PHOTO

Dubai-based investment firm VyCapital and Qatar Holding, a subsidiary of the Gulf state’s sovereign wealth fund, among others, have committed to contribute to Elon Musk's buyout of Twitter.

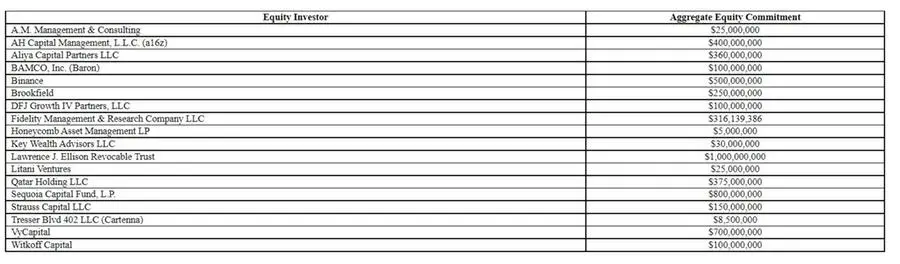

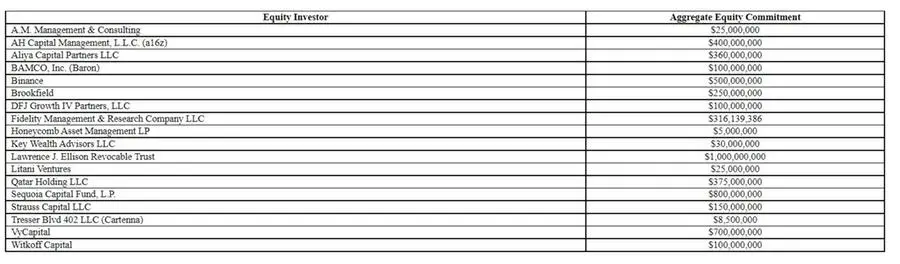

According to a filing on the US Securities and Exchange Commission, the Qatar Investment Authority's subsidiary is contributing $375 million and VyCapital, which specialises in internet related investments, has pledged $700 million to Musk's $44 billion takeover bid.

On Thursday, Musk brought in 18 new investors including Binance, the world's largest cryptocurrency platform; venture capital firm Sequoia; and Oracle CEO Larry Ellison to contribute $7.14 billion to his Twitter deal. Musk is expected to secure the rest of the amount via loans or to dip into his own pocket.

Saudi Arabian investor Prince Alwaleed bin Talal, who was against the buyout, also agreed to roll his $1.89 billion stake into the deal. Among the 18 investors listed by Musk, VyCapital is ranked the third biggest after Oracle's Ellison, who has contributed $1 billion, and Sequoia Capital, which is providing $800 million, according to the SEC filing.

While the new funds are expected to give investors more confidence that the deal will now close, the billionaire Tesla CEO will have to pay a $1 billion breakup fee if his financing efforts fails.

(Reporting by Seban Scaria; editing by Daniel Luiz)