masr starts off the year with an exceptional set of results as revenue reaches EGP 3.0 billion and gross contracted sales book an eight-fold year-on-year increase to EGP 14.9 billion.

Cairo – Madinet Masr, one of Egypt’s leading urban community developers, announced on 23 May 2024 its standalone financial results for the quarter ended 31 March 2024 (Q1 2024), reporting a net profit of EGP 1.2 billion on total revenue of EGP 3.0 billion.

| Summary Income Statement (EGP mn) | Q1 2024 | Q1 2023 | Change |

| Revenue | 2,990.4 | 1,015.2 | 194.6% |

| Gross Profit | 2,412.1 | 579.9 | 316.0% |

| Gross Profit Margin | 80.7% | 57.1% | +23.5 pts |

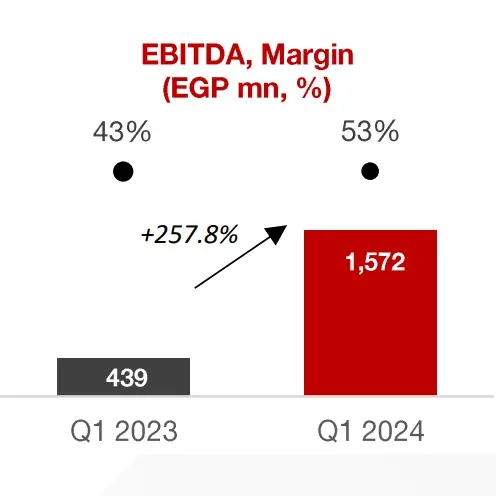

| EBITDA | 1,572.0 | 439.3 | 257.8% |

| EBITDA Margin | 52.6% | 43.3% | +9.3 pts |

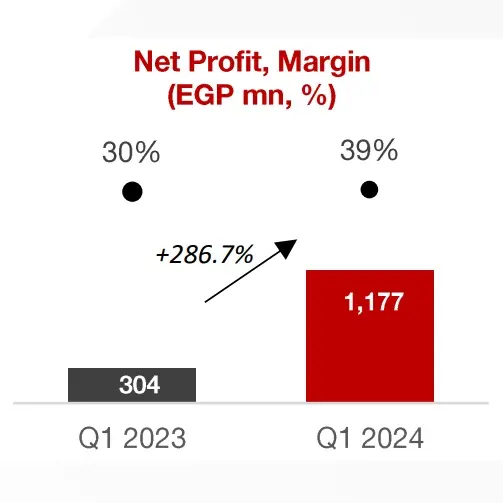

| Net Profit | 1,177.2 | 304.4 | 286.7% |

| Net Profit Margin | 39.4% | 30.0% | +9.4 pts |

|

|

|

|

|

| Key Operational Indicators | Q1 2024 | Q1 2023 | Change |

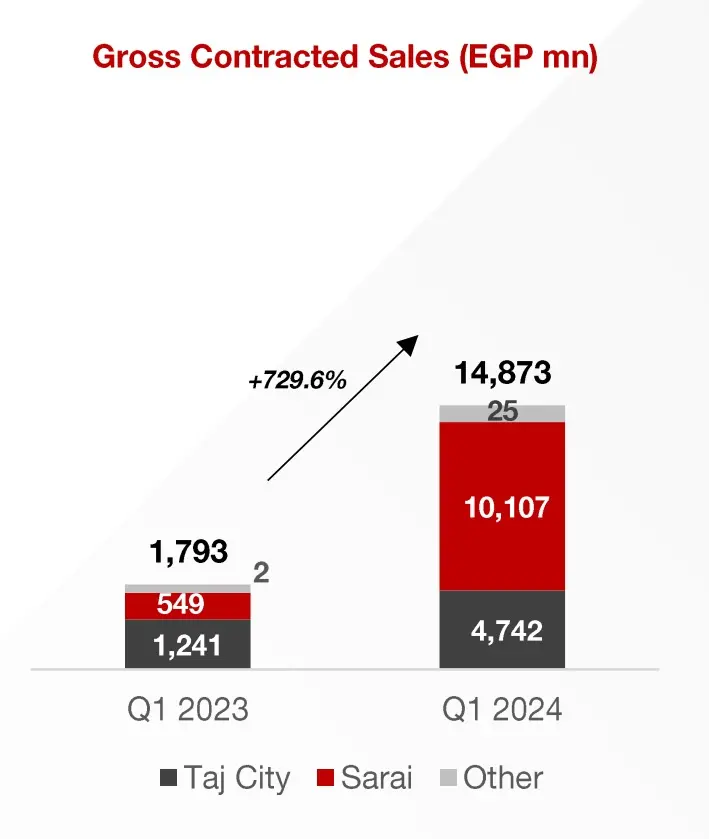

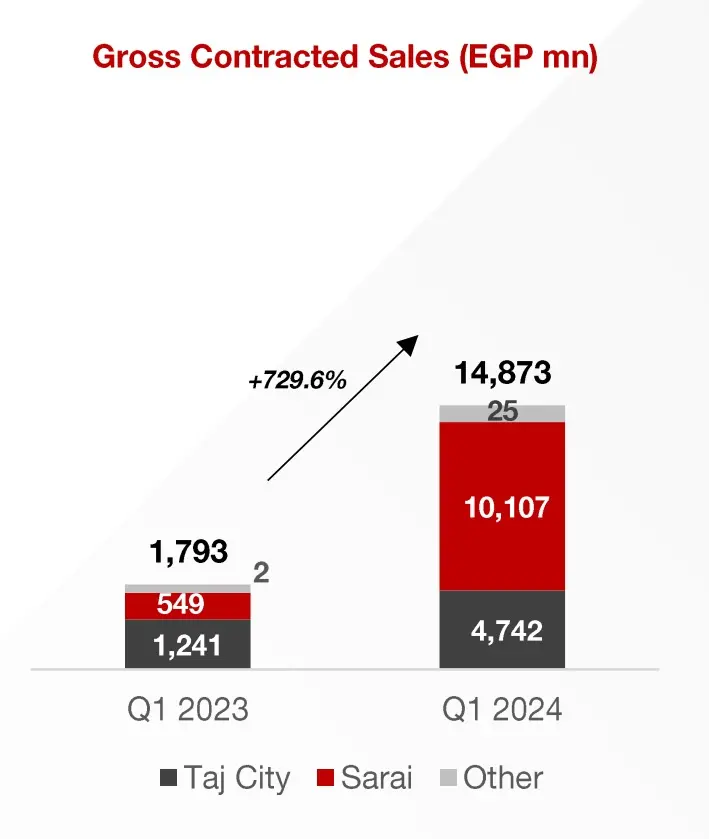

| Gross Contracted Sales (EGP mn) | 14,873.2 | 1,792.8 | 729.6% |

| Units Sold | 2,344 | 333 | 603.9% |

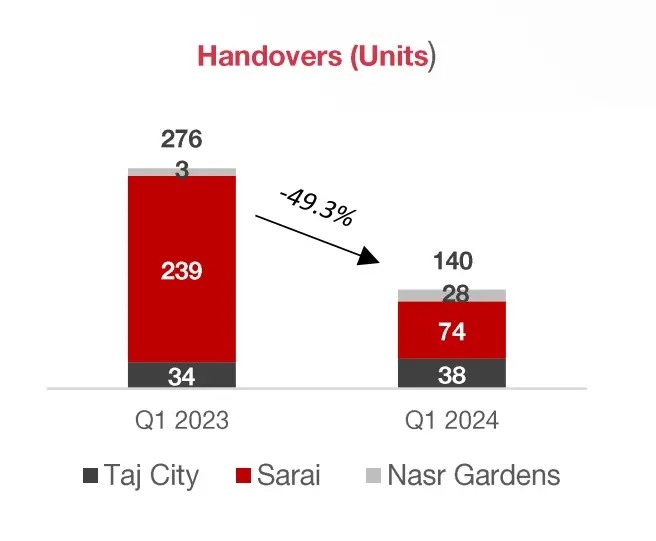

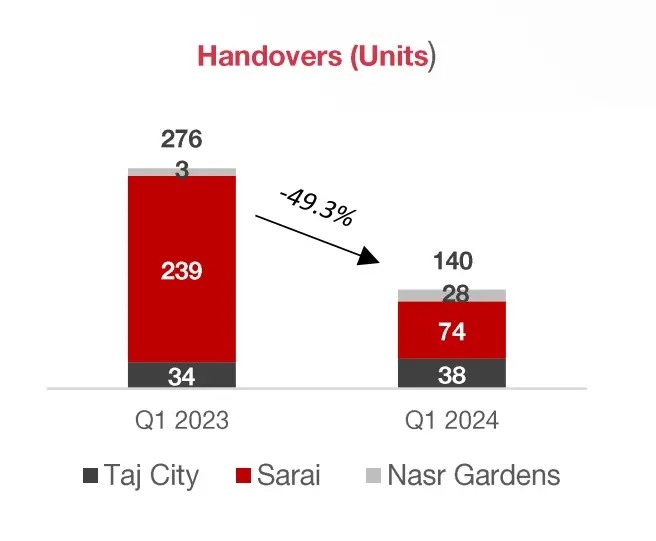

| Deliveries | 140 | 276 | -49.3% |

| Land Bank (million sqm) | 9.6 | 9.6 | - |

Key Highlights

- Madinet Masr records gross contracted sales of EGP 14.9 billion for Q1 2024, up by a substantial 729.6% y-o-y driven by significant unit sales growth. In the first quarter of the year, the Company sold 2,344 units across its developments, up seven-folds year-on-year from 333 units in Q1 2023.

- The Company delivered a total of 140 units during Q1 2024, down 49.3% y-o-y versus the 276 units delivered for Q1 2023, due to Madinet Masr’s focus on mass construction in the public areas of Taj City and Sarai. Unit deliveries are expected to increase towards the end of the year.

