PHOTO

With attention often focused on the fast growing economies in the rest of the region, Mena Fund Manager looks at the investment environment for Algeria, Morocco and Tunisia

Much of the attention on North Africa has centred on the resurgence of post-revolution Egypt. As one of the largest and more sophisticated markets in the Mena region it is understandable. Yet, the other countries in the region - Algeria, Morocco and Tunisia - all have their own drivers of growth and financial services sectors.

Indeed, the economies of Morocco and Tunisia are set to grow at similar rates of growth to Egypt during the coming years, according to data from the IMF, while Algeria may lag behind slightly.

North African countries have been overlooked more recently. The Arab Spring started with a protest over corruption in Tunisia in late 2010, before spreading throughout the wider region.

While some normality has returned to the region there remain a number of unresolved issues. Notably Libya, with the largest oil reserves on the continent, has failed to return to stability with several groups claiming authority.

However, some believe the northern part of Africa can deliver attractive opportunities for those willing to invest in the region.

"We see North Africa as a really interesting and emerging consumer story, you've got much higher levels of GDP per capita, generally have more sophisticated and deeper industrial base compared with sub-Saharan Africa," says Andrew Brown, managing director and CIO of pan-African investment firm Emerging Capital Partners (ECP).

"Growth rates have been a little bit more volatile in recent years because of the political issues but the underlying dynamics of population growth and reasonable levels of GDP growth could throw up some very interesting investment opportunities."

Each of the three North African countries has very different market environments and asset management industries, but where might fund managers see opportunities arise in the coming years?

Algeria

With the second largest economy in North Africa after Egypt, Algeria is one of the hardest markets in the region for fund managers to access. The resource rich North African country has the tenth largest proven oil reserves among OPEC members at around 12.2 billion barrels, contributing to a large part of its economy.

However, the lower oil price environment is set to have a stark effect on the country's economy with growth slowing from 4.1% in 2014 to 2.6% in 2015, according to the IMF's World Economic Outlook in April. Although the economy is set to return to more robust growth in 2016, it is largely contingent on the oil prices returning to more sustainable levels.

With a number of restrictions on foreigners investing into the economy, Algeria has seen foreign direct investment in to the country slide in recent years, and slumped to $1.5bn in 2014 which UNCTAD - the UN body overseeing trade and investment - attributed to an 87% fall in greenfield investment.

Algeria remains a difficult market for many to invest in. Algeria's stock exchange consists of a handful of firms, while fixed income opportunities are also less common than other markets. Lacking a stock market and with few other investable securities, much of the foreign investment in the region is through partnerships with local firms. Investors from outside of Algeria are limited to a 49% stake in local companies

"Algeria's economy has a very tiny stock exchange and not anywhere one might invest directly," Paul Clark, portfolio manager at Ashburton Investments. "The difficulty that companies have in investing in Algeria is the administrative nature of the economy or the civil service-like rulemaking and changing that happens.

"It's very difficult to do things in that sense, you have constantly moving goalposts and requirements." ECP's Brown says while it can be difficult for private equity businesses to exit from investments, good investments will always attract interested investors.

"If you've invested in a business that is strategically interesting to someone and is a good business you will always be able to find a buyer," he says.

"That's one of the key things we focus in on, somewhere like Algeria there are some specific challenges where the strategic investors even if you have something interesting they can't actually acquire control of that because the business has to be 51% Algerian-owned.

"There are some constraints you need to factor in when you're making an investment. But what we've seen is even though you will only be able to sell a 49% stake to a foreign investor that's still strategically interesting enough for people who want to target the growth in the Algerian market, it's not an absolute block on being able to exit."

With an almost non-existent asset management sector, there remain few products for investment, although there is a notable pension fund industry, with assets of $4.8bn according to PricewaterhouseCoopers (PwC).

"If you look at Algeria, one of the main challenges for any business is that there are so few products you can invest in, which is why you get such high real estate prices because all of the liquidity in the market is struggling to find places to be invested," Brown explains. "There's a huge amount of potential that can be unlocked if solutions can be found for that."

