PHOTO

* GRAPHIC-2018 asset returns:

(Adds ShFE arb, closing prices)

By Zandi Shabalala

LONDON, Aug 24 (Reuters) - Copper rose on Friday, clockingits first weekly gain in four on a softer dollar, though worriesabout Chinese demand are expected to cap gains as the country'strade dispute with the United States drags on.

Benchmark copper

The dollar index

"It's a dollar story again today, but from a demand point ofview it is a little more constructive than it was a few weeksback," said ING commodities strategist Warren Patterson.

"The trade war is going to create volatility in the marketbut generally the trend should be higher metal prices."

TRADE: U.S. and Chinese officials ended two days of talks onThursday with no major breakthrough as their trade war escalatedwith activation of another round of duelling tariffs on $16billion of each country's goods.

The tariffs have sapped demand for metals this year.

CHINA INTERVIEW: China will keep retaliating as more U.S.trade tariffs are imposed, but its counter-strikes will remainas targeted as possible to avoid harming businesses in China,both Chinese or foreign, Finance Minister Liu Kun told Reuters.

COPPER SPREADS: The discount for the cash contract to3-month copper has narrowed to $19 a tonne from $42 last weekbecause of worries about metal for nearby delivery on the LMEmarket because of a rise in cancelled warrants for delivery.

STOCKS: Cancelled warrants in LME-approved warehouses haverisen above 100,000 tonnes for the first time this year,representing about 39 percent of LME copper stocks.

SHFE ARBITRAGE: Traders say the cancelled metal is headingfor China because prices on the Shanghai Futures Exchange areabout $7,150 a tonne

CHINA PREMIUMS: China copper import premiums

LEAD: The price of lead

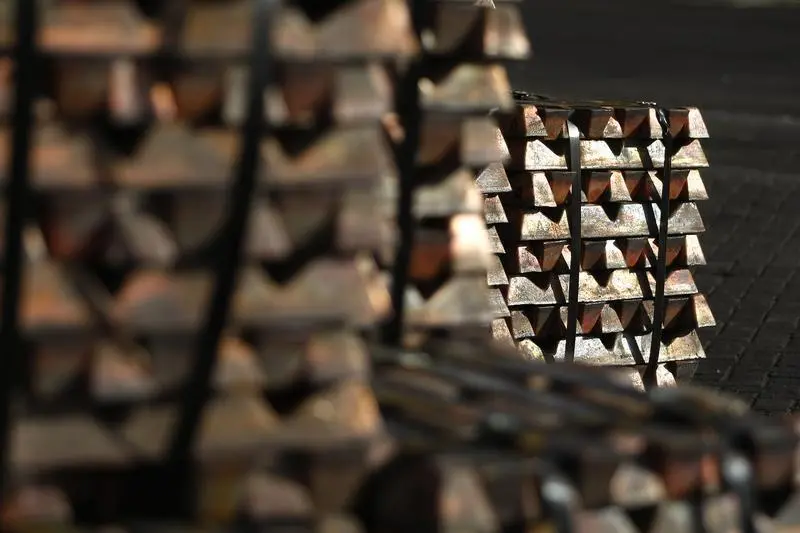

PRICES: Aluminium

<^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^Top Base and Precious Metals Analysis - GFMS

^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^> (Additional reporting by Tom DalyEditing by David Goodman) ((zandi.shabalala@tr.com; +44 207 542 5937; Reuters Messaging:zandi.shabalala.thomsonreuters.com@reuters.net))

(( For related news and prices, click on the codes in brackets: LME price overview