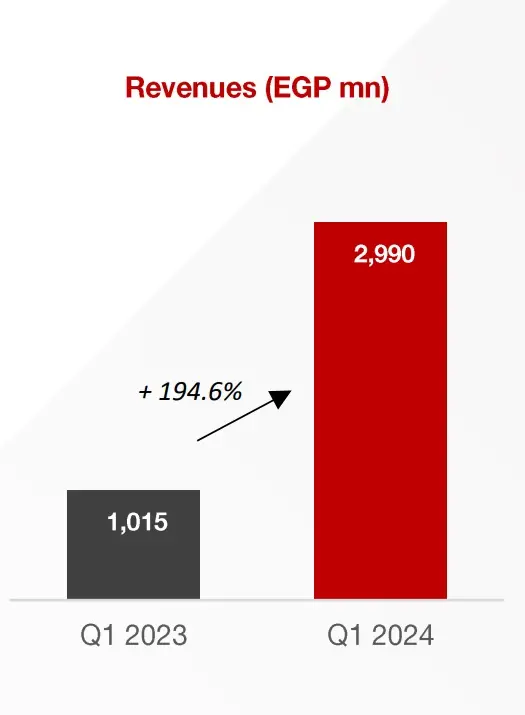

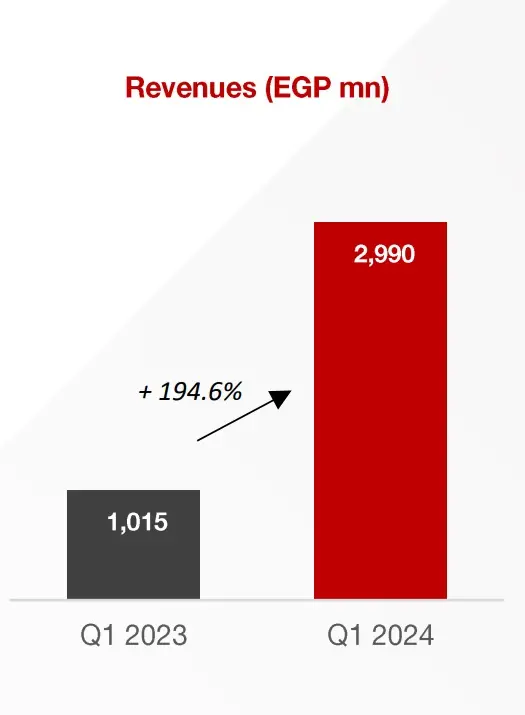

- Revenue came in at EGP 3.0 billion for Q1 2024, up by 194.6% y-o-y, on the back of strong gross contracted sales growth.

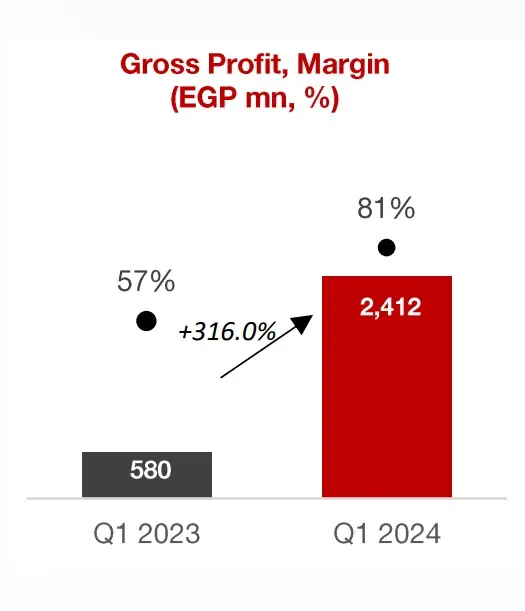

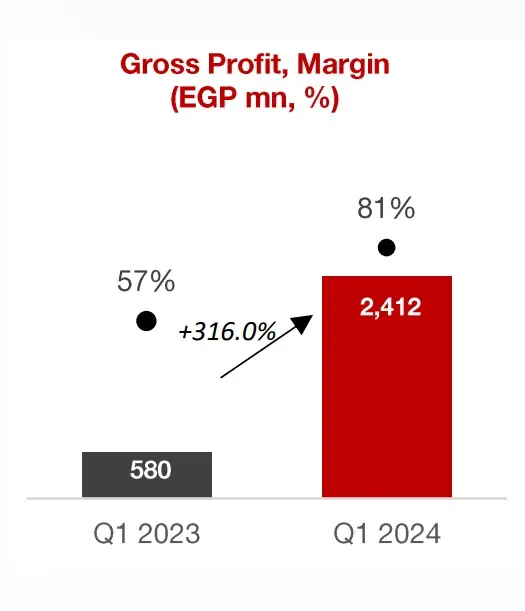

- Gross profit came in at EGP 2.4 billion in Q1 2024, up 316.0% y-o-y. Madinet Masr’s gross profit margin increased from 57.1% in Q1 2023 to 80.7% in Q1 2024 due to an increase in revenue from new sales with higher margins as compared to revenue from unit delivery with lower margins.

- Madinet Masr recorded an EBITDA of EGP 1.6 billion for Q1 2024, climbing 257.8% y-o-y. The EBITDA margin came in at 52.6% for the quarter, against a margin of 43.3% in the same quarter last year.

- The Company booked a net profit of EGP 1.2 billion for Q1 2024, up by 286.7% y-o-y with an associated net profit margin of 39.4% against the 30.0% recorded for Q1 2023.

