PHOTO

Younger consumers are driving changes in global markets with their distinct preferences and habits.

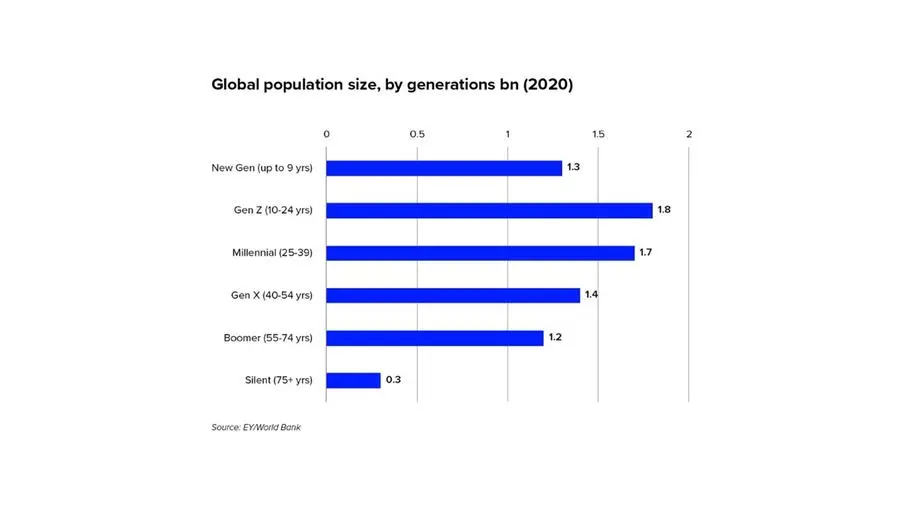

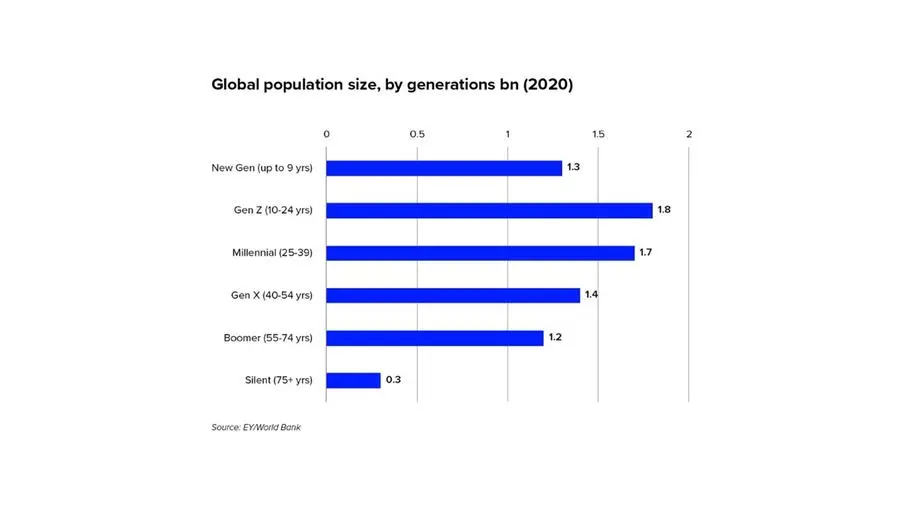

In 2020, 40% of the world’s population was under 25, and 62% of the global population was under 40. The implication is clear: despite a large ageing population, a significant number of the world’s population are youthful and as they continue to enter the workforce and come of age, their consumer preferences and spending habits will increasingly dictate the future of the global economy.

Consequently, it is vital for stakeholders (e.g., governments) and industry players to be cognisant of these generational shifts, understand their preferences and habits, and adapt accordingly.

