PHOTO

Qatar - Qatar Insurance Group has posted a net profit of QR205mn for the first quarter of 2025, up from QR194mn in Q1, 2024.

The results were approved during the Board of Directors meeting presided over by QIC Group Chairman Sheikh Hamad bin Faisal bin Thani Jassim al-Thani here Tuesday.

Sheikh Hamad stated, “QIC’s Q1, 2025 results continue to reflect our consistent and stable bottom line focused growth with net profits of QR205mn at a 6% overall growth. While our direct Mena gross written premiums continued to grow at 17% quarter-on-quarter, our disciplined risk selection and exit from low‑margin international portfolios have strengthened our capital base and underpinned selective growth.

“As market conditions normalise, we are fully committed to accelerating our digital transformation and expanding customer-centric innovations to sustain our leadership position across the region.”

Sheikh Hamad added: “Strategic investments in automation and data-driven decision-making have enhanced our operational efficiency and turnaround times. With the launch of our ESG framework and the establishment of our Sustainability Committee, we are embedding environmental and social responsibility into every aspect of our business.

“In 2025, we are focused on deepening market penetration, advancing digital leadership, and upholding the highest standards of governance. As part of our regional growth strategy, we are moving forward with plans to enter the Saudi market—subject to regulatory approvals—marking a significant step in expanding our footprint across the GCC.”

Group Chief Executive Officer Salem Khalaf al-Mannai said, “Q1, 2025 results are once again the testament of QIC Group’s successful execution of its set strategy to build up a well-diversified and balanced risk portfolio focused in short tail risks, which will deliver consistent and stable bottom-line driven growth. Operational excellence remains at the core of our strategy.

“In Q1, 2025, we delivered insurance service results of QR76mn, net investment and other income of QR229mn and consolidated net profit of QR205mn. The consolidated net profit attributable to shareholders of the parent stood at QR201mn. These results demonstrate robust momentum across our core business lines.”

While the global and regional markets were highly volatile and challenging, QIC Group has delivered a net profit of QR215mn with a 11% growth in bottom line for the period (before the impact of Pillar II, which is effective from 2025).

“As the global insurance rates continue to soften and decline, we continue to maintain our growth momentum and our Gross written premium growth as per plan, generated through our direct regional operations and international operations through Antares Lloyds Syndicate, London.”

Al-Mannai stated: “Our relentless focus on process optimisation and automation is yielding tangible gains in cost efficiency and service speed. Enhancements to the QIC App, including seamless car rentals, repair services, car wash bookings, and real-time vehicle valuations, further cement our reputation as Qatar’s most innovative insurer. Supported by a strong capital position and a Board-approved ESG framework, we are driving consistent, profitable growth while delivering exceptional customer experiences.”

The regional gross written premiums increased to QR1.7bn in Q1, 2025 up 17% quarter on quarter – and now account for more than half (59%), of the group’s total premiums, compared to less than 20% in 2021.

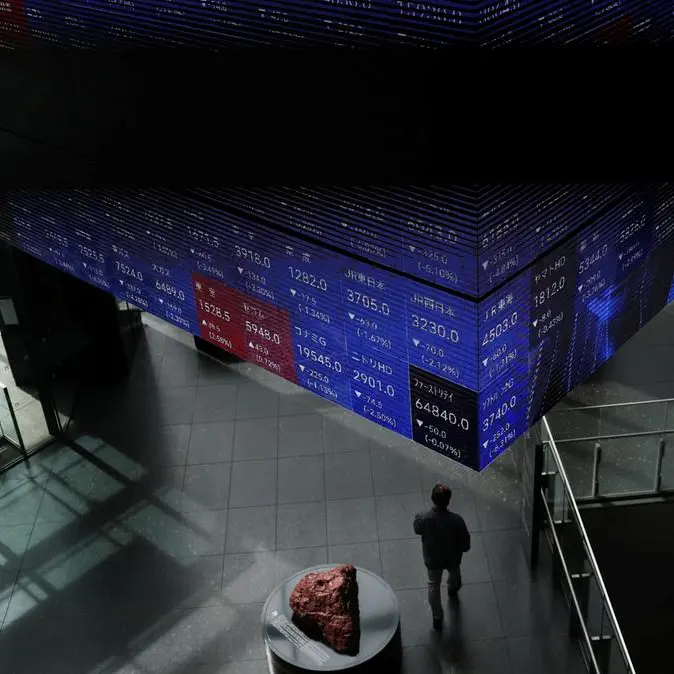

While there is currently a great deal of uncertainty and confusion surrounding tariffs and trade tensions amongst leading global economies that has impacted the global financial markets like a storm cloud, QIC continued to report stable investment and other income of QR229mn for Q1, 2025, compared to QR245mn for the same period in 2024. The return on investment came in at 5%, compared to 5.3% last year.

QIC Group maintained a stable, well-diversified investment portfolio, aligned with its long-term strategic asset allocation.

© Gulf Times Newspaper 2022 Provided by SyndiGate Media Inc. (Syndigate.info).

Doha