PHOTO

Shares in Emirates NBD, Dubai’s largest bank, rose during Wednesday’s trading, as it reported a surge in yearly and fourth quarter (Q4) 2018 earnings.

Net profit for the fiscal year 2018 amounted to 10.04 billion UAE dirhams ($2.73 billion), compared to 8.35 billion UAE dirhams for the fiscal year 2017, up 20 percent year-on-year (YoY).

Q4 net profit 2018 was up 2.39 billion UAE dirhams, compared to 2.18 billion dirhams for Q4 2017, up 9.6 percent year-on-year.

“We perceive this as a positive result and see value in the stock on attractive valuation, as it trades at 0.8x-BVPS (book value per share) 2019 while trading at 15% ROE (return on equity),” Chiro Ghosh, research manager at investment bank SICO, told Zawya.

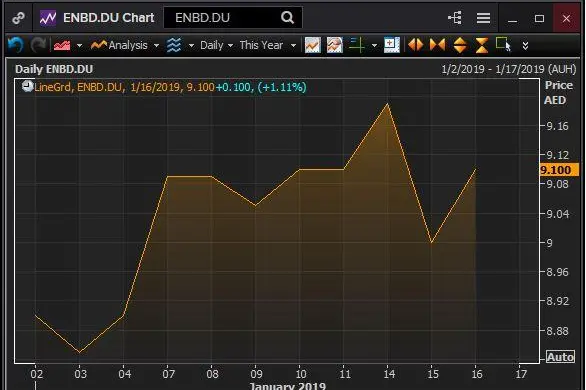

Emirates NBD’s shares rose 1.11 percent on Wednesday, helping Dubai’s financial market close 0.41 percent higher for the day. Since the start of the year 2019, Emirates NBD’s stock has added 2.36 percent.

Net interest income for the year 2018 was at 12.89 billion dirhams, versus 10.79 billion dirhams for the year 2017.

“The bank’s net interest income increased by 20% YoY, driven by NIM (net interest margin) expansion of 34bps (basis points) and healthy balance sheet growth of 6.4 percent YoY,” SICO’s Ghosh said.

However, he added that Emirates NBD would "continue to trade at a discount to peers, until the stock’s FOL (foreign ownership limit) is raised”.

Currently, foreign investors are limited to owning just 5 percent of the bank's shares. In late March 2018, the bank said that its General Assembly has approved raising this limit to 20 percent, pending regulatory approvals.

At the end of December 2018, customer loans stood at 327.9 billion UAE dirhams, compared to 304.1 billion UAE dirhams for the end of December 2017.

Customer deposits were at 347.9 billion UAE dirhams at the end of 2018, compared to 326.5 billion dirhams for the end of the 2017.

Ghosh said that lending book growth of 7.8 percent year-on-year, deposit growth of 6.5 percent year-on-year and the net interest margin achieved "indicates strong core earnings growth”.

The bank’s board of directors has proposed a cash dividend for the fiscal year 2018 of 40 fils per share, translating into a dividend yield of 4.4 percent.

“Overall, a decent set of results. Earnings were in-line, loan growth was decent and bank’s 2019 outlook is reassuring,” Shabbir Malik, a banking analyst at EFG-Hermes, told Zawya by email.

“Their dividend was just shy of my expectation, which suggests to me that they are retaining capital for growth,” Malik added.

According to data from Eikon, three analysts have a 'strong buy' rating on the stock and five analysts have a ‘buy’ rating.

Elsewhere in the region, indices for the Abu Dhabi, Bahrain and Qatar markets were largely flat. Saudi Arabia’s index rose 0.71 percent, Kuwait’s premier market index edged 0.11 percent lower, Oman’s index dropped 0.51 percent and Egypt’s blue-chip index EGX30 gained 0.46 percent.

(Reporting by Gerard Aoun; Editing by Michael Fahy)

Our Standards: The Thomson Reuters Trust Principles

Disclaimer: This article is provided for informational purposes only. The content does not provide tax, legal or investment advice or opinion regarding the suitability, value or profitability of any particular security, portfolio or investment strategy. Read our full disclaimer policy here.

© ZAWYA 2019