PHOTO

Emirates NBD’s profit surges 92% to AED 17.5 billion in the first nine months of 2023 on significant loan growth, a stable low-cost funding base, increased transaction volumes and substantial recoveries. Q3-23 profit exceeded AED 5 billion for the third consecutive quarter reflecting a buoyant regional economy. Emirates NBD’s market-leading deposit franchise grew AED 67 billion, including AED 33 billion of low-cost Current and Savings Accounts in 2023. Strong Retail lending momentum, coupled with landmark multinational-customer deals drove a healthy 8% loan growth. All business units delivered higher income. Emirates NBD is the Principal Banking Partner for COP28. The Group successfully launched its Sustainable Finance Framework and raised USD 750 million with the largest green bond ever issued by a regional bank, helping our customers align to UAE Vision 2030.

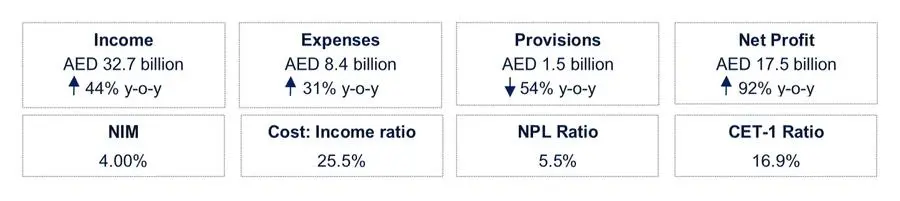

Key Highlights – 9M’23

- 92% increase in profit on significant loan growth, a stable low-cost funding base, increased transaction volumes and substantial recoveries

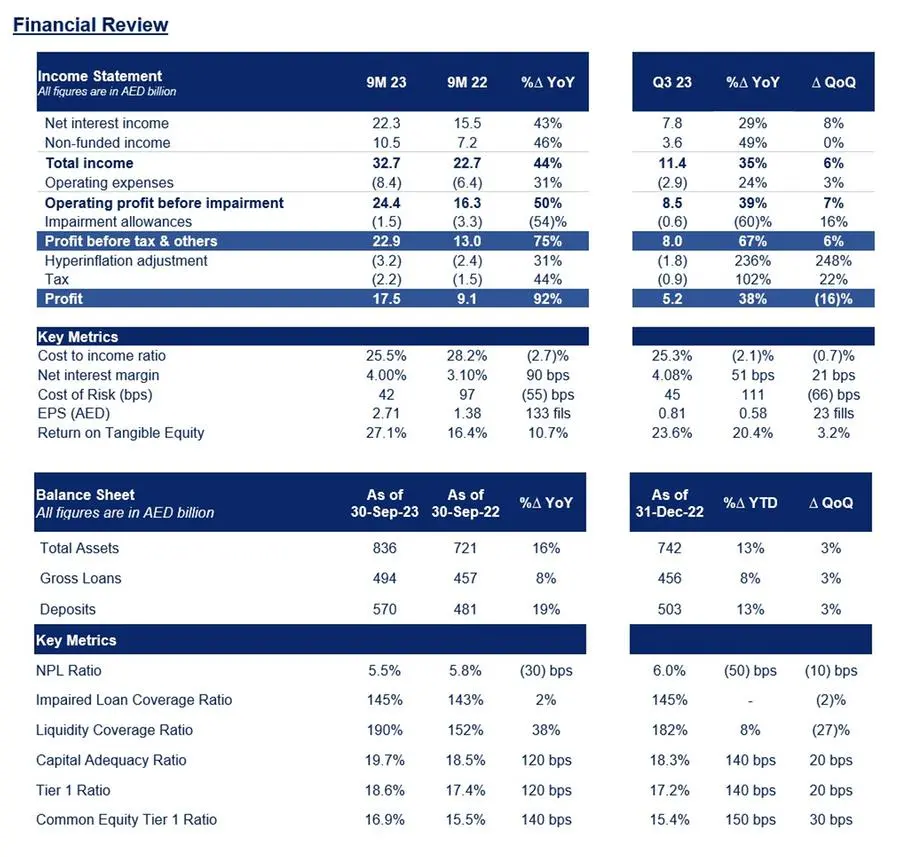

- Total income up 44% to AED 32.7 billion on excellent deposit mix, solid loan growth and strong fee & commission growth across all business segments

