PHOTO

The International Monetary Fund (IMF) is likely to forecast negative growth rates in the global economy than previously estimated for 2020 and sees "profound uncertainty" about the path of recovery, IMF chief economist Gita Gopinath said in a new blog. She also highlighted that a striking divergence of financial markets from real economy may lead to potentially sharp corrections.

The IMF is due to update its World Economic Outlook on June 24. Managing Director Kristalina Georgieva last month said the IMF was "very likely" to revise downward its already pessimistic forecast for a 3 percent contraction in global gross domestic output in 2020, but gave no details.

Global cases of the virus reached over 8 million on Monday, with infections surging in Latin America, while the United States and China are grappling with fresh outbreaks.

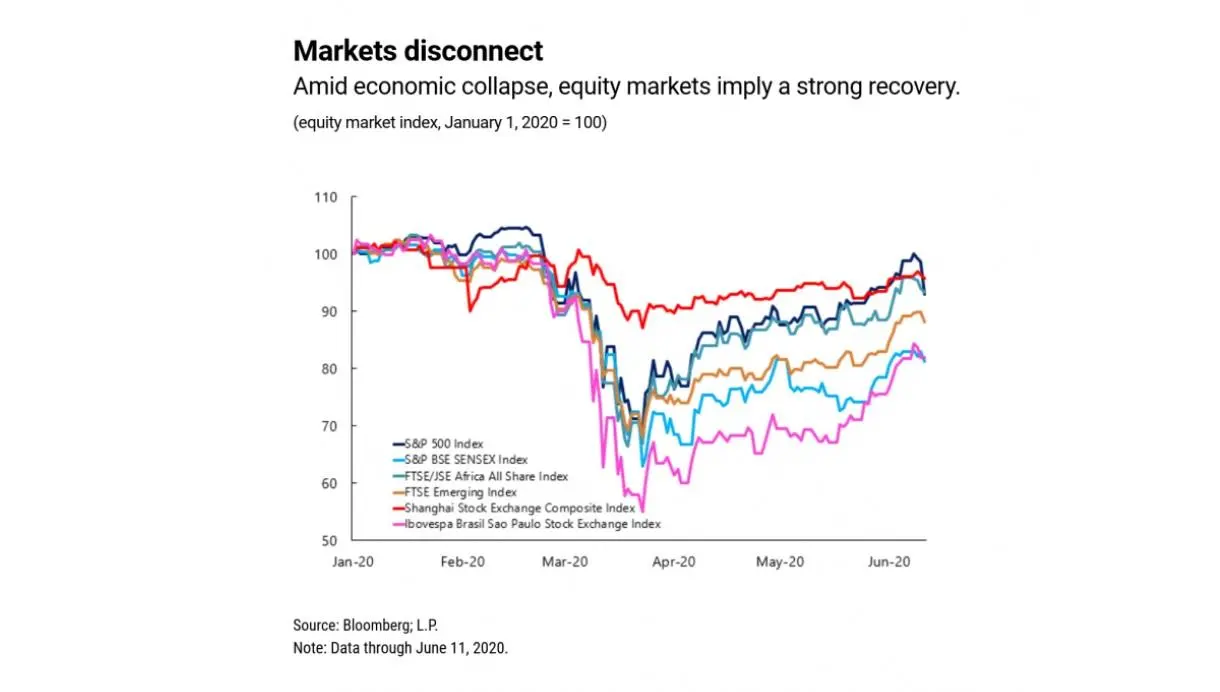

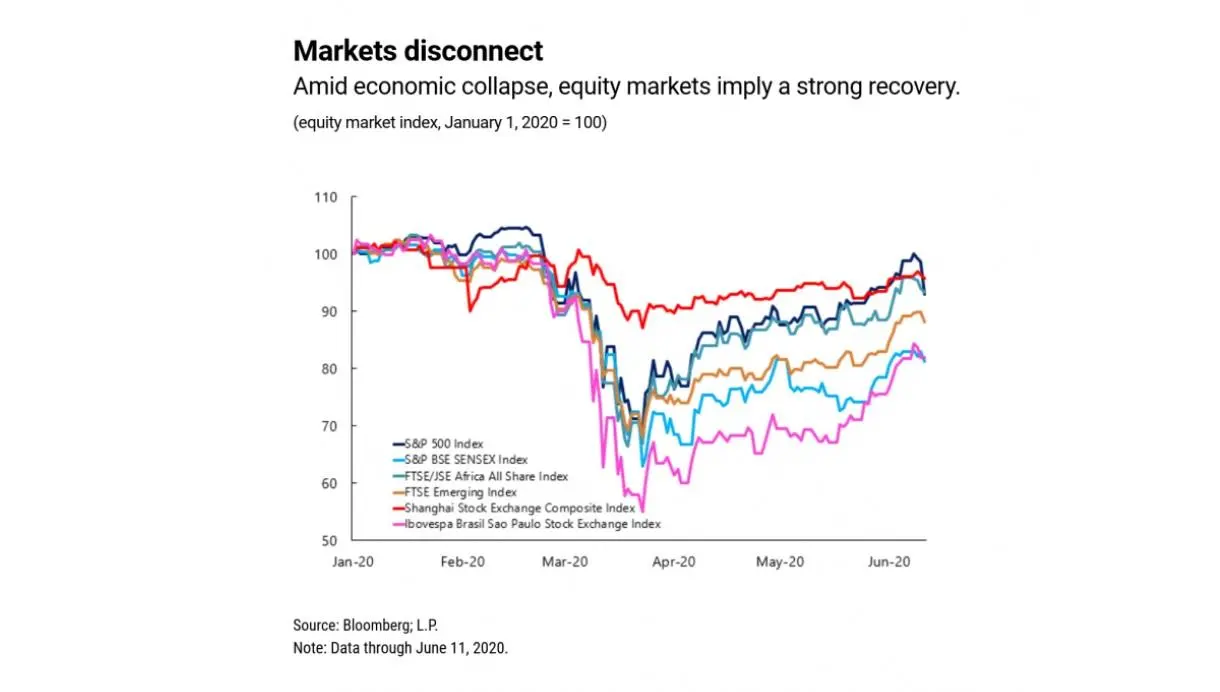

Gopinath noted a striking divergence of financial markets from the real economy, which could portend greater volatility in financial markets and potentially sharp corrections.

Click image to enlarge

Despite the recent correction, the S&P 500 has recouped most of its losses since the start of the crisis; the FTSE emerging market index and Africa index are substantially improved; the Bovespa rose significantly despite the recent surge in infection rates in Brazil; and portfolio flows to emerging and developing economies have stabilized.

Gopinath said there were signs of early recovery in many countries that were reopening their economies, but new waves of infections and reimposed lockdown measures still posed risks.

The economic crisis triggered by COVID-19 is more global and playing out differently than past crises. Unusual characteristics are emerging all over the world, irrespective of the size, geographic region, or production structure of economies with the services sector hit harder than manufacturing in both advanced and emerging market economies, and inflation low across the board, Gopinath said.