Morocco

Of the three countries Morocco has one of the most sophisticated financial services industries, encompassing a thriving asset management sector with an estimated $33.1bn held in collective investment schemes, according to PwC.

Morocco has been keen to be viewed as the financial hub of North Africa. Indeed, UNCTAD noted that foreign direct investment (FDI) had risen by 8.6% during 2014, increasing to $3.6bn.

"Morocco has grown as a services hub in the sub-region, through its efforts to position itself as a gateway to the continent," noted UNCTAD. "The array of incentives offered by Casablanca's 'Finance City' have helped attract major MNEs [multi-national enterprises] such as BNP Paribas, AIG, Boston Consulting Group, Microsoft and Ford to move their regional headquarters there."

The country's government has also made strides towards introducing more Islamic finance structures to the market, having recently approved legislation enabling private firms to issue sukuk and the establishment of Islamic banks.

As well as a growing reputation as a hub for financial and professional services, PwC estimates that pension funds have an estimated $30.0bn in AuM with the majority invested in government bonds.

"The interesting thing about Morocco is that it has a very well-established pension fund industry; one of the better established pension industries on the continent for a long time now," says Clark. "Until recently the funds weren't allowed to invest globally and had to invest mainly in the domestic market."

The size of the pension fund industry and rules that only allowed investment in the domestic securities was part of the reason for the country's downgrade from emerging market status. Morocco was reclassified as a frontier market first by MSCI in 2013 and then by Standard & Poor's Dow Jones Indices in 2014 with liquidity concerns raised as a contributing factor.

"Despite the fact there were very good companies listed in Morocco, they seemed to be quite expensive," says Clark. "Even when it was part of the emerging markets index, you'd find very few emerging market managers had much exposure to Morocco, mainly due to valuation reasons."

Tunisia

Tunisia was the first Arab Spring country to emerge into democracy and last year saw former prime minister Beji Caid Essebsi returned as president in the first free elections since the country gained independence in 1956.

While economic growth stalled following the onset of the Arab Spring and the overthrow of Zine El Abidine Ben Ali, the IMF has forecast economic growth of 3.0% this year before rising to 5.0% in 2018, growing at a fast rate than next-door neighbour Algeria.

"Tunisia from our perspective is a very small economy but a very well developed economy," says Ashburtons Clark. "It's suffered from a three-year, very slow, but ultimately good Arab Spring turnaround.

"The economy needs to recover from that three-year hiatus of not having any strategic policy directives. I'm very positive about the economy, but there are risks posed by insurgents. That's going to be one of the problems Tunisia is going to have to deal with."

Yet, the country has suffered from some of the same challenges as its neighbours. June's attack at the tourist resort of Souse is likely to have a negative impact on the country's reputation and a direct impact on its tourism sector, one of its key economic components.

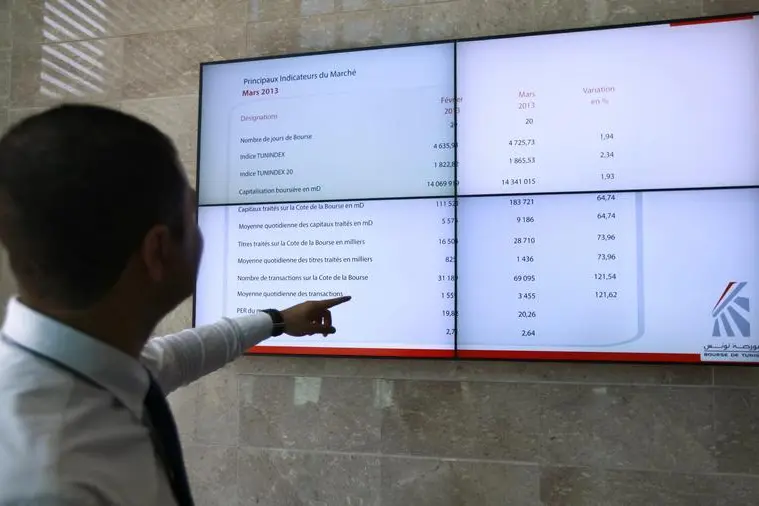

Tunisia's fund market is active with a number of players in the market. The asset management sector boasts total AuM of $4.9bn, reports PwC, although it has yet to recover to a pre-revolution high of $5.2bn, while large local funds are more likely to invest outside of the country.

