PHOTO

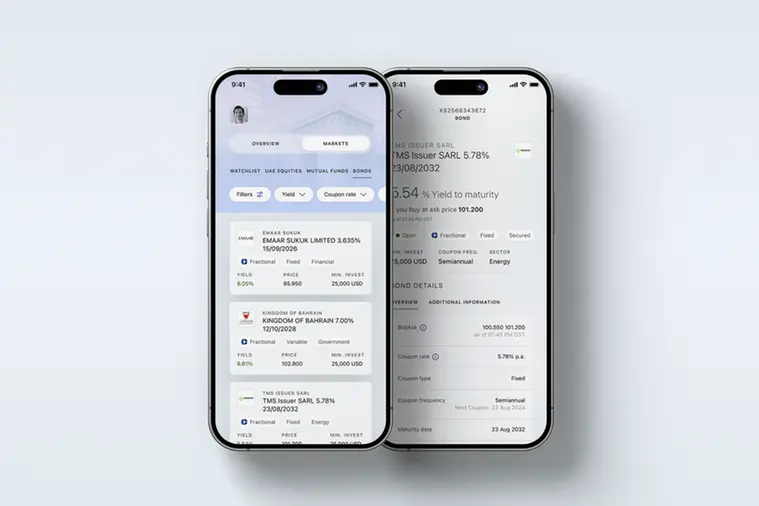

- Minimum investment of just USD 25,000 through a completely digital journey on ENBD X

- ENBD X Mobile platform enhanced with one-of-a-kind wealth offering

Dubai, UAE: Emirates NBD, a leading banking group in the MENAT (Middle East, North Africa and Türkiye) region, has announced the launch of fractional bonds on its awards winning mobile banking app ENBD X. The announcement was made by the bank at the Dubai Fintech Summit, held at Madinat Jumeirah on 6-7 May 2024.

In 2023, Emirates NBD became one of the first financial institutions in the region to provide fractional bonds to individual investors. It will now be extending this offering on its digital wealth platform on ENBD X, which has 96% bank active users.

The international bond market typically demands a minimum investment of USD 200,000. With fractional bonds offered on ENBD X, customers will be able to invest smaller amounts of USD 25,000 and still enjoy the benefits of fixed-income products.

Fractional bonds offer customers several advantages, including diversification opportunities, enabling customers to spread their risk across different bond issuers, sectors, and maturity periods and thereby enhance the stability and resilience of their investment portfolios. They allow customers to create customised bond portfolios that match their investment goals, allowing customers to select bonds based on their risk tolerance, desired yields, credit ratings, and other criteria. Moreover, fractional bond investors can easily liquidate their bond investments and access funds when needed.

The fractional bonds offering on ENBD X app will allow customers to search available bonds by yield, coupon rate, coupon frequency, maturity type, bond rank and bond category, and other advanced criteria. Furthermore, prices will be continuously updated in real-time and, on completion of the transaction, customers will be informed instantly through a push notification on ENBD X. Afterwards, customers will be able to monitor their bond portfolio in real-time, including the accrued interest amount and the next coupon payment.

Marwan Hadi, Group Head of Retail Banking and Wealth Management at Emirates NBD said: "As a front-runner in digital banking innovation in the MENAT region, we are committed to enhancing our customers’ banking experience by continuously introducing groundbreaking next-generation digital products and services. The upcoming addition of fractional bonds on ENBD X’s digital wealth platform exemplifies this commitment by combining our business and technology expertise into a distinctive and scalable solution.”

Ammar Al Haj, Group Treasurer and Head of Global Markets at, Emirates NBD, said: “Catering to the evolving needs of our customers, Emirates NBD's introduction of fractional bonds on the ENBD X’s digital wealth platform marks a pivotal moment in our journey towards increasing access to financial markets. Technology and innovation are the cornerstone at Emirates NBD, and with the new offering we empower investors to participate in the international bond market with as little as USD 25,000, unlocking new avenues for wealth creation and portfolio diversification.”

-Ends-

About Emirates NBD

Emirates NBD (DFM: Emirates NBD) is a leading banking group in the MENAT (Middle East, North Africa and Türkiye) region with a presence in 13 countries, serving over 9 million active customers. As at 31st March 2024, total assets were AED 902 billion, (equivalent to approx. USD 246 billion). The Group has operations in the UAE, Egypt, India, Türkiye, the Kingdom of Saudi Arabia, Singapore, the United Kingdom, Austria, Germany, Russia and Bahrain and representative offices in China and Indonesia with a total of 858 branches and 4,450 ATMs / SDMs. Emirates NBD is the leading financial services brand in the UAE with a Brand value of USD 3.89 billion.

Emirates NBD Group serves its customers (individuals, businesses, governments, and institutions) and helps them realise their financial objectives through a range of banking products and services including retail banking, corporate and institutional banking, Islamic banking, investment banking, private banking, asset management, global markets and treasury, and brokerage operations. The Group is a key participant in the global digital banking industry with 97% of all financial transactions and requests conducted outside of its branches. The Group also operates Liv, the lifestyle digital bank by Emirates NBD, with close to half a million users, it continues to be the fastest-growing bank in the region.

Emirates NBD contributes to the construction of a sustainable future as an active participant and supporter of the UAE’s main development and sustainability initiatives, including financial wellness and the inclusion of people of determination. Emirates NBD is committed to supporting the UAE’s Year of Sustainability as Principal Banking Partner of COP28 and an early supporter to the Dubai Can sustainability initiative, a city-wide initiative aimed to reduce use of single-use plastic bottled water.

For further information on Emirates NBD, please contact:

Ibrahim Sowaidan

Senior Vice President

Head - Group Corporate Affairs

Emirates NBD

e-mail: ibrahims@emiratesnbd.com

asda’a bcw

Dubai, UAE

Email: emiratesnbd@bm.com