PHOTO

HSBC is quitting M&A advisory and equity capital market activities in the UK, the rest of Europe and the Americas in a major retrenchment for its investment bank as CEO Georges Elhedery continues to streamline operations and cut costs.

Bankers said while news of the retreat came as a shock inside and outside the bank, it has been years coming. HSBC is a leading debt capital markets and loans house and will continue with a global footprint there, but attempts to become a global player in M&A and ECM for the last 22 years have always fallen short.

The exit is part of a full review of its investment banking business to focus on areas of strength. "We will retain more focused M&A and equity capital markets capabilities in Asia and the Middle East and will begin to wind down our M&A and equity capital market activities in the UK, Europe and the US,” a spokesperson said.

HSBC intends to shift to "a more competitive, scalable, financing-led model", according to a memo to staff from Michael Roberts, CEO of corporate and institutional banking. The memo said investment banking will continue financing capabilities across DCM and leveraged acquisition finance, complemented by corporate risk solutions and strategic equity and financing.

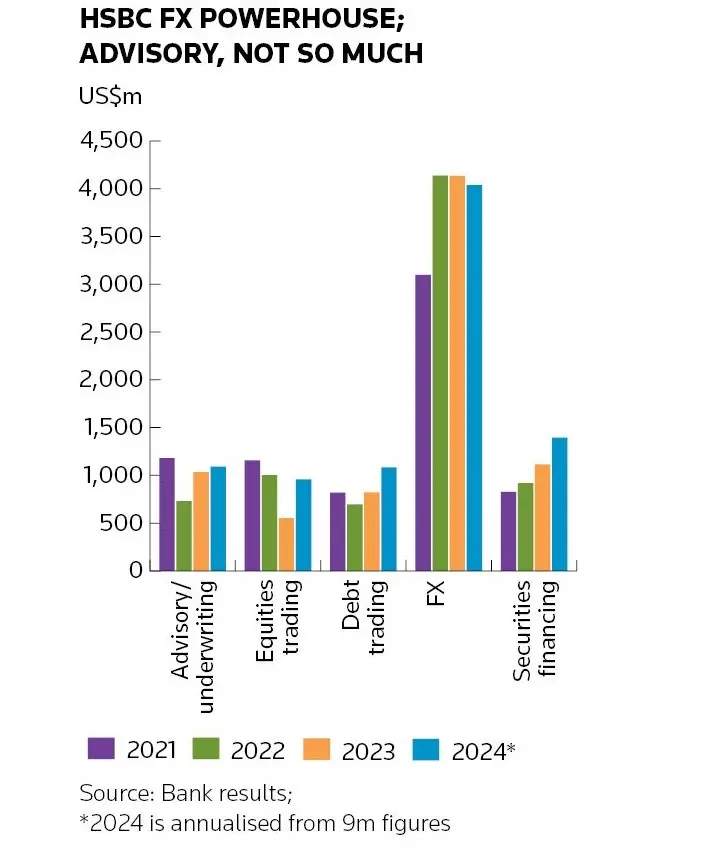

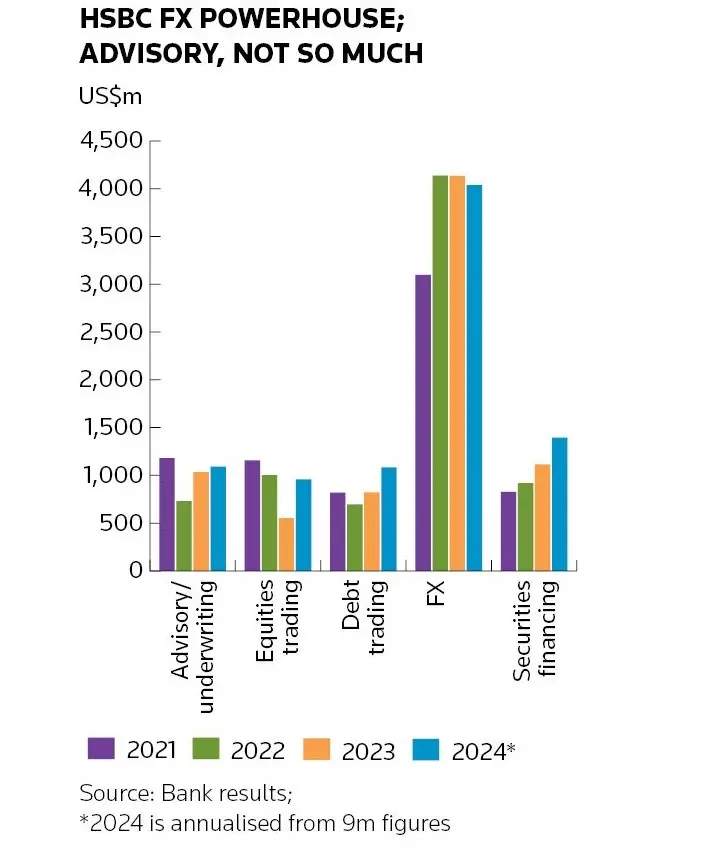

Andrew Coombs, an analyst at Citigroup, estimated that European and US ECM and M&A revenues were only about 1.2% of HSBC's global banking and markets revenue and just 0.3% of group revenues, and they were probably loss-making.