- Solid Loan growth, up an impressive 8% on strong Retail lending momentum with Corporate Banking closing landmark deals for large multinational customers

- Deposit mix is a key strength. Deposits grew AED 67 billion in 9M’23 including AED 33 billion of low-cost Current and Savings Accounts

- Net interest margin rose 90 basis points y-o-y to 4.00% on improved loan & deposit mix and higher interest rates

- Impairment allowances substantially down 54% y-o-y as credit quality improved, reflecting the Group’s prudent approach to credit provisions

- Balance Sheet grew 13% to AED 836 billion at Q3-23

- Earnings per share up significantly by 96% to 271 fils

- One of only three UAE banks to have an investment grade unsupported Fitch Viability Rating

- Emirates NBD’s investment in customer focused services & products is propelling business growth

- SME lending boosted 34% in UAE, supporting this bedrock sector of the economy

- One-third market share of UAE Credit Card spend as card spend grew 28 % y-o-y

- ‘ENBD X’ mobile banking app successfully rolled out, using latest technology, security and user experience trends propelling it to the #1 banking app in the region

- Digital wealth platform expanded giving customers access to more than 11,000 global and regional equities, elevating ENBD X as a one-stop solution for both everyday banking and wealth management

- Signature by Priority Banking introduced, offering ultra-high-net-worth customers unrivalled benefits, services and privileges

- AUMs grew by an impressive 28% in 2023, reflecting Emirates NBD’s full service platform

- Landmark corporate deals including AED 10 billion hybrid Credit Facilities and USD 3.5 billion revolving Credit Facility for large multinational customers

- ‘Emirates NBD Pay’, our Merchant Acquiring service, onboarded more than 20 clients, with over AED 3.5 billion transaction value since launch

- Innovation Fund makes exciting investment in Komgo to revolutionise its digital trade finance offering

- First Repo transaction executed with a KSA Asset Manager and first Islamic Repo with a UAE bank

- KSA loan growth up 26% y-o-y as both Corporate and Retail lending accelerating as branch network expands to 13

- Looking to the future as the UAE hosts COP28, Emirates NBD is delivering ESG solutions to customers as their Net Zero ambitions and sustainability goals drive economic activity

- Principal Banking Partner of COP28, marking Emirates NBD’s commitment to UAE’s Year of Sustainability

- ESG-Linked Supply Chain Finance Programme pioneered in collaboration with Emirates Global Aluminium

- Best Bank for ESG in the UAE at the Euromoney Excellence Awards 2023

- Sustainable Finance Framework published allowing green and sustainability-linked bond issuance

- USD 750 million green-bond issued, the largest ever from a regional bank

- Net Zero Goals commitment by signing UAE Climate-Responsible Companies Pledge

- Gender equality commitment by signing UAE Gender Balance Pledge

- Accelerator programme launched with Green FinTechs to boost sustainability-focused finance solutions

- Carbon Trading introduced as Emirates NBD becomes first UAE bank to offering carbon emission offsetting solution to customers

- Deniz Ventures makes Innovation Fund investment in sustainability start-up Erguvan

Hesham Abdulla Al Qassim, Vice Chairman and Managing Director said:

- Emirates NBD’s profit hit a record high of AED 17.5 billion for the first nine months of 2023, reflecting the Group’s increasing regional presence and leading digital capabilities.

- The buoyant economy, coupled with our focus on service excellence through new product and service delivery, is propelling growth.

- We expanded our branch network to 13 in the Kingdom of Saudi Arabia which is helping drive a 26% y-o-y increase in lending across Corporate and Retail banking.

- We boosted lending to Small and Medium Enterprises by 34% in the UAE, supporting this important sector and bedrock of the economy.

- We pledged our commitment to Net Zero 2050 and Gender Balance goals in the UAE and are proud to be the Principal Banking Partner of COP28.”

Shayne Nelson, Group Chief Executive Officer said:

- Emirates NBD’s profit surges 92% in the first nine months of 2023 on significant loan growth, a stable low-cost funding base, increased transaction volumes and substantial recoveries.

- We delivered an impressive 8% loan growth on strong Retail lending momentum coupled with the Corporate Bank closing landmark deals for large multinational customers.

- Our market-leading deposit franchise grew AED 67 billion including AED 33 billion of low-cost Current and Savings Accounts.