- Madinet Masr is currently a zero-net debt company with a strong net cash position of EGP 1.3 billion. The net debt/EBITDA ratio stood at (0.85)x as of 31 March 2024 compared to 1.47x at year-end FY 2023.[1]

- Net notes receivable recorded EGP 4.0 billion as of 31 March 2024 at par with year-end 2023, yielding a receivables/net debt ratio of (3.01)x for Q1 2024 versus 6.26x at the close of FY 2023. Total accounts and notes receivable, including off-balance sheet PDCs for undelivered units, amounted to EGP 40.7 billion at the close of the quarter compared to EGP 29.8 billion as of 31 December 2023.

- Cash collections booked EGP 3.3 billion in Q1 2024, up by 276.6% y-o-y.

- Madinet Masr deployed EGP 1.0 billion in construction and infrastructure CAPEX during Q1 2024, up from an outlay of EGP 512.1 million in Q1 2023, reflecting ongoing construction primarily at Taj City. Total new construction contracts awarded in Q1 2024 reached EGP 1.26 billion.

Management Comment: Abdallah Sallam, Chief Executive Officer

With the start of the new year marked by stellar results, we are filled with confidence for the year ahead. Building on the momentum and success achieved in 2023, we are embarking on an even more exciting journey this year as we deliver on our vision of building distinguished and sustainable communities across Egypt.

We begin the year with an impressive set of financial and operational results that exemplify our commitment to growth and our ability to deliver on our strategic goals. During the first quarter of 2024, gross contracted sales grew eight-folds year-on-year to EGP 14.9 billion, in addition to EGP 43 million at Minka and EgyCan. The operational success reflected positively on our financial performance, which saw revenue triple year-on-year to close the quarter at EGP 3.0 billion and net profit expand 286.7% year-on-year to EGP 1.2 billion. Our results demonstrate the robust demand for high-quality real estate in Egypt and reflect the ongoing trust and confidence our customers have in Madinet Masr as a premium community developer.

Madinet Masr is committed to fostering innovation and establishing itself as a leader in the Egyptian real estate market. At the start of the year, the company launched Theqa through its R&D arm, Madinet Masr Innovation Labs. Theqa is a pioneering property warranty designed to replace traditional maintenance deposits, offering a first-of-its-kind solution in the market. This initiative aligns with Madinet Masr's vision to tackle the challenges associated with real estate ownership in Egypt and to deliver value-added solutions that enhance the customer experience. By introducing innovative products like Theqa, Madinet Masr continues to set new standards in the industry, reinforcing its role as a forward-thinking community developer.

Moving forward, we are optimistic about the opportunities on the horizon and confident in our capacity to navigate challenges while seizing these prospects. We are encouraged by the robust fundamentals of Egypt's real estate market and expect to maintain our positive momentum throughout the year. Our forward-thinking approach and commitment to innovation position us well to continue driving growth and delivering value to our stakeholders.

Operational Performance

Gross Contracted Sales

Madinet Masr recorded gross contracted sales of EGP 14.9 billion during Q1 2024, up over eight-folds year-on-year from EGP 1.8 billion in Q1 2023, marking record-breaking sales for a first quarter. Approximately 31.9% (EGP 4.7 billion) of Madinet Masr’s gross contracted sales for Q1 2024 were recorded at Taj City, the Company’s 3.6-million-sqm mixed-use development in the eastern suburbs of Cairo. Meanwhile, 68.0% (EGP 10.1 billion) of Madinet Masr’s gross contracted sales for Q1 2024 were generated at Sarai, a 5.5-million-sqm mixed-use project near the New Administrative Capital on the Cairo-Suez Road.

The Company sold a total of 2,344 units in Q1 2024, up 603.9% y-o-y from 333 units in Q1 2023. Madinet Masr sold 713 units at Taj City during the quarter (Q1 2023: 243), 1,626 units at Sarai (Q1 2023: 88), and 5 units at other projects (Q1 2023: 2). The first quarter of the year saw the launch of Sheya in Sarai, a 228,212 sqm project with 744 mixed residential units. As of 31 March 2024, Madinet Masr’s sales reached EGP 4.8 billion in Sheya.