"It has never managed to crack those businesses ... Elhedery probably realised it was a battle it wasn't going to win," a former HSBC staffer said. He said as the bank has cut costs and withdrawn from more countries, the argument for a full M&A and ECM platform had lost its appeal as its global reach and scale diminished.

The changes are likely to result in scores of staff going, but much will depend on how much the pullback from M&A and ECM will affect other areas, such as UK corporate broking, industry coverage, research and sales, bankers said. Another former HSBC banker estimated it could result in about 100 people leaving. HSBC declined to comment on job cuts or the impact on other products.

UK corporate broking looks exposed as being "house broker" involves advising on strategy and raising debt and equity, so M&A and ECM are two of the crucial parts of where a bank makes its money. As of November, HSBC was corporate broker to 20 of the biggest 350 publicly listed firms in the UK, including six in the FTSE 100, according to Adviser Rankings. Corporate broking is a competitive field, and rivals are already likely to be circling those clients.

Structured equity financing is not directly affected, however. The group that covers equity-linked, corporate equity derivatives, margin loans and structured buybacks, is not part of ECM – though it is at many other banks. It hadn't relied on ECM for dealflow – SEF has outpaced cash ECM in Europe and the US of late – and was more closely aligned with corporate and lending relationships and the use of balance sheet.

Try and try again...

HSBC's retreat comes despite a pickup in M&A and IPO activity at the end of 2024 that is expected to continue in 2025. Still, many saw it as an inevitable end to HSBC's attempt to become a leading advisory firm.

It has tried and failed several times, hoping it could turn its many corporate and lending relationships into advisory and ECM mandates. Morgan Stanley M&A dealmaker John Studzinski was hired in 2003, but after an expensive hiring spree he left three years later after internal opposition and limited reward; Matthew Westerman was a high profile hire from Goldman Sachs in February 2016 in an effort to sit HSBC at the big boys' table, but he was out after 21 months.

Both ran into internal opposition and cultural issues – in particular the differences between how HSBC operates compared to big Wall Street firms and the fact that it can still be bogged down by bureaucracy.

Insiders are aware of that, and in 2018 a group of disgruntled senior HSBC executives are said to have been behind a scathing seven-page memo about the failing investment bank strategy and leadership, notably in advisory and underwriting.

Greg Guyett, who started running investment banking in early 2019 after 29 years at JP Morgan, was a more collegiate leader, but failed to turn the tide of underperformance. Guyett took on a newly created role in October as chair for strategic clients in a leadership shakeup by Elhedery.

Elhedery was previously co-head of global banking and markets but he was always on the markets side where HSBC's investment bank makes most of its revenues. Advisory and underwriting revenues in the first nine months of 2024 were US$819m, representing 6% of GBM revenues. That was dwarfed by FX, debt and equities trading, which pulled in US$4.56bn, plus another US$1.05bn from securities financing.

HSBC ranked 14th for global investment banking last year with fees of US$1.78bn, a familiar spot after hovering between 11th and 16th in each of the previous five years, according to LSEG data. It ranked 11th for global DCM fees but was 18th for ECM and 37th for M&A fees.

It was only 28th in the lucrative Americas region last year and wasn't in the top 20 in any of the previous five years, LSEG data show. In Europe, excluding the UK, it was 11th last year. Its strongest region is the Middle East, Africa and Central Asia where it ranked second with fees of US$116m. It also outperformed in the UK where it ranked fourth with fees of US$293m after hovering between fifth and 10th in the previous five years.

"Realistic and pragmatic"

Roberts told staff the bank will share more details on the investment banking review in the coming weeks. But for M&A and ECM the message has gone out so clients planning deals in the coming months are unlikely to ask HSBC to hang around, one of the former bankers said.

Elhedery is reported to be looking to cut US$3bn of costs, equivalent to 10% of the cost base, at the same time as continuing a shift to Asia and the Middle East.

“HSBC's move reflects a realistic and pragmatic doubling down of their bet on Asia and MENA capital flows. They aren't really abandoning a position of great strength in Europe and the US by contrast to their dominance in other markets,” said Alex Marshall, managing partner at consultancy CIL.

Elhedery took over as CEO in September and has made sweeping changes to strategy, structure and leadership, including creating the new corporate and institutional banking business with the aim of drawing the investment bank closer to its commercial bank. Adam Bagshaw was appointed global head of investment banking in December.

Source: IFR