PHOTO

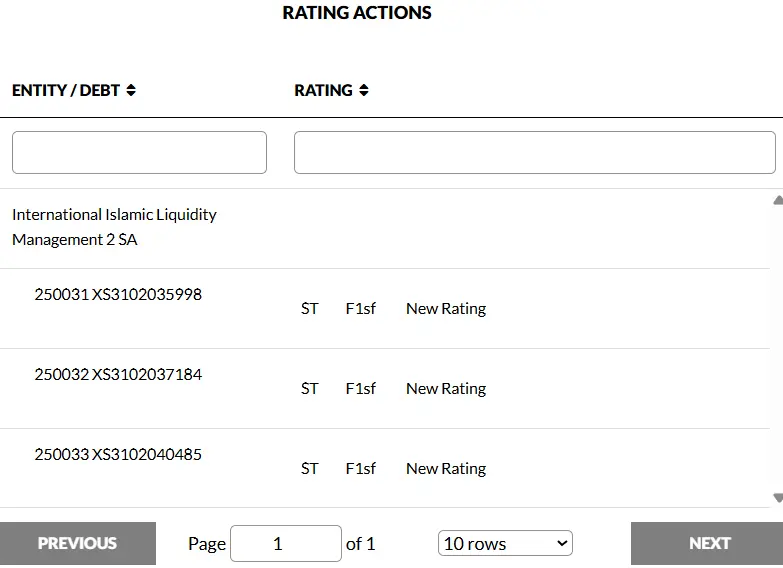

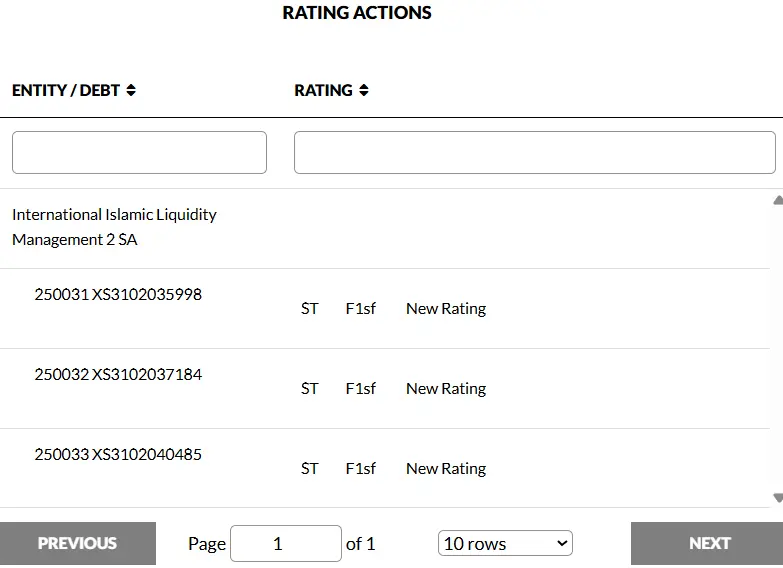

Fitch Ratings - Tokyo - Fitch Ratings has assigned ratings to the trust certificates issued by International Islamic Liquidity Management 2 SA's (IILM 2 SA) asset-backed commercial paper (ABCP) programme as follows:

- USD510 million Series 250031 certificates (XS3102035998): 'F1sf'

- USD290 million Series 250032 certificates (XS3102037184): 'F1sf'

- USD225 million Series 250033 certificates (XS3102040485): 'F1sf'

Transaction Summary

IILM 2 SA is a Luxembourg societe anonyme incorporated in 2013 to issue short-term US dollar-denominated trust certificates with maturities of up to 364 days. The programme size is USD6 billion and the outstanding certificates total USD5.70 billion.

KEY RATING DRIVERS

Credit Link to Assets: The underlying assets introduce credit risk to the programme, although they are required to meet eligibility criteria at purchase, including a minimum 'A' rating by Fitch. The programme is effectively exposed to five risk presenting entities (RPEs), while the current underlying asset pool incorporates 12 sukuk. Fitch's approach to the five RPEs in this transaction is based on the Asset-Backed Commercial Paper Rating Criteria, which stipulate the application of the weakest link approach for credit and liquidity support providers.

Liquidity Risk Mitigated by Structure: An early prepayment feature or external liquidity provider provides liquidity support to mitigate timing mismatches between principal collections on the assets and the repayment of the certificates. If collections from the assets are insufficient to pay transaction costs and target profit amounts of the certificates, we expect the issuer reserve account to cover any shortage.

Experienced Programme Administrator: International Islamic Liquidity Management Corporation (IILM) has served as the programme administrator and investment advisor since the programme's inception in 2013. We assess IILM's asset origination, programme management, operations, administration and credit-risk management capabilities as effective and supportive of the assigned ratings.

Robust Legal Structure and Transaction Documents: The issuer and the holding are public limited liability companies incorporated in Luxembourg. The programme is structured so both entities are isolated from the bankruptcy and insolvency risks of the entities involved in the programme.