Cash Collections

Madinet Masr made cash collections of EGP 3.3 billion for Q1 2024, up by 276.6% from the EGP 888.1 million collected in Q1 2023. The Company recorded a cumulative delinquency rate of 2.0% at the close of Q1 2024, down from the rate of 2.7% reported for Q1 2023. The decrease in the delinquency rate reflects the Company’s continuous efforts to remove nonperforming contracts from its receivables portfolio.

CancellationsCancellations stood at EGP 43.1 million for Q1 2024, down 62.1% y-o-y from EGP 113.9 million in Q1 2023, due to the prevalent economic environment. Cancellations recorded 0.3% as a percentage of gross contracted sales in Q1 2024, down significantly year-on-year from the 6.4% booked in Q1 2023.

Deliveries

The Company delivered 140 units across its developments during Q1 2024, down 49.3% y-o-y from the 276 deliveries recorded for Q1 2023. Madinet Masr is completing mass construction in the public areas of Taj City and Sarai and unit deliveries are expected to increase towards the end of the year. During the first quarter of the year, Madinet Masr completed 74 handovers at Sarai (Q1 2023: 239), 38 handovers at Taj City (Q1 2023: 34) and 28 handovers at Nasr Gardens (Q1 2023: 3), a subsidized housing project.

CAPEX

Madinet Masr deployed construction and infrastructure CAPEX of EGP 1.0 billion during Q1 2024 up from EGP 512.1 million in Q1 2023. The Company’s construction and infrastructure investments at Taj City amounted to EGP 545.8 million in Q1 2024 versus EGP 260.9 million in Q1 2023. At Sarai, Madinet Masr recorded a construction and infrastructure CAPEX spend of EGP 373.7 million for Q1 2024, against EGP 226.3 million for Q1 2023. Construction and infrastructure CAPEX at other projects totaled EGP 115.7 million for Q1 2024, up from the EGP 24.9 million recorded in Q1 2023. Total new construction contracts awarded in Q1 2024 reached EGP 1.26 billion.

Land Bank

Madinet Masr held a land bank measuring 9.6 million sqm at the close of Q1 2024. The Company’s primary land bank is strategically located in Greater Cairo (Taj City and Sarai). The land is owned in freehold, imparting significant competitive advantages to Madinet Masr. As of 31 March 2024, 37.9% of Madinet Masr’s land bank was held at Taj City, 57.5% at Sarai and 4.6% at Zahw Assiut.

At Taj City, 72.6% of the land area was under development at the close of Q1 2024, with unlaunched residential projects and unlaunched nonresidential projects accounting for 4.7% and 22.6%, respectively. At Sarai, 51.6% of the total land area was under development in Q1 2024, with unlaunched residential projects and unlaunched nonresidential projects accounting for 33.7% and 14.7%, respectively.

As of Q1 2024, Madinet Masr’s 437 thousand sqm land bank in the Assiut region of Upper Egypt was under development, marking the Company’s geographical expansion beyond the Greater Cairo area.

Financial Performance

Income Statement

Revenues

The Company recorded revenues of EGP 3.0 billion in Q1 2024, marking a three-fold year-on-year increase from a figure of EGP 1.0 billion in Q1 2023. Revenue growth was driven by strong gross contracted sales value.

Deliveries generated EGP 201.6 million in revenue during Q1 2024, down 48.7% y-o-y, while new sales generated EGP 2.8 billion in revenue during the quarter, up nearly six-folds year-on-year. Revenue from unit deliveries contributed 6.8% of the Company’s gross Q1 2024 sales revenue of EGP 3.0 billion before cancellations, land sale, installment interest and rental revenue. Meanwhile, revenue from new sales accounted for 93.2% of the Company’s gross revenue for the quarter. At the close of Q1 2024, Madinet Masr had an unrecognized revenue backlog of EGP 44.6 billion, calculated at the nominal price of undelivered sales.

