PHOTO

Non-oil private sector businesses in Saudi Arabia recorded strong growth in January, with confidence among the firms rising to a two-year high, according to a business survey.

Confidence among non-oil businesses is high due to strong inflows of new orders, high capacity, rising activity and softening cost pressures. However, job creation slowed from December’s near five-year high as firms continue to reduce their backlogs.

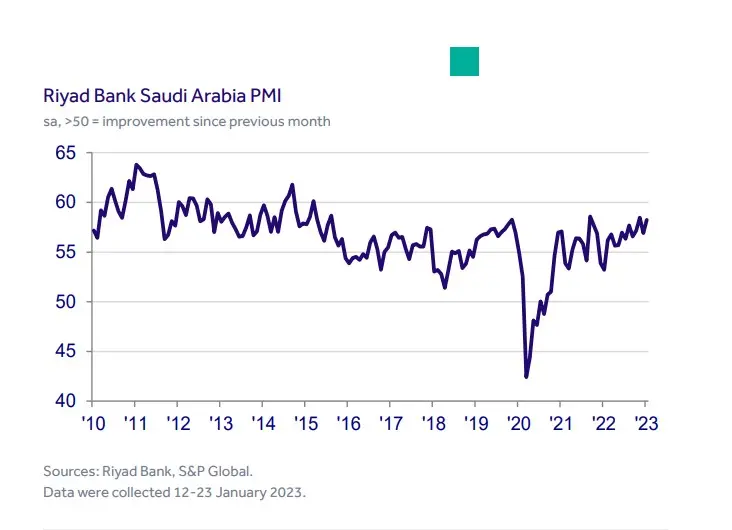

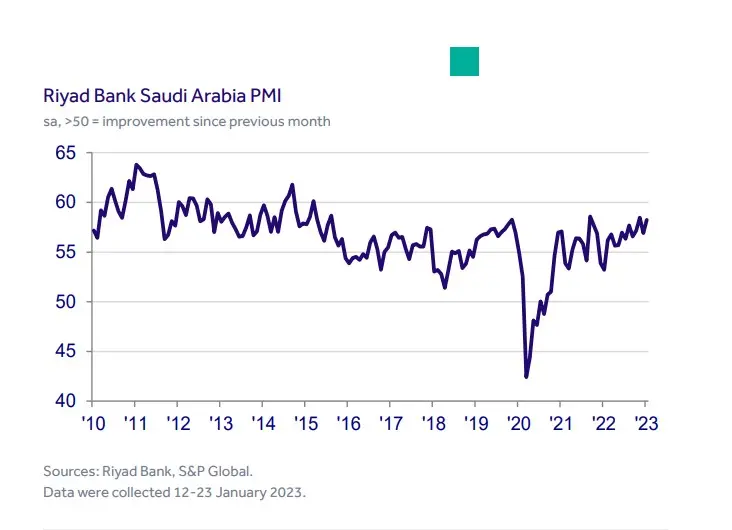

Riyad Bank Saudi Arabia Purchasing Managers’ Index rose from 56.9 in December to 58.2 in January, recording the second highest reading since September 2021.

The leading oil producer in the world has been looking tackle inflation by using oil windfall to pace up economic diversification projects in the kingdom. According to the PMI survey data, inflationary pressures on both costs and charges softened from December.

“Saudi Arabia is continuing its strong performance and outperformed the global economic trends for activity and demand. This growth confirms the Saudi position as the fastest-growing economy among the Group of 20 countries despite economic headwinds," Naif Al-Ghaith PhD, Chief Economist at Riyad Bank, said.

The kingdom's non-oil economy grew an annual 6.2% during Q4 2022, the highest level since Q3 2021, according to estimates from the General Authority for Statistics.

Businesses gave a stronger projection for activity levels in the upcoming year. The degree of positivity picked up to the highest level since January 2021. ". This was driven by the ongoing improvement in the business environment, private-sector employment, and increased foreign investment with governance and labour market reform," Al-Ghaith said.

Subdued cost pressures and softening purchase price inflation witnessed in January could have a positive impact in reducing inflation going forward.

"Inflation is expected to soften in the upcoming months with the reduction in input cost pressures and the continued improvements in supply chains. We have started to see weaker increases in output prices corresponding with input costs, Al-Ghaith said.

"The rise in output prices was the softest in nearly a year, despite the growth in new orders which remained marked in January,” he added.

(Writing by Seban Scaria seban.scaria@lseg.com; editing by Daniel Luiz)