- We successfully rolled out the ‘ENBD X’ mobile banking app using latest technology, security and user experience trends, propelling it to the number one banking app in the region.

- We expanded our digital wealth platform, giving customers access to more than 11,000 global equities, and enhanced our Priority offering for ultra-high-net-worth customers, which helped drive 28% growth in Assets Under Management.”

Patrick Sullivan, Group Chief Financial Officer said:

- Quarterly profit exceeded AED 5 billion for the third consecutive quarter as all business units generated a substantial increase in income.

- The Group’s low-cost Current and Savings Account deposit base was stable in the third-quarter, enabling the Bank to benefit from higher interest rates.

- The Group’s strong capital base enabled the balance sheet to grow 13%, to AED 836 billion, in 2023.

- Emirates NBD’s strength is recognised by Fitch, being one of only three UAE banks to have an investment grade unsupported Viability Rating.

- The Group successfully launched its Sustainable Finance Framework and raised USD 750 million with the largest green bond ever issued by a regional bank, helping our customers align to UAE Vision 2030.”

Rounding differences may appear throughout the document

Business Performance

- Retail Banking and Wealth Management (RBWM) continued its excellent performance with its highest ever nine-month revenue, strongest ever acquisition, and substantial growth in balance sheet.

- Lending increased 16% by AED 15 billion and Deposits grew by AED 29 billion in first nine months of 2023 with a strong CASA to Deposits ratio of 78%

- One-third market share of UAE Credit Card spend as card spend grew 28% y-o-y

- Income grew 36% on the back of record volumes, improved margins and highest ever non-funded income

- ‘ENBD X’ mobile banking app successfully rolled out, using latest technology, security and user experience trends, propelling it to the #1 banking app in the region

- Signature by Priority Banking launched offering ultra-high-net-worth customers unrivalled benefits, services and privileges

- AUMs grew by an impressive 28% in 2023 on the back of the Digital wealth platform expansion, reflecting Emirates NBD’s full-service platform giving customers access to over 11,000 global equities

- Corporate and Institutional Banking strengthened its strategic partnership with major Government entities and Corporates by enhancing digitized service platforms

- Profitability jumped 104% due to significant growth in revenue on increased lending activity, higher cross-sell across products and strong recoveries

- Corporate lending (ex. Sovereign) up 15% on strong origination throughout region in Manufacturing, Trade, Transport, Communication and conglomerates

- Landmark corporate deals including AED 10 billion hybrid Credit Facilities and USD 3.5 billion revolving Credit Facility closed for large multinational customers

- ‘Emirates NBD Pay’, our Merchant Acquiring service, onboarded more than 20 clients, with over AED 3.5 billion transaction value since launch

- ESG-Linked Supply Chain Finance Programme launched in collaboration with Emirates Global Aluminium

- Global Markets and Treasury delivered an outstanding performance, generating almost AED 3 billion in income in the first nine months of 2023.

- Income grew by 186% driven by favourable Balance Sheet positioning coupled with a significant increase in banking book investment income

- The trading desk reported robust numbers with Foreign Exchange trading posting 89% growth

- Sales delivered strong growth, driven by Foreign Exchange and Structured products

- Group Funding issued a USD 750 million green bond, the largest ever from a regional bank

- DenizBank profit up 63% to AED 1.9 billion helped by higher income and strong recoveries

Outlook

GCC economies have been resilient against a weaker global backdrop and higher interest rates. PMI surveys indicate robust activity in non-oil sectors in the first half of 2023 across the region. Emirates NBD Research revised up their forecast for UAE non-oil GDP growth to 5.0% this year, from 3.5% previously, with their forecast for UAE growth in 2023 adjusted to 2.9% on the expectation of a contraction in hydrocarbon GDP. The UAE’s national energy strategy expects up to AED 200 billion of investment as it triples the contribution of renewable energy by 2030. Other economic sectors such as tourism are flourishing with Dubai tourist numbers recovering to pre-pandemic levels. In the wider MENAT region, Egypt continues to explore asset sales reflecting their commitment to revamp the economy and Türkiye increased interest rates to help address inflation.