Gross Profit

Gross profit booked EGP 2.4 billion for Q1 2024, up four-folds year-on-year from EGP 579.9 million in Q1 2023. Strong expansion in gross profit was supported by the Company’s significant top-line growth for the quarter. Madinet Masr booked a gross profit margin of 80.7% in Q1 2024 compared to 57.1% in Q1 2023. The expansion in the gross profit margin (GPM) during the quarter was achieved due to the increase in revenue from new sales with higher margins as compared to revenue from unit deliveries with lower margins.

Sales, General & Administrative Expense

Sales, general & administrative (SG&A) expenses came in at EGP 696.2 million for Q1 2024, up by 324.7% y-o-y from the outlay of EGP 164.0 million booked in the same quarter the previous year. SG&A expenses rose primarily due to a 729.6% increase in gross contracted sales during the quarter. As percentage of revenues, SG&A expense came in at 23.3% for Q1 2024, up from 16.2% in Q1 2023.

Finance Cost

Finance cost booked EGP 138.8 million in Q1 2024, up 96.0% y-o-y from EGP 70.8 million in the same period last year.

EBITDA

Madinet Masr reported an EBITDA of EGP 1.6 billion for Q1 2024, increasing 257.8% y-o-y from EGP 439.3 million in Q1 2023. The associated EBITDA margin was 52.6% in Q1 2024 versus 43.3% in Q1 2023 due to the increase in the share of new sales with higher profit margins in the Company’s revenue mix for Q1 2024.

Net Profit

Net profit reached EGP 1.2 billion for Q1 2024, growing a significant 286.7% y-o-y compared to EGP 304.4 million in Q1 2023. Bottom-line growth for the quarter reflects increases in gross profit, optimization of operating cost, and income tax. The net profit margin (NPM) booked 39.4% for Q1 2024, against 30.0% in Q1 2023. The increase in the Company’s NPM was supported by a significant increase in gross profit margin for the quarter.

Balance Sheet

Net Cash & Short-term Investments

On the balance sheet front, Madinet Masr held net cash and short-term investments of EGP 3.2 billion excluding customer maintenance deposits as of 31 March 2024, up 126% from EGP 1.4 billion at the close of 2023.

Debt

As of 31 March 2024, Madinet Masr had zero outstanding debt compared to EGP 645.1 million booked at year-end 2023. Madinet Masr holds a net cash position after covering all debt balances of EGP 1.3 billion. The Company’s debt/equity ratio stood at 22.2% as of 31 March 2024, down from 28.4% at the close of 2023. Madinet Masr recorded a net debt/EBITDA ratio of (0.85)x as of 31 March 2024 compared to 1.47x as of 31 December 2023. The Company’s strategy is to optimize efficient utilization of borrowing to support growth and manage financial risk.

Notes Receivable

Madinet Masr held EGP 4.0 billion in net notes receivable at the close of Q1 2024, of which EGP 2.5 billion were short-term receivables, EGP 1.1 billion long-term receivables and EGP 414.4 million were due from customers. Total accounts and notes receivable as of 31 March 2024, including off-balance sheet PDCs for undelivered units amounted to EGP 40.7 billion compared to EGP 29.8 billion as of 31 December 2023. Receivables to net debt stood at (3.01)x by the end of Q1 2024 versus the 6.26x recorded at year-end 2023.

PP&E

PP&E, fixed assets under construction, and property investments booked EGP 960.6 million at the close of Q1 2024, up from the EGP 691.4 million booked at the close of 2023.

Recent Corporate Developments

- In January 2024, Madinet Masr launched the first phase of Sheya, its latest project in Sarai. Sheya spans an area of 228,212 sqm and offers a total of 744 mixed residential units.

