PHOTO

11 October 2015

Low oil prices and economic uncertainty have weighed heavily on GCC markets.

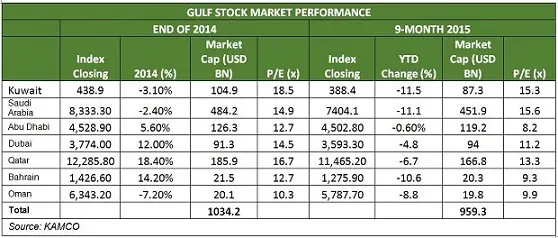

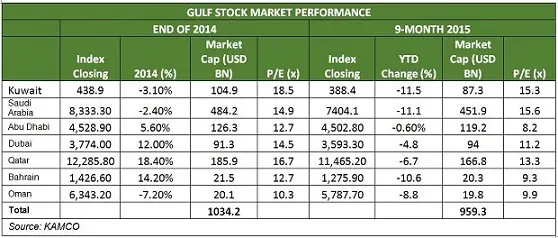

Gulf equity markets had been motoring along in the first half of the year, defying wider emerging market weakness, but low oil prices and global economic uncertainty over the last three months have wiped out the gains.

GCC markets lost USD 159 million in market capitalisation in the third quarter, after gaining USD 69 million in the first six months of the year, according to data from Global Investment House.

"GCC markets closed largely in negative territory due to oil price volatility, concerns over China's economic growth, and uncertainty over the timing of the U.S. Fed's interest rate hike," Global Investment House said.

The Kuwaiti Stock Exchange was the worst performing, falling 12.4% by the end of September. Dubai Financial Market was down nearly 5% for the year after rising as much as 8% in the first half of the year.

The Saudi Tadawul index shed 11.2% in the first nine months, even though it was up 9% by the end of June. Tadawul's overvaluation ahead of the opening of the Saudi market to direct foreign invest earlier this year also created a bubble which burst when investors booked profits and exited the index.