RATING SENSITIVITIES

Factors that Could, Individually or Collectively, Lead to Negative Rating Action/Downgrade

The ratings on the certificates issued from the programme are sensitive to changes in the Long-Term Issuer Default Ratings (IDRs) of the RPEs.

Based on the applicable criteria, a one-notch downgrade of any RPE would not affect the ratings. A two-notch downgrade of the weakest link may result in a one-notch downgrade of the programme and certificates.

Factors that Could, Individually or Collectively, Lead to Positive Rating Action/Upgrade

A one-notch upgrade of the weakest link would not lead to an upgrade of the certificates as the asset eligibility criteria require at least an 'A' rating.

USE OF THIRD PARTY DUE DILIGENCE PURSUANT TO SEC RULE 17G -10

Form ABS Due Diligence-15E was not provided to, or reviewed by, Fitch in relation to this rating action.

DATA ADEQUACY

The majority of the underlying assets or RPEs have ratings or credit opinions from Fitch and/or other Nationally Recognized Statistical Rating Organizations and/or European Securities and Markets Authority registered rating agencies. Fitch has relied on the practices of the relevant groups within Fitch and/or other rating agencies to assess the asset portfolio information or information on the RPEs.

Overall, and together with any assumptions referred to above, Fitch's assessment of the information relied upon for the agency's rating analysis according to its applicable rating methodologies indicates that it is adequately reliable.

REFERENCES FOR SUBSTANTIALLY MATERIAL SOURCE CITED AS KEY DRIVER OF RATING

The principal sources of information used in the analysis are described in the Applicable Criteria.

REPRESENTATIONS, WARRANTIES AND ENFORCEMENT MECHANISMS

A description of the transaction's representations, warranties and enforcement mechanisms (RW&Es) that are disclosed in the offering document and which relate to the underlying asset pool was not prepared for this transaction. Offering Documents for this market sector typically do not include RW&Es that are available to investors and that relate to the asset pool underlying the trust. Therefore, Fitch credit reports for this market sector will not typically include descriptions of RW&Es. For further information, please see Fitch's Special Report titled 'Representations, Warranties and Enforcement Mechanisms in Global Structured Finance Transactions'.

ESG Considerations

Fitch does not provide ESG relevance scores for IILM 2 SA.

In cases where Fitch does not provide ESG relevance scores in connection with the credit rating of a transaction, programme, instrument or issuer, Fitch will disclose any ESG factor that is a key rating driver in the key rating drivers section of the relevant rating action commentary. For more information on Fitch's ESG Relevance Scores, visit https://www.fitchratings.com/topics/esg/products

Additional information is available on www.fitchratings.com

PARTICIPATION STATUS

The rated entity (and/or its agents) or, in the case of structured finance, one or more of the transaction parties participated in the rating process except that the following issuer(s), if any, did not participate in the rating process, or provide additional information, beyond the issuer’s available public disclosure.

APPLICABLE CRITERIA

- Asset-Backed Commercial Paper Rating Criteria (pub. 01 Mar 2022) (including rating assumption sensitivity)

- Structured Finance and Covered Bonds Counterparty Rating Criteria (pub. 29 Nov 2023)

- Structured Finance and Covered Bonds Counterparty Rating Criteria: Derivative Addendum (pub. 29 Nov 2023)

- Global Structured Finance Rating Criteria (pub. 19 Nov 2024) (including rating assumption sensitivity)

- Structured Finance and Covered Bonds Country Risk Rating Criteria (pub. 17 Jun 2025)

ADDITIONAL DISCLOSURES

- Dodd-Frank Rating Information Disclosure Form

- Solicitation Status

- Endorsement Policy

ENDORSEMENT STATUS

| International Islamic Liquidity Management 2 SA | EU Endorsed, UK Endorsed |

DISCLAIMER & DISCLOSURES

All Fitch Ratings (Fitch) credit ratings are subject to certain limitations and disclaimers. Please read these limitations and disclaimers by following this link: https://www.fitchratings.com/understandingcreditratings. In addition, the following https://www.fitchratings.com/rating-definitions-document details Fitch's rating definitions for each rating s

Read More

Solicitation Status

The ratings above were solicited and assigned or maintained by Fitch at the request of the rated entity/issuer or a related third party. Any exceptions follow below.

Endorsement Policy

Fitch’s international credit ratings produced outside the EU or the UK, as the case may be, are endorsed for use by regulated entities within the EU or the UK, respectively, for regulatory purposes, pursuant to the terms of the EU CRA Regulation or the UK Credit Rating Agencies (Amendment etc.) (EU Exit) Regulations 2019, as the case may be. Fitch’s approach to endorsement in the EU and the UK can be found on Fitch’s Regulatory Affairs page on Fitch’s website. The endorsement status of international credit ratings is provided within the entity summary page for each rated entity and in the transaction detail pages for structured finance transactions on the Fitch website. These disclosures are updated on a daily basis.