PHOTO

The construction industry is headed towards a modular future, wherein a significant portion of the work would be done offsite, according to Narish Nathan, Chief Executive Officer (CEO) of Eversendai Offshore.

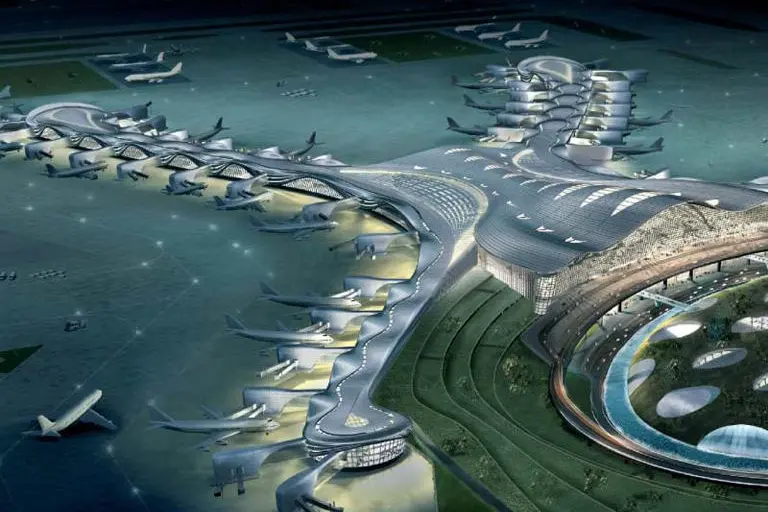

The oil and gas contractor is a subsidiary of the Malaysia Stock Exchange-listed-Eversendai Corporation, which is known for its steel structures and civil construction, delivering high-rise buildings, power plants, oil and gas plants and infrastructure all over the world. The group has been involved in building iconic projects such as the Burj Khalifa in Dubai, Petronas Tower 2 in Malaysia, Khalifa Olympic Stadium in Qatar, Kingdom Centre in Saudi Arabia and Republic Plaza in Singapore.

Last month, Eversendai Offshore and Korea’s Hyundai Engineering & Construction (Hyundai E&C) signed a global strategic partnership deal to carry out modular construction work for the energy and construction industries.

Commenting on the rationale behind the partnership, Nathan pointed out that the company has participated with Hyundai E&C in many projects in Malaysia, Singapore, Qatar, Saudi, the UAE and Kuwait.

“With this MoU, both companies have come forward and agreed that there is a future in modular construction. We are formalising this relationship so that we can collaborate, secure and execute projects together across the globe and ship from the UAE,” he told Zawya Projects.

Nathan said the partnership would identify key projects where they can add value to the client and would proceed to bid based on a modular approach.

“It could be a combination of modular and stick-built approach or a complete plug and play model but we [will] decide right from the beginning and proceed on that basis,” he said.

He gave the example of a recent modular project that his company had executed with Hyundai for a refinery in Kuwait [Al-Zour refinery for Kuwait Integrated Petroleum Industries Company], involving “a completely engineered, built and fitted out” seven-storied Offshore Support Building on an EPCC [Engineering, Procurement, Construction and Commissioning] basis.

“This model allows us to minimise risk because everything is being built in a controlled environment in our fabrication yard and is managed effectively in one single location. We bring in all the subcontractors into our fabrication yard, whether it is electrical or other disciplines and execute the entire project in our yard. That is the approach we are trying to do with Hyundai,” he explained.

Fit for modular

However, the Eversendai official also cautioned that “not all projects can be modularised and not all elements can be modularised,” since cost and time savings associated with modularisation is project-specific. He also underlined that in the Middle East, barring the oil and gas sector, modular construction is a nascent concept.

“In developed countries like Malaysia, Singapore, Europe...we have something called the IBS...Industrialised Building System… where you do a lot of things offsite and have less people on site. For example, in a congested city like London, it is a widely practised industry norm to have steel buildings fabricated offsite and delivered just in time for the buildings to be built.”

The modular model, Nathan continued, is more prevalent in the region’s oil and gas, and offshore sectors, where deploying workers in the sea poses a major challenge. Depending on the project, he said cost-savings of up to 20 percent are possible since fewer people need to be deployed under the difficult conditions.

He also pointed out that the time saved would depend on how much of the project is modularised. “We have seen in the past where complete projects have been modularised, …it was decided by the client that there was no way we could do a stick-built approach given the time and schedule. It was better to modularise everything from the factory and do a plug-and-play. It is very subjective, but definitely, there will be time savings,” he said.

Made in UAE for the world

Nathan said the majority of Eversendai Offshore's investments are in the UAE. “We have invested in three fabrication facilities in the UAE. We have a fairly new fabrication yard spread over 200,000 square metres (sqm) with half a kilometre of exclusive jetty access in RAK Maritime City, Ras Al Khaimah, where we can fabricate and construct large structures and ship directly from the jetty. We have already executed projects for Hyundai E&C from this facility.”

Eversendai Offshore’s other facilities in the Middle East include a 211,168 sqm facility at Hamriyah Free Zone, Sharjah; a 12,000 sqm facility at Al Qusais Industrial Area, Dubai and a 39,479 sqm facility in Industrial Area, Doha.

Last year, the Ras Al Khaimah yard started executing three wind energy contracts for Europe marking the company’s diversification into the European offshore wind sector.

Nathan elaborated: “We do not need to have a physical presence in Europe as the entire project is being fabricated and built in the Ras Al Khaimah yard and will be shipped to Europe. Our yard can fabricate large structures for the offshore wind segment, whether it is offshore wind substation topside platform or jacket structures. We see a lot of potential in the European offshore wind market and are planning to increase our presence in this sector by building and exporting from here [the UAE].”

Eversendai has also bagged a building construction project in Morroco in the last quarter, its first in North Africa, from a repeat long-term client.

COVID-19 impact

Commenting on the impact of COVID-19, Nathan said it was business as usual in the Middle East, since the region didn’t go in for a complete lockdown but cautioned that tough times lay ahead.

“All our projects are running, and all our fabrication units are operating in full swing, but we did face some supply chains disruptions,” he said.

“When we secure a project, we procure majority of the steel upfront, so that we have adequate raw material to fabricate. The only issue is with consumables [that] we need for day-to-day requirements. There we see a bit of delay here and there. We are trying to increase our inventory so that we don’t have many day-to-day disruptions”.

Though the global economic outlook, in the short-term, has shifted downwards, the company’s diversified business would help it weather the challenges, noted Nathan.

He continued: “It is going to be an uphill situation for the next few quarters for sure. I believe, and what we also hear from the markets is that it may take up to the third quarter of 2021 for the business sentiment to improve. Our business model of not depending on a single market or client will definitely help us to ride through the storm.”

He said the company’s current order book of approximately 2.3 billion Malaysian Ringgit ($530 million) is its highest ever and provides visibility till late 2021.

“As a group, we see about 55-60 percent of the revenues coming from the Middle East. But going forward there may be situations where certain projects that we are chasing could be awarded later. As of now, we do not see any signs of delays, but we are anticipating it,” he concluded.

(Reporting by Sowmya Sundar; Editing by Anoop Menon)

#EVERSENDAI #MODULAR #OFFSITE #RASALKHAIMAH #OFFSHORE #OILANDGAS #WINDENERGY

Disclaimer: This article is provided for informational purposes only. The content does not provide tax, legal or investment advice or opinion regarding the suitability, value or profitability of any particular security, portfolio or investment strategy. Read our full disclaimer policy here.

© ZAWYA 2020