It is possible that with pent-up consumer demand there will be a quicker rebound, unlike after previous crises. However, this is not guaranteed in a health crisis as consumers may change spending behavior to minimize social interaction, and uncertainty can lead households to save more, she said in her blog.

MIXED SIGNALS

There is a decline in inflation and inflation expectations in developed and emerging market economies despite the large supply shocks unique to this crisis. Though inflation has drifted down, food inflation has increased, IMF noted.

"Despite the considerable conventional and unconventional monetary and fiscal support across the globe, aggregate demand remains subdued and is weighing on inflation, alongside lower commodity prices. With high unemployment projected to stay for a while, countries with monetary policy credibility will likely see small risks of spiraling inflation," Gopinath said.

“Pent-up consumer demand could fuel a quicker rebound in hard-hit services, but this was not guaranteed since consumers might change spending behavior to minimize social interaction, and uncertainty could trigger higher savings rates,” she added.

In China, one of the early exiters from lockdown, the recovery of the services sector was lagging, with the hospitality and travel sectors struggling to regain demand.

She said the longer-term impact on tourism-dependent economies was a particular concern, and governments should pursue policies to reallocate workers from shrinking sectors to those with stronger prospects.

(Reporting by Seban Scaria, editing by Daniel Luiz)

#IMF #ECONOMY #GLOBAL

Disclaimer: This article is provided for informational purposes only. The content does not provide tax, legal or investment advice or opinion regarding the suitability, value or profitability of any particular security, portfolio or investment strategy. Read our full disclaimer policy here.

© ZAWYA 2020