Overview

While there are a number of opportunities for fund managers in these markets there are a number of factors to consider. With many instead preferring to invest in the bigger and more sophisticated Egyptian market.

"From an African mindset Tunisia and Morocco have generally been underweighted by Africa fund managers, whereas at the moment people are much more overweight Egypt," says Ashburton's Clark.

"We've seen a lot of companies come to market in Egypt and certainly looking at the banking system across North Africa it is reasonably liquid," says Clark. "Interest rates might be a bit high and that can be a bit prohibitive for companies to borrow.

"There is always capital available in equity markets but if you ask companies they would say that listing requirements are quite strict. That can be a double-edged sword," he adds.

"On the one hand if you want stock exchanges to be a means for companies to raise risk capital [but] you want to make sure companies that list don't borrow and make the requirements quite strict."

Clark says more distressed prices may also have deterred new companies from coming to market. Yet, a reluctance to list is being seen across the Mena region currently. Just two companies - both Egyptian - IPOed during the first quarter of 2015, according to consultancy EY. Just one from Morocco is expected to list during the next three years, oil & gas company Marsa Maroc.

Liquidity remains an issue for Mena fund managers wanting to access the North African economies.

"What we have in North Africa is liquidity issues. Smaller markets are a bit different compared with Saudi, Dubai and Egypt," says Charlemagne Capital's Akhilesh Baveja. "I would be worried about liquidity and being able to find better companies in the GCC [than in Tunisia or Morocco]."

Performance, too, will be of concern for investors seeking a return. While economies may be forecast to expand in the coming years, markets have stalled somewhat. According to S&P Dow Jones Indices, last year the Tunisian market was down by -6.7%, while Morocco recorded an anaemic gain of 0.4%. So far this year, Tunisia is the stronger of the two with a 4.8% gain, although trailing the stronger GCC economies, it remains ahead of loss-making Egypt. Elsewhere, Morocco has lost -3.3% during the first half of the year.

"Equity markets in North Africa have made a disappointing start to the year," London-based economics consultancy wrote earlier this year. "But we expect them to rebound soon as governments plough ahead with economic reforms and economic growth strengthens."

Furthermore the barriers to entry for fund managers wanting to access the Algerian market may deter many potential investors from making investments in the country. There are positive signs for the region, however.

"When we we're thinking about country risk is specific to the business in that market rather than saying 'this is risky, let's not do anything'," says ECP's Brown.

"We don't tend to think about individual countries, particularly when you look at somewhere like Tunisia and Algeria. A lot of the investments that we're looking at is where there are Tunisian companies that tend to be more sophisticated and have a higher calibre of management but are stuck in a small market. How can we partner with those or use that expertise to open up the much larger Algerian market.

He adds: "If you look at Morocco, there's a lot of time and effort at a government level looking to foster investment links into francophone West Africa, partly because Morocco's relationship with Algeria makes it much harder for them to follow the same kind of strategy we're seeing between Tunisia and Algeria.

"It's really those regional linkages we're looking to exploit and we're we see the opportunities because when you can build those regional businesses you suddenly find you've got an addressable market of 50-100 million people that's how you create something that's interesting for a strategic investor"

But it may take some time for the message to spread to investors in the region.

"We've seen a little bit of investment from the market to invest in funds but it's coming off a low base," says Brown." We've seen more investment into our funds from the rest of Africa, but that is an emerging trend. Investors in the local market will move to find ways to put money to work."

© MENA Fund Manager 2015