Awards:

- Emirates NBD won Best Bank in the Middle East, Best Bank in the UAE and Best Bank for ESG in the UAE at the Euromoney Excellence Awards 2023

- Emirates NBD won Best Bank in the Middle East by Euromoney’s Real Estate Awards 2023

- Emirates NBD won Middle East's Best Private Bank for Digital and Best Domestic Private Bank in the UAE by Euromoney Global Private Banking Awards 2023

- Emirates NBD won Innovation in Digital Banking Awards in the Middle East Category by The Banker

- Emirates NBD won Best Private Bank Digital Solutions for Clients in the Middle East and UAE by Global Finance World’s Best Private Banks Awards 2023

- Emirates NBD KSA won Best Foreign Bank in KSA by International Finance Awards, Most Innovative Retail Bank – Saudi Arabia 2022 by Global Economics Awards and Best Green Building Initiative – Banking KSA 2022 by the International Finance Awards

- Emirates NBD Capital secured 16 prestigious awards at the Bonds, Loans and Sukuk Awards 2023

- Emirates NBD was named the UAE’s most valuable banking brand and MENA’s third most valuable banking brand, with a value of USD 3.89 billion, in The Banker’s 2023 brand valuation

- Emirates NBD won Grand Prix in Glass: The Award for Change for Emirati Women’s Day Campaign at the Dubai Lynx Awards 2023

- Emirates Islamic won Best Islamic Real Estate Deal at the Euromoney Islamic Finance Awards 2023

- Emirates Islamic won Most Innovative Islamic Bank in the UAE and Best Islamic SME Bank in the UAE at the International Finance Awards 2023

Emirates NBD has a leading retail banking franchise, with 853 branches and 4,213 ATMs / SDMs in the UAE and overseas. It is a major player in the UAE corporate and retail banking arena, and has strong Islamic banking, investment banking, private banking, asset management, global markets & treasury and brokerage operations. The bank has operations in the UAE, Egypt, India, Türkiye, the Kingdom of Saudi Arabia, Singapore, the United Kingdom, Austria, Germany, Bahrain, Russia and representative offices in China and Indonesia. For more information, please visit: www.emiratesnbd.com

For more information:

| Ibrahim Sowaidan | Patrick Clerkin |

This document has been prepared by Emirates NBD Bank PJSC (ENBD) for information purposes only. The information, statements and opinions contained in this document do not constitute a public offer under any applicable legislation or an offer to sell or solicitation of an offer to buy any securities or financial instruments or any advice or recommendation with respect to such securities or other financial instruments. This document is not intended for distribution in any jurisdiction in which such distribution would be contrary to local law or reputation. The material contained in this press release is intended to be general background information on ENBD and its activities and does not purport to be complete. It may include information derived from publicly available sources that have not been independently verified. No representation or warranty is made as to the accuracy, completeness or reliability of the information. It is not intended that this document be relied upon as advice to investors or potential investors, who should consider seeking independent professional advice depending on their specific investment objectives, financial situation or particular needs. In the event that the press release contains any pro forma financial information on ENBD, that information has been prepared for illustrative purposes only, may address a hypothetical situation and may not give a true picture of the financial performance of the ENBD group. Furthermore, any pro forma financial information may only be meaningful where read in conjunction with the historical audited consolidated financial statements of ENBD. Unless expressly disclosed to the contrary, any pro forma financial information has been compiled based on the accounting policies of the group as disclosed in its most recent consolidated financial statements. This document may contain certain forward-looking statements with respect to certain of ENBD’s plans and its current goals and expectations relating to future financial conditions, performance and results. These statements relate to ENBD’s current view with respect to future events and are subject to change, certain risks, uncertainties and assumptions which are, in many instances, beyond ENBD’s control and have been made based upon management’s expectations and beliefs concerning future developments and their potential effect upon ENBD. By their nature, these forward-looking statements involve risk and uncertainty because they relate to future events and circumstances which are beyond ENBD’s control, including, among others, the UAE domestic and global economic and business conditions, market related risks such as fluctuations in interest rates and exchange rates, the policies and actions of regulatory and Governmental authorities, the impact of competition, the timing impact and other uncertainties of future acquisition or combinations within relevant industries. As a result, ENBD’s actual future condition, performance and results may differ materially from the plans, goals and expectations set out in ENBD’s forward-looking statements and persons reading this document should not place reliance on forward-looking statements. Such forward-looking statements are made only as at the date on which such statements are made and ENBD does not undertake to update forward-looking statements contained in this document or any other forward-looking statement it may make.