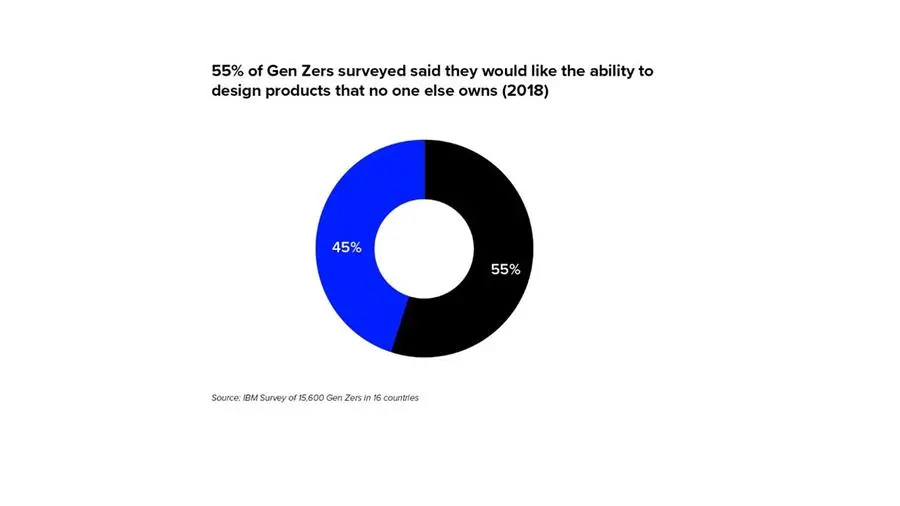

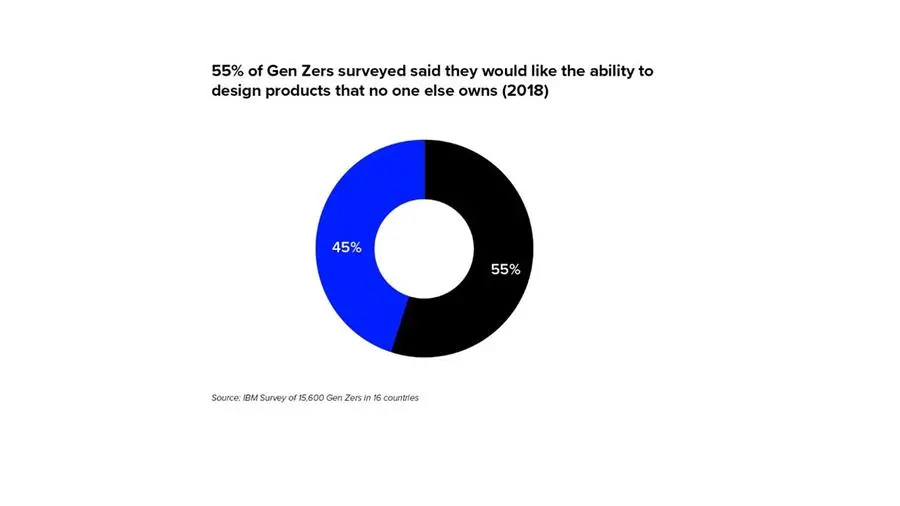

Gen Z (born after 1996) are noticeably different from other generations. Industry research, such as surveys focused on Gen Z respondents, has shown that Gen Z are perhaps more entrepreneurial, less trusting, and more focused on different values (work-life balance, wellbeing) than previous generations.

According to research by IBM, Gen Z also have distinct consumer preferences and habits that manifest in the following ways: an expectation that retailers get the basics right, technology should be an enabler, and a preference for personalised shopping experiences.

OIC markets are particularly youthful

OIC markets are particularly youthful. According to OIC estimates, member states collectively account for 27% of the global youth population, and by 2050 this proportion will increase to 35%. Additionally, in 2017, two-thirds of Muslims globally were under 30 (Ogilvy Noor), and in the US for instance, 42% of Muslims are under 30, making Muslims the youngest major religious community nationally.

Although not much research exists on Gen Z Muslims, new publications such as ‘Muslim’ are starting to provide online spaces for this demographic to come together and communicate.

Moreover, there is a growing body of insights on the next most youthful group in the OIC, Muslim Millennials (‘Gen M’). Market analysis of Gen M suggests they are entrepreneurial, modern, and yet also place emphasis on combining their faith values with modernity, for example, as indicated by the rise and continued projected growth of the modest fashion sector in the global Islamic economy.

To address the challenges facing Muslim youth, the OIC has come up with a ‘youth strategy’ with 11 key priorities earmarked.

Islamic fintech can enable ambitions

In recent years, Islamic fintech has risen to become one of the key, albeit still nascent, segments of Islamic finance. The Islamic fintech market size (by transaction volume) was $49 billion in 2020, and this is projected to grow to $128 billion by 2025 at an annual growth rate (CAGR) of 21%, compared to 15% for conventional fintech.

Core markets remain in MENA and Southeast Asia, as indicated by Islamic fintech market sizes in 2020 and where most Islamic fintechs are based. However, non-OIC countries that have substantial and active Muslim presence, such as the UK, USA and Canada, are growing in importance for global Islamic fintech by providing innovative use cases.

The Islamic fintech market is blossoming, with 241 Islamic fintechs currently. One of the key drivers of this growth is that younger Muslims, in line with global youth, are drawn to app-based solutions for their various financial lifecycle needs, from savings and investments to financing and charitable giving.

For more insights and key findings, read the report.

(Reporting by Tayyab Ahmed; editing by Seban Scaria)