- In March 2024, Madinet Masr unveiled “Theqa” the latest innovation by Madinet Masr Innovation Labs. Theqa is the first-of-its-kind property warranty solution designed to substitute maintenance deposits

| Income Statement

Balance Sheet

|

-Ends-

About Madinet Masr

Since 1959, Madinet Masr has served the housing needs of millions of Egyptians. Initially founded to develop master projects for the Cairo district of Nasr City, home to three million residents, Madinet Masr has grown into a premier real estate developer and has become one of the country’s most recognizable real estate brands. Madinet Masr was listed on the Egyptian Exchange in 1996, capitalizing on a long and successful track record of delivering world-class housing and infrastructure projects to broaden its exposure to various target segments of the Egyptian real estate market. Anchored in the Greater Cairo Area and with a growing presence in other regions of Egypt, the Company holds a land bank of over nine million square meters (sqm).

Madinet Masr had 22 active projects across three developments at the close of Q1 2024: Taj City, a 3.6 million sqm mixed use development positioned as a premier cultural destination, Sarai, a 5.5 million sqm mixed use development strategically located near Egypt’s New Administrative Capital between Cairo and Suez, and Zahw, a 104-acre mixed use development strategically positioned in west of Assiut Governorate beside Assiut’s airport and 15-minute away from its center. Zahw compliments the contemporary real estate products in Upper Egypt and is Madinet Masr’s first expansion project outside of Cairo Governorate.

Investor Relations Contact

Ahmed Khalil

akhalil@madinetmasr.com

Investor Relations Department

investor.relations@madinetmasr.com

Madinet Masr

4 Youssif Abbas Street, District 2

Nasr City, Cairo, Egypt

www.madinetmasr.com

Forward Looking Statements

The information, statements and opinions contained in this Presentation do not constitute a public offer under any applicable legislation or an offer to sell or solicitation of any offer to buy any securities or financial instruments or any advice or recommendation with respect to such securities or other financial instruments. Information in this Presentation relating to the price at which investments have been bought or sold in the past, or the yield on such investments, cannot be relied upon as a guide to the future performance of such investments.

This Presentation contains forward-looking statements. Such forward-looking statements contain known and unknown risks, uncertainties and other important factors, which may cause actual results, performance or achievements of Madinet Masr (the "Company") to be materially different from any future results, performance or achievements expressed or implied by such forward-looking statements. Forward-looking statements are based on numerous assumptions regarding the Company's present and future business strategies and the environment in which the Company will operate in the future.

None of the future projections, expectations, estimates or prospects in this Presentation should be taken as forecasts or promises nor should they be taken as implying any indication, assurance or guarantee that the assumptions on which such future projections, expectations, estimates or prospects are based are accurate or exhaustive or, in the case of the assumptions, entirely covered in the Presentation. These forward-looking statements speak only as of the date they are made and, subject to compliance with applicable law and regulation, the Company expressly disclaims any obligation or undertaking to disseminate any updates or revisions to any forward-looking statements contained in the Presentation to reflect actual results, changes in assumptions or changes in factors affecting those statements.

The information and opinions contained in this Presentation are provided as of the date of the Presentation, are based on general information gathered at such date and are subject to changes without notice. The Company relies on information obtained from sources believed to be reliable but does not guarantee its accuracy or completeness. Subject to compliance with applicable law and regulation, neither the Company, nor any of its respective agents, employees or advisers intends or has any duty or obligation to provide the recipient with access to any additional information, to amend, update or revise this Presentation or any information contained in the Presentation.

Certain financial information contained in this presentation has been extracted from the Company's unaudited management accounts and financial statements. The areas in which management accounts might differ from International Financial Reporting Standards and/or U.S. generally accepted accounting principles could be significant and you should consult your own professional advisors and/or conduct your own due diligence for complete and detailed understanding of such differences and any implications they might have on the relevant financial information contained in this presentation. Some numerical figures included in this Presentation have been subject to rounding adjustments. Accordingly, numerical figures shown as totals in certain tables might not be an arithmetic aggregation of the figures that preceded them.

[1] Madinet Masr’s net debt/EBITDA ratio for Q1 2024 was calculated using an annualized EBITDA of EGP 1.6 billion.