PHOTO

UAE accounted for largest share with 33% of total deals by MENA companies in SSA South Africa constituted the main target for acquisitions by MENA companies Total cross-border M&A deals between MENA and SSA totals $24 billion in 10 years DUBAI, UNITED ARAB EMIRATES: 1 November 2016 – Total trade of goods between Middle East and North Africa (MENA) and Sub-Saharan Africa (SSA) reached peak levels during recent years, having progressed at a pronounced pace. According to a report released by Thomson Reuters at the Thomson Reuters Africa Trading Summit, this trend has further entrenched the complementarity between the production and trading ecosystems of both regions and sets the floor for steady potential ahead.

During the past ten years, selected countries have been the key drivers behind the development of trade between SSA and MENA. Geographies such as UAE, Saudi Arabia, South Africa, Kenya, Nigeria and Ethiopia account for the lion’s share of the flow of goods between both directions.

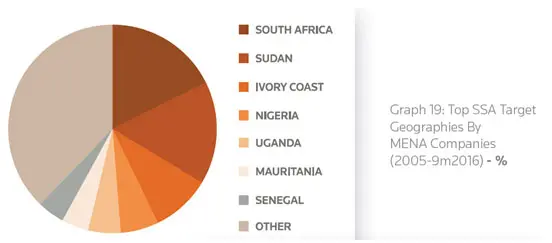

According to data gathered from Thomson Reuters Eikon, a small number of MENA countries have been key drivers behind the increased acquisitions activity in SSA. During the period 2005-9m2016, South Africa constituted the main target geography for acquisitions by MENA companies with 21 deals or a share of 18% of the total, followed by Sudan 19 deals, Ivory Coast 11 deals and Nigeria 7 deals. In terms of acquiring countries, UAE accounted for the largest share with 33% of total deals by MENA companies in SSA, followed by Morocco 24% and Egypt 12%.

Nadim Najjar, Managing Director, MENA, Thomson Reuters, said: “MENA and SSA have substantially evolved during the past decade, driven by strong economic development, superior demographics and mutual agreements that laid foundations for a larger potential ahead. Such trend is bolstering, over the long-term, the inter-regional economic ties where goods & capital are mutually serving the strategic interests of both regions. Within this context, business synergies are materializing under the form of companies expanding cross-border through their product offerings and though merger & acquisition strategies.”

“As MENA and SSA further their long-term sustainable economic development, businesses in both regions are tackling hefty investment opportunities in a large number of geographies and niche sectors. Add to this, governments are aggressively reforming in order to promote business-friendly environments and attract local and foreign capital,” Najjar added.

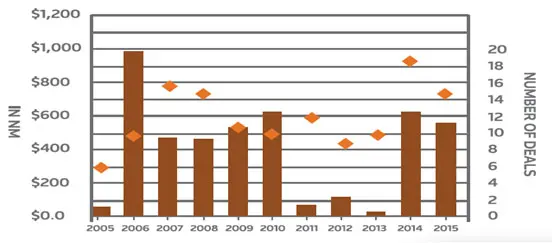

Deal activity has been on the rise during recent years between MENA and SSA regions, indicating increased business synergies between the operating corporates. Based on data gathered from Thomson Reuters Eikon, total cross-border M&A deals between MENA and SSA cumulated, during the past decade (2005-9m2016), to around 149 deals for an estimated value of no less than $24 bn. When compared to all deals by foreign companies in MENA and SSA, these figures represent a steady share of around 5%.

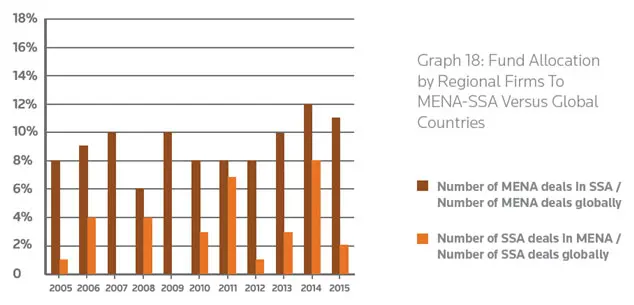

MENA companies are relatively more active in investing into Africa. Total number of M&As by MENA in SSA remained constantly elevated, totaling 119 during 2005-9m2016 versus only 30 from SSA in MENA. This pinpoints to the traction found by MENA-based corporates in opportunities offered by African countries.

Furthermore, MENA companies have been increasingly allocating their funds towards Africa as opposed to other parts of the World. During the past 5 years, the share of SSA in their global deals rose from 8% in 2010 to 11% in 2015. This is compared to SSA firms allocating less than 8% of their global deals to MENA.

-Ends-

About Thomson Reuters

Thomson Reuters is the world's leading source of intelligent information for businesses and professionals. We combine industry expertise with innovative technology to deliver critical information to leading decision makers in the financial and risk, legal, tax and accounting, intellectual property and science and media markets, powered by the world's most trusted news organization. Thomson Reuters shares are listed on the Toronto and New York Stock Exchanges (symbol: TRI). For more information, go to www.thomsonreuters.com

CONTACT

Tarek Fleihan

Head, Corporate Communications

Middle East, Africa, & Russia / CIS

Thomson Reuters

+97144536527

tarek.fleihan@tr.com

© Press Release 2016